Visa 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 Visa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

other types of general purpose and limited-use cards; eCommerce and mobile-based platforms and other electronic payments,

including wire transfers, electronic benefits transfers, automatic clearing house, or ACH, payments and electronic data interchange.

Within the general purpose payment card industry, we face substantial and intense competition worldwide in the provision of

payments services to financial institution clients and their cardholder merchants. The leading global card brands in the general

purpose payment card industry are Visa, MasterCard, American Express, and Diners Club. Other general purpose card brands are

more concentrated in specific geographic regions, such as JCB in Japan and Discover in the United States. In certain countries, our

competitors have leading positions, such as UnionPay in China, which remains the sole domestic inter-bank bankcard processor

and operates the sole domestic bankcard acceptance mark in China. We also compete against private-label cards, which can

generally be used to make purchases solely at the sponsoring retail store, gasoline retailer or other merchant.

In the debit card market segment, Visa and MasterCard are the primary global brands. In addition, our Interlink and Visa

Electron brands compete with Maestro, owned by MasterCard, and various regional and country-specific debit network brands

including STAR, NYCE, and PULSE in the United States, EFTPOS in Australia, NETS in Singapore, and Interac in Canada. In

addition to our PLUS brand, the primary cash access card brands are Cirrus, owned by MasterCard, and many of the online debit

network brands referenced above. In many countries, local debit brands are the primary brands, and our brands are used primarily

to enable cross-border transactions, which typically constitute a small portion of overall transaction volume.

As the payments landscape evolves, we may increasingly face competition from emerging players in the payment space,

many of which are non-financial institution networks that have departed from the more traditional “bank-centric” business model.

The emergence of these potentially competitive networks has primarily been via the online channel with a focus on eCommerce

and/or mobile technologies. PayPal, Google and Isis are examples. These providers compete with Visa directly in some cases, yet

may also be significant partners and customers of Visa.

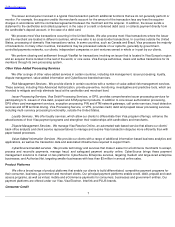

Based on payments volume, total volume and number of transactions, Visa is the largest retail electronic payments network in

the world. The following chart compares our network with those of our major general purpose payment network competitors for

calendar year 2011:

Sources: MasterCard, American Express, JCB and Diners Club data sourced from The Nilson Report issue 992 (April 2012).

Includes all consumer and commercial credit, debit and prepaid cards. Some prior year figures have been restated. Currency

figures are in U.S. dollars. MasterCard excludes Maestro and Cirrus figures. American Express includes figures for third-party

issuers. JCB figures include third-party issuers and other payment-related products. Some figures are estimates. Diners Club

figures are for the 12 months ended November 30, 2011. Discover data sourced from The Nilson Report issue 986 (January 2012)

— U.S. data only and includes business from third-party issuers.

14

Company

Payments

Volume

Total

Volume

Total

Transactions

Cards

(billions)

(billions)

(billions)

(millions)

Visa Inc.

(1)

$

3,768

$

6,029

77.6

2,011

MasterCard

2,430

3,249

39.8

1,059

American Express

808

822

5.3

97

Discover

114

122

1.9

59

JCB

160

166

1.4

77

Diners Club

28

29

0.2

6

(1)

Visa Inc. figures as reported on Form 8

-

K filed with the SEC on February 8 and May 2, 2012, respectively. Visa figures represent

total volume, payments volume and cash volume, and the number of payments transactions, cash transactions, accounts and

cards for products carrying the Visa, Visa Electron and Interlink brands. Card counts include PLUS proprietary cards. Payments

volume represents the aggregate dollar amount of purchases made with cards carrying the Visa, Visa Electron and Interlink

brands for the relevant period. Total volume represents payments volume plus cash volume. The data presented is reported

quarterly by Visa's clients on their operating certificates and is subject to verification by Visa. On occasion, clients may update

previously submitted information.