Valero 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Valero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

2014 Summary Annual Report

Unlocking Implicit Asset Value

Valero Energy Partners LP (“VLP”), our

sponsored master limited partnership, remains

our primary strategy to grow Valero’s logistics

business and unlock asset value.

yIn 2014, we executed our rst acquisition

(“drop-down”) of Valero pipeline and terminal

assets into the partnership since the initial

public oering in late 2013.

yIn March of 2015, we completed our second

drop-down to VLP of the Houston and St.

Charles Terminal Services Business for $671

million.

yWe are targeting approximately $1 billion of

drops into VLP in 2015. Several new projects

are also under evaluation for drops into VLP.

Service to Others

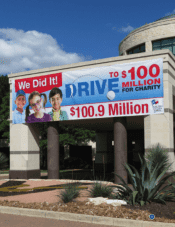

We are pleased that others recognize that Valero

is an admirable company and a great place

to work, and that our team is committed to

supporting our communities.

yIn 2014, Valero, its employees and charitable

organization – the Valero Energy Foundation

– generated more than $38 million for

worthy charities or causes, through direct

donations or fundraising. Our employees also

volunteered more than 136,000 hours in 2014

for hundreds of community projects.

Capital Allocation

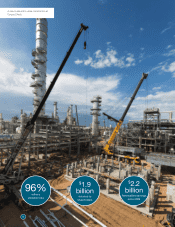

yWe returned $1.9 billion in cash to you

through dividends and stock purchases.

That’s an increase of one-third compared

with 2013. Early in 2015, we further raised

our regular quarterly dividend by 45 percent,

to 40 cents per share, or $1.60 annualized.

This increase demonstrates our belief in

Valero’s earnings power and conrmation

of our desire to share our earned cash with

shareholders.

yWe are dedicated to maintaining our

investment-grade credit rating and continue

to govern our uses of cash accordingly.

Valero nished 2014 with cash and

temporary cash investments of $3.7 billion,

additional liquidity of $6.1 billion and a net

debt-to-capitalization ratio of 17.4 percent.

Disciplined Capital Investments

yWe expect our new crude units at the

Houston and Corpus Christi reneries to

optimize our crude and feedstock slates by

increasing our capability to process price-

advantaged light, sweet crude oils.

yOur new hydrocrackers at Port Arthur and St.

Charles have performed better than expected

to increase production of distillates.

yWe’re investing in logistics assets to increase

our feedstock exibility and our capability to

export products.

yOur ethanol plants achieved record operating

income of $786 million for the year. Since

2009, they have produced more than $2.2

billion of earnings before interest, taxes,

depreciation and amortization.

The rigor and discipline that our team applied

to project review and spending enabled us

to complete our 2014 capital program under

budget at approximately $2.8 billion.

We are dedicated to maintaining

our investment-grade credit

rating and continue to govern

our uses of cash accordingly.