Unum 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Unum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10%

Table of contents

-

Page 1

2008 annual report staying the course -

Page 2

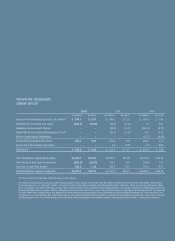

...UnUm groUp 2008 (in millions) per share* (in millions) 2007 per share* (in millions) 2006 per share* income from continuing operations, as adjusted** net realized investment gain (loss) regulatory reassessment charges special tax items and Debt Extinguishment costs Broker compensation settlements... -

Page 3

...-tax operating income* Unum's vision is to be the leading provider of employee beneï¬ts products and services that help employers manage their businesses and employees protect their families and livelihoods. And for more than 160 years, we have been doing just that. With disability, long-term care... -

Page 4

... execution of Unum's business plan has resulted in more than $1.64 billion in net income, enabling the company to further build on its strong ï¬nancial position. Unum's investment performance for 2008 was solid as well. Our portfolio, which is designed to match the long-term nature of our business... -

Page 5

... disciplined progress, executing on our business plans and strengthening our financial position. We are maintaining a constant focus on what we do best - providing beneï¬ts products and services that help businesses and their employees stay on track, too. For more than 160 years, Unum has extended... -

Page 6

... the market. By consistently executing on our plans, we have diversiï¬ed our business, signiï¬cantly improved our operating results, strengthened our ï¬nancial position, and resolved a number of legacy regulatory and legal issues, while at the same time establishing a culture of customer service... -

Page 7

... in my business career have financial strength and ï¬,exibility been more important than they are today. This past year we successfully completed a $700 million share repurchase and still closed the year well in excess of our capital guidelines. I am especially pleased to see that the credit rating... -

Page 8

... as a primary long-term investor in the economy, supporting capital investment in both the public and private sectors. Our company continues to serve in an increasingly important niche of the life insurance market. The employer-sponsored benefits market (where insurance coverage is offered by an... -

Page 9

...workplace. The growing gap in ï¬nancial security can place even further pressure on government resources already facing funding and budgetary pressures, which is why we at Unum are advocates for continued cooperation between the public and private sectors to address this critical problem. Employers... -

Page 10

Exp 6 -

Page 11

... network of Benefits Knowledge) Unum partners with brokers and other human resource and benefits professionals who have extensive knowledge of the employee benefits landscape. together, we not only evaluate what employers and employees need, but also design the best solutions to meet those needs. We... -

Page 12

EDUc 8 -

Page 13

...employers and their employees about the benefits they have as well as any possible gaps that may exist in their protection. By sharing information about benefits solutions and exploring the ways those solutions fit into the broader financial picture for individuals and their families, we help people... -

Page 14

oppor 10 -

Page 15

... access to products, Unum creates opportunities for individuals to easily obtain the coverage they need to protect their lifestyle and provide financial security. But Unum's value goes well beyond simply providing access to benefits. We help workers protect the financial foundation they have... -

Page 16

protE 12 -

Page 17

...defense against the potentially catastrophic financial fallout of death, illness and injury. With a full array of benefits solutions, Unum not only protects financially vulnerable workers and their families during uncertain times, but we also help businesses build a more stable, successful workforce... -

Page 18

... Unum UK is also a market innovator in vocational rehabilitation services that help ease the disruption to both businesses and employees by enabling them to return to full capacity as soon as they are able. Kevin mccarthy president and chief Executive officer Unum Us susan ring president and chief... -

Page 19

.... Colonial Life's market leadership has been built on establishing one-to-one relationships that educate employers and their employees on the beneï¬ts they have as well as any coverage gaps that may exist. Together, we are committed to developing targeted solutions to help businesses better manage... -

Page 20

...cer, Colonial Life E. liston Bishop iii Executive Vice President and General Counsel Joseph r. foley Senior Vice President and Chief Marketing Ofï¬cer Kevin p. mccarthy President and Chief Executive Ofï¬cer, Unum US robert c. greving Executive Vice President, Chief Financial Ofï¬cer and Chief... -

Page 21

...Flows 99 Consolidated Statements of Comprehensive Income (Loss) 100 Notes to Consolidated Financial Statements 149 Reports of Independent Registered Public Accounting Firm and Management's Annual Report on Internal Control over Financial Reporting 152 Cautionary Statement Regarding Forward-Looking... -

