Valero 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Valero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

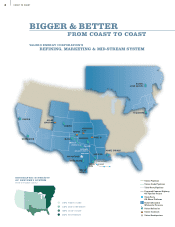

12 REFINERIES ACROSS NORTH AMERICA & NEARLY 2MILLION BPD OF CAPACITY

With the UDS acquisition, Valero became one of the nation’s biggest refiners with 12 refineries and a

throughput capacity of nearly 2 million barrels per day (BPD). And, bigger in this case is definitely

better because Valero achieved greater geographic diversity while maintaining its leverage to low-cost

feedstocks and premium products.

By adding refineries in locations stretching from Canada to California, Valero staked its claim as the most

geographically diverse refiner in the United States. Because margins vary at different times for different

products at different locations, having a geographically diverse refining system helped balance Valero’s

earnings. When margins were weak in one area of the system, they were often offset by stronger margins

in other areas of the network. For example, Valero’s Mid-Continent and Canadian refining systems—where

Valero previously had no presence—contributed $250 million to operating income in 2002, which

represented approximately 40 percent of the total refining contribution for the year.

And because these newly acquired

refineries were generally high-conversion

facilities, Valero’s network remained the

most complex refining system in the

United States. The majority of Valero’s

refineries are capable of processing

lower cost feedstocks, such as resid and

sour crude oil, into premium products,

such as reformulated gasoline (RFG),

low-sulfur diesel and jet fuel.

As a result, Valero’s refining system

has a complexity rating of 11.9 versus

the U.S. average of 10.4 as ranked by

the Nelson Complexity Scale.

Making these advantages all the more

powerful is the fact that Valero has

substantially more leverage to refining

margins than its nearest competitor.

For every $1.00 improvement in

margins, Valero should realize a

$4.00 increase in earnings per share.

The bottom line is being a bigger

refiner means better returns for

Valero’s shareholders.

0102030405060708090100

55%

GASOLINE & BLENDSTOCKS

30%

DISTILLATES

15%

ASPHALT, LUBES & PETROCHEMICALS

75%

of distillates

are low-sulfur.

50%

of gasoline &

blendstocks are produced

as RFG and CARB.

PRODUCT SLATE

12 OPERATIONS

0102030405060708090100

05%

OTHER FEEDSTOCKS

05%

BLENDSTOCKS

30%

SWEET CRUDE OIL

60%

SOUR FEEDSTOCKS

FEEDSTOCK SLATE

Valero’s Three Rivers Refinery

▲