Visa 2013 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2013 Visa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

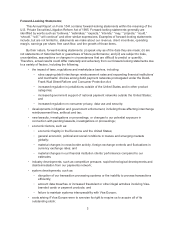

Based on payments volume, total volume and number of transactions, Visa is the largest retail

electronic payments network in the world. The following chart compares our network with those of our

major general purpose payment network competitors for calendar year 2012:

Company

Payments

Volume

Total

Volume

Total

Transactions Cards

(billions) (billions) (billions) (millions)

Visa Inc.(1) ...................... $ 4,018 $ 6,409 81.6 2,128

MasterCard (2) .................. $ 2,693 $ 3,647 46.3 1,158

American Express (2) ............. $ 884 $ 888 5.9 102

Discover (2) ..................... $ 122 $ 130 2.1 62

JCB (2) ......................... $ 179 $ 186 1.6 79

Diners Club (2) ................... $ 27 $ 28 0.2 6

(1) The data presented is provided by our financial institution clients. Previously submitted information

may be updated and all data is subject to review by Visa.

(2) MasterCard, American Express, JCB and Diners Club data sourced from The Nilson Report issue

1014 (March 2013) and Discover data sourced from The Nilson Report issue 1009 (January 2013).

Includes all consumer and commercial credit, debit and prepaid cards. Some figures are estimates

and currency figures are in U.S. dollars. MasterCard excludes Maestro and Cirrus figures. American

Express includes figures for third-party issuers. Discover figures consist of U.S. data only and

include third-party issuers. JCB figures include third-party issuers and other payment-related

products.

Certain general purpose payment network competitors are more concentrated in specific

geographic regions, such as JCB in Japan and Discover in the United States. Our competitors also

have leading positions in certain countries. For example, China UnionPay remains the sole processor

of domestic transactions and operates the sole domestic acceptance mark in China.

In the global debit network market segment, our Interlink and Visa Electron brands compete with

Maestro, owned by MasterCard, and various regional and country-specific debit network brands,

including STAR, NYCE and PULSE in the United States, EFTPOS in Australia, NETS in Singapore and

Interac in Canada. In addition to our PLUS brand, the primary cash access card brands are Cirrus,

owned by MasterCard, and many of the debit network brands referenced above. In many countries,

local debit brands provide the primary network, and our brands are used primarily to enable cross-

border transactions, which typically constitute a small portion of our overall transaction volume.

The global payments industry continues to undergo dynamic change. We may face increasing

competition from emerging players in the payment space, many of which are non-financial institution

networks that have departed from the more traditional business model. The emergence of these

potentially competitive networks has primarily been via the online channel with a focus on eCommerce

and/or mobile technologies. PayPal, Google and Isis are examples. These providers compete with us

directly in some cases, yet may also be significant partners and customers of ours.

We also face increasingly intense competitive pressure on the prices we charge our financial

institution clients. We believe our fundamental value proposition of convenience, interoperability,

accessibility and security offers us a key competitive advantage. We succeed in part because we

understand the needs of the individual markets in which we operate. We do so by partnering with local

financial institutions, merchants, governments, non-governmental organizations and business

organizations to provide tailored solutions to meet their varied needs. We believe Visa is well-

10