Page 22

... of dollars, except share data) 2008 2007 2006 2005 2004 Statement of Operations Data Revenue Premium Income Net Investment Income Net Realized Investment Gain (Loss) Other Income total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts (1) Commissions Interest and... -

Page 23

...are regulatory claim reassessment charges (credits) and broker compensation settlement expenses of $(12.8) million, $33.5 million, $22.3 million, and $42.5 million in 2007, 2006, 2005, and 2004, respectively, and, in 2004, charges related to the impairment of the individual disability - closed block... -

Page 24

..., Unum UK achieved underlying sales growth of approximately 16 percent in 2008 relative to 2007. The U.K. market remains highly competitive. We are developing new products and services to target new customer segments. During 2008 we launched a dual beneï¬t group disability product designed for... -

Page 25

... percent. The number of new accounts and the average new case size both increased over the prior year. During the latter part of 2007, we introduced a new hospital conï¬nement indemnity insurance plan product and a group limited beneï¬t medical plan product, and in the ï¬rst quarter of 2008, we... -

Page 26

... claim reserve discount rates are adequate relative to investment portfolio yield rates. • We believe our risk management is strong; we have a diversified business mix, with a core market focus which generally has lower and less volatile claim incidence. • Our historical pattern of benefits paid... -

Page 27

... stated capital management strategy. See "Liquidity and Capital Resources" contained herein and Note 8 of the "Notes to Consolidated Financial Statements" for additional information. Other During the ï¬rst quarter of 2008, we established a new non-insurance company, Unum Ireland Limited, which is... -

Page 28

... for beneï¬t costs for claims reopened for our Unum US group long-term disability product line $76.5 million. The revision related to the increase during the second quarter of 2007 in the overturn rate and the average cost, as well as a slightly higher number of claims. 2. We decreased our previous... -

Page 29

... for our Unum US group disability line of business $66.2 million and increased 2007 before-tax operating earnings for our Individual Disability - Closed Block segment $13.2 million. Financing The scheduled remarketing of the senior note element of our 2004 adjustable conversion-rate equity units... -

Page 30

... of the 55 percent already reviewed at that time. The third quarter charge decreased before-tax operating results for our Unum US group disability line of business $291.4 million and our Individual Disability - Closed Block segment $34.0 million. Regulatory Investigations Beginning in 2004, several... -

Page 31

... disclosure and provide information on our Company website about our broker compensation programs. Under these policies, any customer who wants speciï¬c broker compensation related information can obtain this information by contacting our Broker Compensation Services at a toll-free number. Other... -

Page 32

... and group long-term care, and voluntary benefits products in our Unum US segment; individual disability products in our Unum UK segment; disability and cancer and critical illness policies in our Colonial Life segment; and, the Individual Disability - Closed Block segment products. The reserves are... -

Page 33

..., commissions, and expenses we will pay and the expected future gross premiums we will receive. We maintain policy reserves for a policy for as long as the policy remains in force, even after a separate claim reserve is established. Policy reserves for Unum US, Unum UK, and Colonial Life products... -

Page 34

...product lines. The estimation methods we have chosen are those that we believe produce the most reliable reserves at that time. Claim reserves supporting our Unum US group and individual disability and group and individual long-term care lines of business and our Individual Disability - Closed Block... -

Page 35

...) Policy Reserves % Total Total Reinsurance Ceded Total Net Group Disability Group Life and Accidental Death & Dismemberment Individual Disability - Recently Issued (1) Long-term Care Voluntary Beneï¬ts Unum US Segment Unum UK Segment Colonial Life Segment Individual Disability - Closed Block... -

Page 36

... many factors. Reserves, particularly for policies offering insurance coverage for long-term disabilities, are dependent on numerous assumptions other than just those presented in the preceding discussion. The impact of internal and external events, such as changes in claims management procedures... -

Page 37

... of time than our other reserve assumptions. These rates are reviewed on a quarterly basis for the death and recovery components separately. Claim resolution rates in our Unum US segment group and individual long-term disability product lines and our Individual Disability - Closed Block segment... -

