Vectren 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

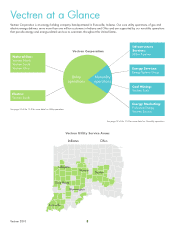

Utility Group

The Utility Group consists of the Company’s regulated operations and other operations that provide information technology and

other support services to those regulated operations. The Company segregates its regulated operations into a Gas Utility

Services operating segment and an Electric Utility Services operating segment. The Gas Utility Services segment includes the

operations of Indiana Gas, the Ohio operations, and SIGECO’s natural gas distribution business and provides natural gas

distribution and transportation services to nearly two-thirds of Indiana and to west central Ohio. The Electric Utility Services

segment includes the operations of SIGECO’s electric transmission and distribution services, which provides electric distribution

services primarily to southwestern Indiana, and the Company’s power generating and wholesale power operations. In total,

these regulated operations supply natural gas and/or electricity to over one million customers. Following is a more detailed

description of the Utility Group’s Gas Utility and Electric Utility operating segments.

Gas Utility Services

At December 31, 2010, the Company supplied natural gas service to approximately 994,800 Indiana and Ohio customers,

including 909,300 residential, 83,800 commercial, and 1,700 industrial and other contract customers. Average gas utility

customers served were approximately 982,100 in 2010, 981,300 in 2009, and 986,700 in 2008.

The Company’s service area contains diversified manufacturing and agriculture-related enterprises. The principal industries

served include automotive assembly, parts and accessories, feed, flour and grain processing, metal castings, aluminum

products, polycarbonate resin (Lexan®) and plastic products, gypsum products, electrical equipment, metal specialties, glass,

steel finishing, pharmaceutical and nutritional products, gasoline and oil products, ethanol, and coal mining. The largest Indiana

communities served are Evansville, Bloomington, Terre Haute, suburban areas surrounding Indianapolis and Indiana counties

near Louisville, Kentucky. The largest community served outside of Indiana is Dayton, Ohio.

Revenues

The Company receives gas revenues by selling gas directly to customers at approved rates or by transporting gas through its

pipelines at approved rates to customers that have purchased gas directly from other producers, brokers, or marketers. Total

throughput was 197.0 MMDth for the year ended December 31, 2010. Gas sold and transported to residential and commercial

customers was 106.2 MMDth representing 54 percent of throughput. Gas transported or sold to industrial and other contract

customers was 90.8 MMDth representing 46 percent of throughput. Rates for transporting gas generally provide for the same

margins earned by selling gas under applicable sales tariffs.

For the year ended December 31, 2010, gas utility revenues were approximately $954.1 million, of which residential customers

accounted for 68 percent and commercial 25 percent. Industrial and other contract customers account for only 7 percent of

revenues due to the high number of transportation customers in that customer class.

Availability of Natural Gas

The volume of gas sold is seasonal and affected by variations in weather conditions. To mitigate seasonal demand, the

Company’s Indiana gas utilities have storage capacity at seven active underground gas storage fields and six liquefied

petroleum air-gas manufacturing plants. Periodically, purchased natural gas is injected into storage. The injected gas is then

available to supplement contracted and manufactured volumes during periods of peak requirements. The volumes of gas per

day that can be delivered during peak demand periods for each utility are located in “Item 2 Properties.”

Natural Gas Purchasing Activity in Indiana

The Indiana utilities also contract with a wholly-owned subsidiary of ProLiance Holdings, LLC (ProLiance), to ensure availability

of gas. ProLiance is an unconsolidated, nonutility, energy marketing affiliate of Vectren and Citizens Energy Group (Citizens).

(See the discussion of Energy Marketing below and Note 5 in the Company’s Consolidated Financial Statements included in

“Item 8 Financial Statements and Supplementary Data” regarding transactions with ProLiance). The Company also prepays

ProLiance for natural gas delivery services during the seven months prior to the peak heating season in lieu of maintaining gas

storage. Vectren received regulatory approval on April 25, 2006, from the IURC for ProLiance to continue to provide natural gas

supply services to the Company’s Indiana utilities through March 2011. On November 3, 2010, a settlement agreement was

filed with the IURC providing for ProLiance’s continued provision of gas supply services to the Company’s Indiana utilities and

Citizens Gas for the period of April 1, 2011 through March 31, 2016. The settlement has been agreed to by all of the

representatives that were parties to the prior settlement. An order is anticipated during the first quarter of 2011.