Vectren 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

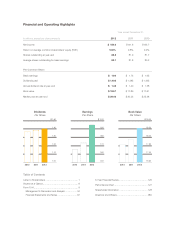

Year ended December 31,

In millions, except per share amounts 2012 2011 2010

Net income $ 159.0 $141.6 $133.7

Return on average common shareholders’ equity (ROE) 10.6% 9.8% 9.4%

Shares outstanding at year-end 82.2 81.9 81.7

Average shares outstanding for basic earnings 82.1 81.8 80.2

Per Common Share

Basic earnings $ 1.94 $ 1.73 $ 1.65

Dividends paid $ 1.405 $ 1.385 $ 1.365

Annual dividend rate at year-end $ 1.42 $ 1.40 $ 1.38

Book value $ 18.57 $ 17.89 $ 17.61

Market price at year-end $ 29.40 $ 30.23 $ 25.38

Table of Contents

Letter to Shareholders ................................................... 1

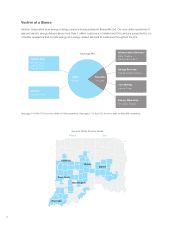

Vectren at a Glance ....................................................... 8

Form 10-K ..................................................................... 9

Management’s Discussion and Analysis .................. 34

Financial Statements and Notes .............................. 67

5-Year Financial Review ............................................. 126

Performance Chart .................................................... 127

Shareholder Information ............................................ 128

Directors and Officers ................................................ IBC

Financial and Operating Highlights

Earnings

Per Share

$ 2.00

1.90

1.80

1.70

1.60

1.50

2010 2011 2012

Dividends

Per Share

$ 1.50

1.40

1.30

1.20

1.10

1.00

2010 2011 2012

Book Value

Per Share

$ 19.00

18.50

18.00

17.50

17.00

16.50

2010 2011 2012