Page 38

... Period Amortization Period Unum Us Group Disability Group Life and Accidental Death & Dismemberment Supplemental and Voluntary Individual Disability - Recently Issued Long-term Care Voluntary Beneï¬ts Unum UK Group Disability Group Life Individual Disability colonial life 6 6 15 17 25... -

Page 39

... would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date and, therefore, represents an exit price, not an entry price. The exit price objective applies regardless of a reporting entity's intent and/or ability to... -

Page 40

... new issuance and secondary trades • Broker/dealer quotes and pricing • Security cash flows and structures • Recent issuance/supply • Sector and issuer level spreads • Credit ratings/maturity/weighted average life/seasoning/capital structure • Security optionality • Corporate actions... -

Page 41

... were based on observable market spreads. Newly issued private placement securities have historically offered yield premiums of 20 basis points over comparable newly issued public securities. • An additional five basis points were added to the risk free rates for foreign investments, consistent... -

Page 42

... from brokers or pricing services validated to other observable market data and quoted prices for similar assets or liabilities. • Level 3 - Inputs reflect our best estimate of what market participants would use in pricing the asset or liability at the measurement date. Generally, assets and... -

Page 43

... of certain members of our senior management personnel to review reports on the entire portfolio, identifying investments with changes in market value of ï¬ve percent or more, investments with changes in rating either by external rating agencies or internal analysts, investments segmented by... -

Page 44

... best estimate of future expected experience. Major assumptions used in accounting for these plans include the expected discount (interest) rate and the long-term rate of return on plan assets. We also use, as applicable, expected increases in compensation levels and a weighted-average annual rate... -

Page 45

...through annual liability measurements, periodic asset/liability studies, and quarterly investment portfolio reviews. Risk tolerance is established through consideration of plan liabilities, plan funded status, and corporate ï¬nancial condition. The long-term rate of return on assets used in the net... -

Page 46

... as of December 31, 2007. The fair value of plan assets in our OPEB plan was $12.0 million at December 31, 2008 and 2007. These assets represent life insurance reserves to fund the life insurance beneï¬t portion of our OPEB plan. Our OPEB plan represents a non-vested, non-guaranteed obligation, and... -

Page 47

... the settlement is effective. We believe that tax positions have been reï¬,ected in our ï¬nancial statements at appropriate amounts in conformity with FIN 48. consolidated operating results Year Ended December 31 (in millions of dollars) 2008 % change 2007 % Change 2006 revenue Premium Income Net... -

Page 48

...these product lines has begun to stabilize as expected. Unum UK premium income, in local currency, increased in 2007 relative to the prior year but declined in 2008 due to lower persistency in the group long-term disability line of business. Premium income in the Individual Disability - Closed Block... -

Page 49

... million settlement regarding broker compensation as well as litigation expenses related to two pending cases in our individual disability - closed block segment. During 2007, expenses include an $11.6 million settlement related to a plan beneï¬ciary class action. We intend to aggressively manage... -

Page 50

..., for our Unum US group market on an aggregate basis. See "Segment Results" as follows for additional discussion of sales by segment. segment results Our reporting segments are comprised of the following: Unum US, Unum UK, Colonial Life, Individual Disability - Closed Block, and Corporate and Other... -

Page 51

... our insurance liabilities as opposed to the generation of realized investment gains and losses, and a long-term focus is necessary to maintain proï¬tability over the life of the business. Realized investment gains and losses depend on market conditions and do not necessarily relate to decisions... -

Page 52

Unum 2008 management's Discussion and analysis of financial condition and results of operations Unum Us segment The Unum US segment includes group long-term and short-term disability insurance, group life and accidental death and dismemberment (AD&D) products, and supplemental and voluntary lines ... -

Page 53

... Disability - Recently Issued Group Long-term Care Individual Long-term Care Voluntary Beneï¬ts Subtotal total fully insured products administrative services only (aso) products total sales sales by market sector Group Disability, Group Life, and AD&D Core Market (< 2,000 lives) Large Case Market... -

Page 54

... annualized premium basis declined year over year in our group core market segment, the number of new accounts in this segment increased over 2006. Sales for our individual disability line of business increased over 2006. Long-term care sales were generally in line with our strategy for this product... -

Page 55

..., except ratios) 2008 % change 2007 % Change 2006 operating revenue Premium Income Group Long-term Disability Group Short-term Disability Total Premium Income Net Investment Income Other Income total Benefits and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Interest... -

