Vectren 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

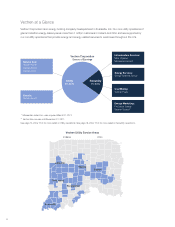

our system while at the same time being mindful of the impact to customer bills.

Our nation’s emphasis on the need to address aging pipelines combined with

the surge of shale gas drilling throughout the U.S. has certainly opened a door of

opportunity for our Infrastructure Services division. In fact, the spotlight on safe,

reliable infrastructure led us to acquire Minnesota Limited, a large Midwestern

transmission pipeline construction contractor serving the natural gas and petroleum

industries, in March 2011. Minnesota Limited joined wholly owned subsidiary Miller

Pipeline (Miller) in this business division. 2011 was an outstanding year for these

companies, and the investment in Minnesota Limited is already reaping rewards. In

fact, the combined earnings of the two Infrastructure Services companies of $14.9

million compared nicely to Miller’s 2010 earnings of $3.1 million.

These two companies share a common history in beginning as family-owned and

operated companies and have built success around cultures that value employees,

quality and superior customer satisfaction. They, too, put safety as a high priority

from on-the-job employee safety to the infrastructure they install. Through the

acquisition, these businesses have gained an expanded service territory with little

customer or geographic overlap, resources to compete for larger projects and

a more diverse revenue stream within the construction markets served. The two

continue working together to find more operational efficiencies, and we’re excited

about the long-term growth opportunities that lie ahead.

We can’t conclude our safety discussion without discussing Vectren Fuels, our

coal mining subsidiary. With two underground mines in full production, Prosperity

and Oaktown 1, and a third mine targeted to open later this year, Oaktown 2, the

emphasis on employee safety naturally dominates this industry. As we continued

to ramp up operations at Oaktown 1 in 2011, we were challenged by safety

compliance, especially as our mine operators integrated a growing employee

population, some of whom are relatively new to the coal industry. By the end of the

year, we saw safety performance improve – reaching best-in-class in Indiana by

the fourth quarter of 2011, and we continue implementing initiatives and incentives

to achieve this level of safety performance consistently. At the same time, safety

statistics at our Prosperity mine remain an area of focus, especially coming off a

best-in-class performance at that mine in 2010.

On the production side, the Oaktown 1 mine helped bolster total coal mining

production to 5.1 million tons for the year and led to a year-over-year revenue

increase of $76 million. As such, earnings increased from $11.9 million in 2010

to $16.6 million in 2011. Expected coal production and sales in 2012 is 6 million

tons, with approximately 75% of that production sold. As the second Oaktown

mine begins production, we expect to hit contract employment levels of nearly 800

workers at the three mines. More so, we expect to fully realize the benefits of this

significant investment for years to come in providing Indiana coal to a number of

power plants throughout the region. At the same time, we remain cognizant that the

market price of coal will ultimately heavily influence annual results, as will activities

and changing regulations of the Mine Safety and Health Administration.

For our utility

business, 2011

proved to be the

best year on

record for job

safety.

5

2011 Annual Report.indd 7 3/2/2012 3:21:58 PM