Vodafone 2000 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

58

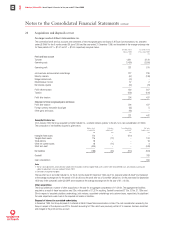

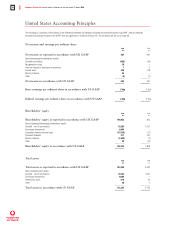

United States Accounting Principles

The following is a summary of the effects of the differences between US Generally Accepted Accounting Principles (“US GAAP”) and UK Generally

Accepted Accounting Principles (“UK GAAP”) that are significant to Vodafone AirTouch Plc. The principles are set out on page 59.

Net income and earnings per ordinary share

2000 1999

£m £m

Net income as reported in accordance with UK GAAP 487 637

Items (decreasing)/increasing net income:

Goodwill amortisation (425) (99)

Reorganisation costs 25 –

Profit on disposal of fixed asset investments 14

Income taxes 439 (28)

Minority interests 35 –

Other (9) (4)

–––––––– ––––––––

Net income in accordance with US GAAP 553 510

–––––––– ––––––––

Basic earnings per ordinary share in accordance with US GAAP 2.04p 3.30p

–––––––– ––––––––

Diluted earnings per ordinary share in accordance with US GAAP 2.02p 3.29p

–––––––– ––––––––

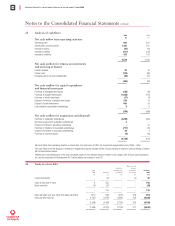

Shareholders’ equity 2000 1999

£m £m

Shareholders’ equity as reported in accordance with UK GAAP 140,833 815

Items increasing/(decreasing) shareholders’ equity:

Goodwill – net of amortisation 10,283 1,031

Fixed asset investments 9,054 –

Cumulative deferred income taxes (12,334) (71)

Proposed dividends 417 100

Minority interests (1,939) (3)

Other 20 (14)

–––––––– ––––––––

Shareholders’ equity in accordance with US GAAP 146,334 1,858

–––––––– ––––––––

Total assets 2000 1999

£m £m

Total assets as reported in accordance with UK GAAP 153,368 3,643

Items increasing total assets:

Goodwill – net of amortisation 10,283 1,031

Fixed asset investments 9,054 –

Deferred tax asset 616 44

Other 26 1

–––––––– ––––––––

Total assets in accordance with US GAAP 173,347 4,719

–––––––– ––––––––