Valero 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Valero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

LETTER TO SHAREHOLDERS

volumes in the U.S. by 100,000 BPD and distillate volumes by 320,000 BPD. These costly sulfur reduction

modifications are also expected to result in the closure of a number of smaller refineries and the tighter

fuel specifications are expected to result in reduced refined product imports into the U.S. As a result,

U.S. demand growth is expected to outpace capacity growth in the coming years. This should result in

a better-than-average margin environment, which is important because every $1.00 improvement in our

system’s average refining margin, improves per share earnings by about $4.00.

And, as crude oil production increases in the coming years, heavy, sour crude oil production is expected

to outpace sweet crude oil production by a four-to-one ratio, which should translate into high sour crude

oil discounts going forward.

A NEW ERA FOR REFINING

So, while many talk about the volatility of earnings in the refining industry, I believe we have entered into

a new era where margins will be higher and where periods of low refining margins will be less frequent

and shorter in duration.

While 2002 was a challenging year, 2000 and 2001 were both record years for Valero and now 2003 is

shaping up to be a record year as well. How many industries have done as well? Valero has significantly

outperformed its peers, as well as the S&P 500 Index over the last five years. Valero shareholders enjoyed

a total cumulative return of 24 percent—far better than the 16 percent return of our peer group and the

S&P’s three percent loss!

We are in the right business at the right time. Everything has come together—from low gasoline and

distillate inventories, to strong demand, to wider sour crude oil discounts—to create a very bullish outlook.

And, no refiner is better positioned to benefit from these long-term bullish fundamentals than Valero.

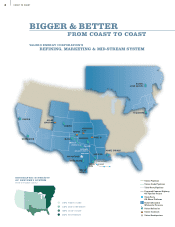

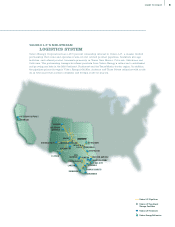

We will benefit from our geographic diversity and our more diversified business lines. We will also benefit

from our leverage to less expensive, heavy sour crude oil feedstocks and the higher-margin, cleaner-

burning fuels and premium products we make.

And, most importantly, we will continue to benefit from the hard work and dedication of our 20,000

employees, who are the best in the industry and our number-one asset.

That is why I always say and firmly believe, the best is yet to come!

CHAIRMAN OF THE BOARD

AND CHIEF EXECUTIVE OFFICER

P.S. While I do believe the best is yet to come, 2003 will be “bittersweet” in one respect. Two of my very

favorite long-time executives—Bill Latham, Senior Vice President of Information Services and Chief

Information Officer, and John Krueger, Senior Vice President and Controller—both retired at the close of

2002. These two individuals were largely responsible for the systems integration that we accomplished

in a record nine months in 2002. And both have been tireless supporters of Valero for many, many years.

Both Bill and John truly epitomize the Valero work ethic and standard of excellence, and they will be

missed! But we’re thankful for all of their many contributions and wish them all of life’s best in retirement.