Vodafone 2000 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

62

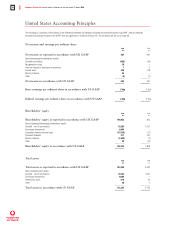

Summary of differences between UK and US GAAP pro forma financial information

The pro forma financial information has been prepared in accordance with UK generally accepted accounting principles (“UK GAAP”). A description of the

relevant accounting principles which differ materially from US GAAP is provided on page 59. The effects of these differing accounting principles on the

pro forma profit and loss accounts presented for the years ended 31 March 2000 and 31 March 1999 are summarised below.

2000 1999

£m £m

UK GAAP pro forma net income/(loss) 104 (1,106)

Items (decreasing)/increasing net income/(loss):

Goodwill amortisation (534) (535)

Reorganisation costs 25 –

Profit on disposal of fixed asset investments 14

Income taxes 625 637

Minority interests 46 45

Other (9) 4

–––––––– ––––––––

Pro forma net income/(loss) in accordance with US GAAP 258 (951)

–––––––– ––––––––

US GAAP pro forma basic earnings/(loss) per ordinary share 0.83p (3.13)p

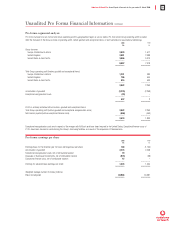

Pro forma proportionate information

The following tables of pro forma customer and financial information are presented on a proportionate basis. Proportionate presentation is not required by

UK GAAP and is not intended to replace the consolidated financial statements prepared in accordance with UK GAAP. However, since significant entities in

which the Group has an interest are not consolidated, proportionate information is provided as supplemental data to facilitate a more detailed

understanding and assessment of the consolidated financial statements prepared in accordance with UK GAAP.

UK GAAP requires consolidation of entities controlled by the Group and the equity method of accounting for entities in which the Group has significant

influence but not a controlling interest. Joint ventures are consolidated using the gross equity method. Proportionate presentation is a pro rata

consolidation, which reflects the Group’s share of turnover and expenses in both its consolidated and unconsolidated entities. Proportionate results are

calculated by multiplying the Group’s ownership interest in each entity by each entity’s results.

Proportionate information includes results from the Group’s equity accounted investments and investments held at cost. The Group does not have control

over the turnover, expenses or cash flow of these investments and is only entitled to cash from dividends received from these entities. The Group does

not own the underlying assets of these investments.

As a condition to the European Commission’s approval of the merger with AirTouch Communications, Inc. the Group entered into an undertaking to

dispose of its interest in E-Plus Mobilfunk GmbH following merger completion. As a result, pro forma proportionate customer and financial information

excludes E-Plus for the years presented.

2000 1999

Proportionate customer information (thousands) Number Number

Proportionate number of customers

Europe, Middle East & Africa 15,662 9,170

United Kingdom 8,791 5,575

United States & Asia Pacific 14,686 10,676

–––––––– ––––––––

39,139 25,421

–––––––– ––––––––

2000 1999

Proportionate financial information £m £m

Proportionate turnover

Europe, Middle East & Africa 4,437 3,208

United Kingdom 2,945 2,170

United States & Asia Pacific 5,187 3,807

–––––––– ––––––––

12,569 9,185

–––––––– ––––––––

Proportionate EBITDA*

Europe, Middle East & Africa 1,492 1,127

United Kingdom 934 816

United States & Asia Pacific 1,522 1,103

–––––––– ––––––––

3,948 3,046

Less: Depreciation and amortisation, excluding goodwill (1,240) (991)

–––––––– ––––––––

Proportionate total Group operating profit before goodwill and exceptional costs 2,708 2,055

–––––––– ––––––––

* Proportionate EBITDA (earnings before interest, tax, depreciation and amortisation) is defined as operating profit before exceptional reorganisation costs plus depreciation and amortisation

of subsidiary undertakings, joint ventures, associated undertakings and investments, proportionate to equity stakes. Proportionate EBITDA represents the Group’s ownership interests in the

respective entities’ EBITDA. As such, proportionate EBITDA does not represent EBITDA available to the Group.

Unaudited Pro forma Financial Information continued