Page 56

... the incidence of claims or the rate of recovery, as well as persistency, mortality, and interest rates used in calculating the reserve amounts. Within the group disability market, pricing and renewal actions can be taken to react to higher claim rates. However, these actions take time to implement... -

Page 57

... the adjustments to our claim reassessment incremental operating expense estimate, increased in 2007 compared to 2006 due to the decline in premium income as well as an increase in advertising and branding expenses and product and service development costs. Unum US Group Life and Accidental Death... -

Page 58

... beneï¬t ratio decreased in 2008 due primarily to lower paid claim incidence rates for both group life and the accidental death and dismemberment lines of business. The deferral of acquisition costs increased in 2008 due primarily to increased sales in the group core market segment. Amortization of... -

Page 59

... ratios) 2008 % change 2007 % Change 2006 operating revenue Premium Income Individual Disability - Recently Issued Long-term Care Voluntary Beneï¬ts Total Premium Income Net Investment Income Other Income total Benefits and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions... -

Page 60

... market, group long-term care, and voluntary lines of business. Our growth strategy includes offering a broad selection of beneï¬ts which provide cost predictability and stability over the long term for our clients through employee funding and deï¬ned employer contribution programs. We will seek... -

Page 61

... to 2008 for our group life and accidental death and dismemberment line of business. Unum UK segment Unum UK includes insurance for group long-term disability, group life, and individual disability products sold primarily in the United Kingdom through ï¬eld sales personnel and independent brokers... -

Page 62

..., claims, and expenses are received or paid in pounds, and we hold pound denominated assets to support Unum UK's pound denominated policy reserves and liabilities. We translate Unum UK's pound-denominated ï¬nancial statement items into dollars for our consolidated ï¬nancial reporting. We translate... -

Page 63

...and management of a closed block of group long-term disability claims through a reinsurance arrangement with Royal London Mutual Insurance Society Limited. At the time of the transaction, Unum UK received cash of £24.5 million, recorded £0.4 million in accrued premiums receivable, assumed reserves... -

Page 64

... for group long-term disability. Continued aggressive competition in the U.K. market is unfavorably affecting sales in all product lines. In the U.K., legislative changes that removed discrimination by employers on the basis of age, therefore encouraging the extension of insurance coverage, became... -

Page 65

... & Accident Insurance Company and marketed to employees at the workplace through an agency sales force and brokers. Operating Results Shown below are ï¬nancial results and key performance indicators for the Colonial Life segment. Year Ended December 31 (in millions of dollars, except ratios) 2008... -

Page 66

...and cancer and critical illness lines of business. The improvement in the accident, sickness, and disability line of business resulted from the continued favorable experience related to several new products introduced between 2002 and 2004. The life line of business beneï¬t ratio was higher in 2008... -

Page 67

... Individual Disability - Closed Block segment generally consists of those individual disability policies in force before the substantial changes in product offerings, pricing, distribution, and underwriting, which generally occurred during the period 1994 through 1998. A small amount of new business... -

Page 68

...the expected run-off of this block of closed business due to persistency and policy maturities. Net investment income decreased in 2008 compared to the prior year due to a decrease in bond call premiums, a lower level of assets supporting this closed block of business, and a decline in the portfolio... -

Page 69

... Holdings and Northwind Holdings out of Corporate and Other into Unum US and Individual Disability - Closed Block, respectively, and the transfer of excess assets, capital, and the associated investment income from Unum UK into Corporate and Other. Financial results previously reported have been... -

Page 70

..., which includes reinsurance pool participation; direct reinsurance, which includes accident and health, long-term care, and long-term disability coverages; and Lloyd's of London syndicate participations. During 2008, this line of business reported an operating loss of $7.7 million compared... -

Page 71

Unum 2008 Individual Life and Corporate-Owned Life During 2000, we reinsured substantially all of the individual life and corporate-owned life insurance blocks of business and ceded approximately $3.3 billion of reserves to the reinsurer. The $388.2 million before-tax gain on these transactions was... -

Page 72

... and guidelines annually, or more frequently if deemed necessary, and recommend adjustments, as appropriate. Any revisions are reviewed by the ï¬nance committee of Unum Group's board of directors and must be approved by the boards of directors of our insurance subsidiaries. See "Critical Accounting... -

