Vectren 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Helping Vectren Energy Delivery and many other energy companies

throughout the nation to lay the groundwork for reliable energy

delivery systems is our Infrastructure Services group. This group

consists of Miller Pipeline Corporation, which specializes in the

installation of distribution infrastructure, and Minnesota Limited, which

specializes in the installation of transmission pipelines. As discussed

earlier, their financial performance for the year was exceptional, and

revenues in 2012 were $664 million, compared to revenues of $421

million in 2011.

With demonstrated ability to manage unprecedented growth – in

employees, customers and revenues – combined with a long

demand-driven cycle, the positive outlook remains for this business

segment. For utilities, Infrastructure Services is successfully bidding

to complete distribution and transmission pipeline work in multiple

regions of the country. In fact, they added several first-time large

gas utility customers in 2012, which bodes well for 2013 and

beyond. This group is also poised to continue playing an expanded

role in installing the pipeline systems to gather and transport our

nation’s growing shale gas and oil supply. For example, in late 2012,

Minnesota Limited was awarded a contract to begin construction of

an 80-mile pipeline in North Dakota that will ultimately bring gas from

the Bakken shale region to the Chicago marketplace. Finally, in what

is more of a long-term opportunity, there is considerable potential for

growth in water and wastewater infrastructure replacement where

Environmental Protection Agency (EPA) regulations have those

industries modernizing their systems as well.

For our electric utility, our groundwork for reliability was solidified

in 2010 after our decade-long investment in emissions control

equipment for our coal-fired generation units. We are well ahead of

other coal-fired utilities when it comes to meeting EPA air standards

without significant, additional capital investments. These investments

have led to documented improvements in air quality for southwestern

Indiana. It’s important to note these air emissions investments are

already included in rates, and as other utilities begin to retire and/or

upgrade their coal-fired fleets with emissions control equipment, we

are set to be able to readily provide our customers with reliable power

and take advantage of emerging wholesale power options as this

retirement and retrofitting process continues. However, we know that

additional air, water and ash rules may emerge, which may trigger

more investments, but we believe they will be more manageable

expenditures.

Finally, we concluded the year by energizing our 345-kilovolt

transmission line, the first of its size in our electric service territory,

Vectren’s Infrastructure

Services

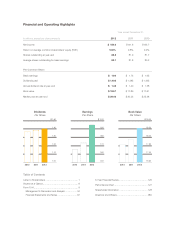

With several consecutive years of revenue

growth, Vectren’s Infrastructure Services

division has become a key driver of the

nonutility portfolio’s financial performance.

Growth of Vectren’s

Infrastructure Services

$750

$600

$450

$300

$150

$0

Gross Revenue (in millions)

2010 2011 2012

Minnesota Limited, Inc., was acquired

March 31, 2011.

3