Valero 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 Valero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VA L E R O E N E R G Y C O R P OR AT I O N 11

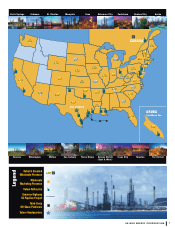

Developing One of the World’s

Most Complex Refining Systems

Valero’s refining system isn’t just

the biggest in North America, it’s

stretches back to the beginning of the

company – to plan for a future that

would belong to companies with the

ability to process lower-cost heavy,

sour feedstocks into premium, clean-

burning fuels. That strategy has paid

off for Valero ever since 1984, when

it entered the refining business by

commissioning its Corpus Christi

refinery.

To keep its competitive advantage over

other refiners, Valero has acquired

facilities and upgraded them to meet

this strategy. For example, the Port

Arthur refinery – part of the Premcor

acquisition in 2005 – became Valero’s

most profitable plant in 2006, and

including expansions through the first

quarter of 2007, it has added 325,000

barrels per day (BPD) of medium

and heavy sour feedstocks to Valero’s

capacity.

Today, Valero has more catalytic

cracking capacity than some refining

companies’ total conversion capacity.

The same is true of Valero’s coking

capacity. Sour crude oil and residual

fuels make up approximately

60 percent of Valero’s raw materials

input, which provides tremendous

cost advantages. As the world moves

toward cleaner fuel standards, the

demand for easy-to-process light,

sweet crude is growing. Meanwhile,

the long-term trend for most new

oil being produced to meet rising

worldwide demand typically has

been heavier and more sour, and not

number of different heavy, sour and

resid feedstocks that Valero processes

has grown from 27 in 2002 to 40 in

2006. Because Valero is able to choose

from a wide selection of feedstocks,

the company can ensure that it’s

getting the best prices the marketplace

is offering.

And with Valero’s large throughput

capacity, changes in price differentials

rapidly add up. Every $1 difference

between sweet and sour crude oils

impacts Valero by about $500 million

per year in operating income.

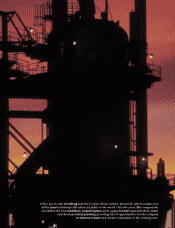

Internal projects to add conversion

capacity have given Valero even more

of a competitive advantage. A new

hydrocracker reactor at the Ardmore

refinery in 2006 should contribute

an additional $10 million to $12

million to the refinery’s 2007 operating

income, and in 2007 new mild

hydrocracking units at the Houston

and St. Charles refineries should boost

the company’s conversion capacity

even higher.

Valero’s strategy was forward-

thinking when it was adopted in the

early 1980s. Today, because of its

tremendous complexity and flexibility,

the company’s refining system is

considered to be one of the very best

in the world.

Resid

Maya

Arab

Light/Medium

2002 2003 2004 2005 2006

$5

$0

$10

$15

$20

$25

Continued Wide Differentials

Valero’s ability to

process a wide

variety of feedstocks

allows it to quickly

take advantage of

price differentials

in the marketplace

and mitigate supply

disruptions.

all refiners are as well-positioned as

Valero to process those grades of

crude oil. As those trends continue,

the difference in price between heavy

or sour crude oil and more costly

light, sweet crude oil should remain

favorable.

As a result of the company’s focus on

increasing feedstock flexibility, the

also one of the most complex. This is

a result of Valero’s strategy – which