Page 73

... by a Fortune 500 ï¬nancial services company, the return of which is linked to a Vanguard S&P 500 index mutual fund. This note had an embedded derivative contract and substituted highly rated bonds in place of the underlying S&P 500 index mutual fund to provide principal protection if there was... -

Page 74

... reinsurance transactions involving our Individual Disability - Closed Block segment business and the related issuance of $800.0 million of notes, as well as our capital redeployment plans. • During 2007, we recorded an adjustment to the book values and related unrealized loss of two securitized... -

Page 75

... to cancel the reinsurance contract with us. However, neither party can unilaterally terminate the reinsurance agreement except in extreme circumstances resulting from regulatory supervision, delinquency proceedings, or other direct regulatory action. Cash settlements or collateral related to... -

Page 76

... Value Net Unrealized Gain (Loss) Gross Unrealized Loss Gross Unrealized Gain Basic Industry Canadian Capital Goods Communications Consumer Cyclical Consumer Non-Cyclical Energy (Oil & Gas) Financial Institutions Mortgage/Asset-Backed Sovereigns Technology Transportation U.S. Government Agencies... -

Page 77

...374.1 million in gross unrealized losses at December 31, 2008, $2,719.0 million, or 80.6 percent, are related to investment-grade ï¬xed maturity bonds and result primarily from increases in interest rates or changes in market or sector credit spreads which occurred subsequent to acquisition of the... -

Page 78

Unum 2008 management's Discussion and analysis of financial condition and results of operations Unrealized loss on Below-investment-grade fixed maturity Bonds length of time in Unrealized loss position as of December 31, 2008 2008 (in millions of dollars) December 31 september 30 June 30 march 31 ... -

Page 79

... 31, 2008 (in millions of dollars) Classiï¬cation Fair Value Gross Unrealized Loss Number of Issuers investment-grade Utilities Financial Institutions Capital Goods Consumer Cyclical Consumer Non-Cyclical Basic Industry Communications Energy U.S. Government Agencies Transportation Technology total... -

Page 80

... 31, 2008 (in millions of dollars) Fixed Maturity Bonds Fair Value Gross Unrealized Loss Length of Time in a Loss Position investment-grade Principal Protected Equity Linked Trust Certiï¬cates U.S. Based Insurance and Financial Services Company Global Building Materials Company Global Building... -

Page 81

...fundamentals and a favorable regulatory environment. The company has adequate access to capital markets, and it recently implemented cash preservation policies such as suspension of its share repurchase program and freezing any shareholder dividend increases. Additionally, management has stated that... -

Page 82

... market operations in capital markets, asset-backed securities, wealth management, asset management, commodities, and insurance. The company has recently raised capital apart from the U.K. government program and purchased capital market businesses. The company eliminated its dividend during 2008... -

Page 83

.... The company also owns marketable long-lived assets. Our mortgage/asset-backed securities were approximately $3.7 billion and $4.0 billion on an amortized cost basis at December 31, 2008 and 2007, respectively. At December 31, 2008, the mortgage/asset-backed securities had an average life of 3.79... -

Page 84

... the individual and group long-term care and the individual and group disability products. All other product portfolios are periodically reviewed to determine if hedging strategies would be appropriate for risk management purposes. Our current credit exposure on derivatives, which is limited to the... -

Page 85

... our ability to pay our stockholder dividends or meet our debt and other payment obligations. Our policy beneï¬ts are primarily in the form of claim payments, and we have minimal exposure to the policy withdrawal risk associated with deposit products such as individual life policies or annuities... -

Page 86

... January and August 2008, as well as the transition to ï¬,oating rate ï¬xed maturity securities in lieu of short-term investments during the ï¬rst half of 2008. Proceeds from acquisitions relate to the second quarter of 2008 Unum UK acquisition of a group long-term disability claims portfolio. We... -

Page 87

...Unum Group and certain of its intermediate holding company subsidiaries and/or finance subsidiaries depend on payments from subsidiaries to pay dividends to stockholders, to pay debt obligations, and/or to pay expenses. These payments by our insurance and non-insurance subsidiaries may take the form... -

