Valero 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Valero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

utilization of our conversion capacity, from 2009 to

2010 we improved our average liquid volume yield

from 98.6 percent to 99 percent. This 0.4 percent

gain added $242 million to revenues.

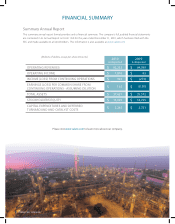

FINANCIALLY STRONGER AND MORE COMPETITIVE

We maintained our investment-grade credit rating

in 2010. In mid-December, we exited a challenging

East Coast rening market with the sale of our

renery in Paulsboro, New Jersey, for $707 million

including working capital. We also divested our

50 percent interest in the Cameron Highway Oil

Pipeline System for $330 million. Early in the year,

we sold our shut-down Delaware City renery site

and equipment for $220 million.

Our general and administrative expenses have

consistently trended downward since 2008, and in

2010, we achieved an additional $225 million in

pre-tax cost savings. Since 2007, our employees

have saved the company nearly $620 million, before

taxes, through the execution of numerous cost

reduction eorts.

Our U.S. and Canadian retail businesses earned

$346 million for the year, nearly matching their

record results in 2008. After adding three

world-class ethanol plants to our system, for a total

of 10, our ethanol business set a record high of

$209 million in operating income for the year.

Moving forward, our nancial strength and

signicant liquidity allow us to complete major

value-added capital projects at our reneries. Valero

is able to take advantage of attractive acquisition

opportunities that will improve our competitiveness

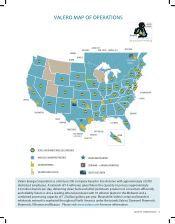

and broaden our geographic footprint. Our pending

acquisition of Chevron’s Pembroke Renery and

marketing assets in the United Kingdom and Ireland

with cash on hand is just one example of this

nancial strength.

2011 WILL BE A MUCH BETTER YEAR

This year, we expect to expand into Europe,

complete our FCC revamp projects at Memphis

and St. Charles, and benet from upgrading

the coke drums at Port Arthur. The bulk of our

active turnaround schedule will be completed by

summer. We expect signicant progress on our

high-return hydrocracker projects at Port Arthur and

St. Charles and our hydrogen plants at McKee and

Memphis. Our competitive Gulf Coast reneries are

well-positioned for today’s higher-margin export

opportunities – a signicant change in our business

that we anticipated and beneted from last year

and so far this year. Another major change in our

business has been the discounted price of inland

domestic sweet crude versus water-borne sweet

crudes like Brent or Louisiana Light Sweet.

However, some challenges remain. Current

government regulations and proposals aecting

greenhouse gases (GHGs) will hurt our industry.

These regulations being discussed are bad for our

industry, bad for consumers, bad for jobs, and bad

for the country – and still would have no impact at

all on global warming or climate change. Having

been unsuccessful in passing cap-and-trade

legislation in Congress, the Obama Administration

is attempting to regulate GHGs under the Clean Air

Act. This debate is continuing in Congress.

While we are proud to be the world’s largest

independent rener and one of the nation’s largest

fuel retailers and ethanol producers, we take

even more pride in being an excellent operator

and corporate citizen. By doing ordinary things

extraordinarily well, our employees ensure that

our company stays the course on safety, reliability,

protability and corporate responsibility. We

continue to add value to society, making people’s

lives better and more productive, and we make our

communities a better place to live and work.

I want to thank our employees for a very dedicated

eort to make our company successful and you for

your support, interest, and investment in Valero.

4TO OUR SHAREHOLDERS

Bill Klesse

Chairman of the Board, Chief Executive Ocer

and President