Page 88

... insurance company regulations and capital guidance in the United Kingdom. Approximately £145.5 million is available for the payment of dividends from Unum Limited during 2009, subject to regulatory approval. The amount available during 2008 for the payment of ordinary dividends from Unum Group... -

Page 89

... in a private offering. Recourse for the payment of principal, interest, and other amounts due on the notes will be limited to the assets of Tailwind Holdings, consisting primarily of the stock of its sole subsidiary Tailwind Re, a South Carolina special purpose ï¬nancial captive insurance company... -

Page 90

...analysis of financial condition and results of operations Tailwind Re to pay dividends to Tailwind Holdings will depend on its satisfaction of applicable regulatory requirements and on the performance of the reinsured claims of Unum America reinsured by Tailwind Re. None of Unum Group, Unum America... -

Page 91

... expected beneï¬t payments related to these plans, discounted with respect to interest and reï¬,ecting expected future service, as appropriate. See Note 9 of the "Notes to Consolidated Financial Statements" and "Critical Accounting Estimates" contained herein for additional information. Payable for... -

Page 92

... that assign issuer credit ratings to Unum Group and ï¬nancial strength ratings to our insurance subsidiaries. Issuer credit ratings reï¬,ect an agency's opinion of the overall ï¬nancial capacity of a company to meet its senior debt obligations. Financial strength ratings are speciï¬c to each... -

Page 93

... Group and the ï¬nancial strength ratings for each of our traditional insurance subsidiaries as of the date of this ï¬ling. AM Best Fitch Moody's S&P issuer credit ratings financial strength ratings Provident Life & Accident Provident Life & Casualty Unum Life of America First Unum Life Colonial... -

Page 94

... rate investments include ï¬xed maturity securities, mortgage loans, policy loans, and short-term investments. Fixed maturity securities include U.S. and foreign government bonds, securities issued by government agencies, corporate bonds, mortgage-backed securities, and redeemable preferred stock... -

Page 95

... Value Hypothetical FV + 100 BP Change in FV assets Fixed Maturity Securities (1) Mortgage Loans Policy Loans, Net of Reinsurance Ceded liabilities Unrealized Adjustment to Reserves, Net of Reinsurance Ceded and Other (2) Short-term Debt Long-term Debt Derivatives (1) Swaps Forwards DIG Issue B36... -

Page 96

Unum 2008 Quantitative and Qualitative Disclosures about market risk The effect of a change in interest rates on asset prices was determined using a duration implied methodology for corporate bonds and government and government agency securities whereby the duration of each security was used to ... -

Page 97

... for overseeing our enterprise-wide risk management program that is managed by our chief risk ofï¬cer. The executive management team is responsible for managing our strategic risk. We provide an ERM report to the audit committee of Unum Group's board of directors on a regular basis. We believe that... -

Page 98

... millions of dollars) 2008 2007 Assets investments Fixed Maturity Securities - at fair value (amortized cost: $34,407.6; $34,628.1) Mortgage Loans Policy Loans Other Long-term Investments Short-term Investments total investments other assets Cash and Bank Deposits Accounts and Premiums Receivable... -

Page 99

Unum 2008 December 31 (in millions of dollars) 2008 2007 Liabilities and Stockholders' Equity liabilities Policy and Contract Beneï¬ts Reserves for Future Policy and Contract Beneï¬ts Unearned Premiums Other Policyholders' Funds Income Tax Payable Deferred Income Tax Short-term Debt Long-term ... -

Page 100

...31 (in millions of dollars, except share data) 2008 2007 2006 revenue Premium Income Net Investment Income Net Realized Investment Gain (Loss) Other Income total revenue Benefits and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Interest and Debt Expense Deferral of... -

Page 101

... of Year Change During Year Cumulative Effect of Accounting Principle Change - Note 1 Balance at End of Year retained Earnings Balance at Beginning of Year Net Income Dividends to Stockholders ($0.30 per common share) Cumulative Effect of Accounting Principle Changes - Note 1 Balance at End of Year... -

Page 102

... and Beneï¬t Payments from Policyholder Accounts Net Short-term Debt Repayments Issuance of Long-term Debt Long-term Debt Repayments Cost Related to Early Retirement of Debt Issuance of Common Stock Dividends Paid to Stockholders Purchases of Treasury Stock Other, Net net cash provided (Used) by... -

Page 103

...) of $139.0; $(6.0); $(39.8)) Change in Adjustment to Reserves for Future Policy and Contract Beneï¬ts, Net of Reinsurance and Other (net of tax expense of $578.1; $34.0; $50.5) Change in Foreign Currency Translation Adjustment (net of tax benefit of $-; $-; $0.3) Change in Unrecognized Pension and... -

Page 104

... other related services. We market our products primarily to employers interested in providing beneï¬ts to their employees. We have three major business segments: Unum US, Unum UK, and Colonial Life. Our other segments are the Individual Disability - Closed Block segment and the Corporate and Other... -

Page 105

... positive, the derivatives are grouped by counterparty for which a master netting agreement has been executed. Private equity fund limited partnerships are generally carried at cost plus our share of changes in the investee's ownership equity since acquisition. Short-term Investments are carried at... -

Page 106

... and the costs of acquiring the new policy are capitalized and amortized in accordance with our accounting policies for deferred acquisition costs. Loss recognition is generally performed on an annual basis. Insurance contracts are grouped for each major product line within a segment when we perform... -

Page 107

.... We perform loss recognition tests on our policy reserves annually, or more frequently if appropriate, using best estimate assumptions as of the date of the test, without a provision for adverse deviation. We group the policy reserves for each major product line within a segment when we perform the... -

Page 108

... exchange rates. Assets and liabilities are translated at the rate of exchange on the balance sheet date. The translation gain or loss is generally reported in accumulated other comprehensive income, net of deferred tax. accounting for participating individual life insurance: Participating policies... -

Page 109

... provisions are generally applied only to share-based awards granted subsequent to adoption. Prior to adoption of SFAS 123(R), the unrecognized compensation cost related to nonvested stock awards was reported as additional paid-in capital and deferred compensation, a contra equity account. The value... -

Page 110

...Note 1, the sale of GENEX closed effective March 1, 2007, and we recognized an after-tax gain of $6.2 million on the sale, which is included in income from discontinued operations in our statements of income. We intend to continue to purchase certain disability management services for a period of up... -

Page 111

... 2008 (in millions of dollars) Carrying Amount Fair Value Carrying Amount 2007 Fair Value assets Fixed Maturity Securities Mortgage Loans Policy Loans Other Long-term Investments Derivatives Miscellaneous Long-term Investments liabilities Policyholders' Funds Deferred Annuity Products Supplementary... -

Page 112

...-for-sale securities United States Government and Government Agencies and Authorities States, Municipalities, and Political Subdivisions Foreign Governments Public Utilities Mortgage/Asset-Backed Securities All Other Corporate Bonds Redeemable Preferred Stocks total fixed maturity securities $ 1,591... -

Page 113

... Value Unrealized Loss Fair Value Unrealized Loss Description United States Government and Government Agencies and Authorities Foreign Governments Public Utilities Mortgage/Asset-Backed Securities All Other Corporate Bonds Redeemable Preferred Stocks total $ - 128.8 983.7 218.7 3,245.0 91.7 $4,667... -

Page 114

...relative to their historical cycles. • Market conditions. • Rating agency actions. • Bid and offering prices and the level of trading activity. • Adverse changes in estimated cash flows for securitized investments. • Any other key measures for the related security. If we determine that the... -

Page 115

... $85.6 million, $0.6 million, and $13.7 million, respectively, as of December 31, 2008. The bonds are reported as ï¬xed maturity securities, and the non-redeemable preferred stock and partnerships are reported as other long-term investments in the consolidated balance sheets. We have a signiï¬cant... -

Page 116

... be due at closing of the mortgage loans. Net Investment Income Sources for net investment income are as follows: Year Ended December 31 (in millions of dollars) 2008 2007 2006 Fixed Maturity Securities Derivative Financial Instruments Mortgage Loans Policy Loans Other Long-term Investments Short... -

Page 117

... would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date and, therefore, represents an exit price, not an entry price. The exit price objective applies regardless of a reporting entity's intent and/or ability to... -

Page 118

Unum 2008 notes to consolidated financial statements The selection of the valuation method(s) to apply considers the deï¬nition of an exit price and depends on the nature of the asset or liability being valued. For assets and liabilities accounted for at fair value, we generally use valuation ... -

Page 119

...• Corporate actions • Underlying collateral • Prepayment speeds/loan performance/delinquencies • Public covenants • Comparative bond analysis • Derivative spreads • Third-party pricing sources • Relevant reports issued by analysts and rating agencies The overall valuation process for... -

Page 120

... used to determine fair values of the securities transferred: (1) transactional data for new issuance and secondary trades, (2) broker/dealer quotes and pricing, primarily related to the lack of an active and orderly market, and (3) comparable bond metrics from which to perform an analysis. For... -

Page 121

... table summarizes the timing of anticipated settlements of interest rate swaps outstanding at December 31, 2008, whereby we receive a ï¬xed rate and pay a variable rate. The weighted average interest rates assume current market conditions. (in millions of dollars) 2009 2010 2011 2012 2013 Total... -

Page 122

Unum 2008 notes to consolidated financial statements Cash Flow Hedges We have executed a series of cash ï¬,ow hedges for certain of our long-term product portfolios using forward starting interest rate swaps. The purpose of these hedges is to lock in the reinvestment rates on future anticipated ... -

Page 123

... to cancel the reinsurance contract with us. However, neither party can unilaterally terminate the reinsurance agreement except in extreme circumstances resulting from regulatory supervision, delinquency proceedings, or other direct regulatory action. Cash settlements or collateral related to... -

Page 124

...to 2007 relates primarily to an increased rate of claim recoveries for our group long-term disability lines of business in Unum US and Unum UK. Our claim resolution rate assumption used in determining reserves is our expectation of the resolution rate we will experience over the life of the block of... -

Page 125

... at U.S. federal statutory tax rates, to the income tax expense (beneï¬t) as included in the consolidated statements of income, is as follows: December 31 2008 2007 2006 Statutory Income Tax Prior Year Taxes and Interest Tax-exempt Investment Income Foreign Net Operating Losses Other Foreign... -

Page 126

... Asset total net Deferred tax (asset) liability 561.4 233.4 45.5 840.3 4.1 836.2 $(438.8) - 148.3 36.6 184.9 5.6 179.3 $251.7 $ 297.9 - 99.5 397.4 $284.9 62.1 84.0 431.0 Our consolidated statements of income include amounts subject to both domestic and foreign taxation. The income and related tax... -

Page 127

...expense and penalties related to unrecognized tax expense in our consolidated statements of income of $5.9 million and $2.0 million during 2008 and 2007, respectively. We had no changes to uncertain tax positions as a result of settlements or lapses in statutes of limitations during 2008 or 2007. We... -

Page 128

... of loss carryforwards during 2008 as well as the ï¬,uctuation in the British pound sterling to dollar exchange rate. Total income taxes paid during 2008, 2007, and 2006 were $369.0 million, $189.9 million, and $129.2 million, respectively. note 8. Debt Long-term and short-term debt consists of the... -

Page 129

... disability insurance policies issued by or reinsured by Provident Life and Accident Insurance Company, Unum Life Insurance Company of America (Unum America), and The Paul Revere Life Insurance Company (collectively, the ceding insurers) pursuant to separate reinsurance agreements between Northwind... -

Page 130

... investors. Each unit had a stated amount of $25 and consisted of (a) a contract pursuant to which the holder agrees to purchase, for $25, shares of Unum Group common stock on May 15, 2007 and which entitled the holder to contract adjustment payments at the annual rate of 3.165 percent, payable... -

Page 131

... retired $17.8 million of our outstanding 5.859% notes and $175.0 million of our 5.997% notes. Interest and Debt Expense Interest paid on long-term and short-term debt and related securities during 2008, 2007, and 2006 was $157.3 million, $184.1 million, and $200.7 million, respectively. The cost... -

Page 132

Unum 2008 notes to consolidated financial statements The following tables provide the changes in the beneï¬t obligation and fair value of plan assets and statements of the funded status of the plans. Pension Beneï¬ts U.S. Plans (in millions of dollars) 2008 2007 Non U.S. Plans 2008 2007 ... -

Page 133

...) 2008 2007 Non U.S. Plans 2008 2007 Postretirement Beneï¬ts 2008 2007 Current Pension Liability Noncurrent Pension Liability Unfunded liability Unrecognized Pension and Postretirement Beneï¬t Costs Net Actuarial Loss Prior Service Credit Transition Asset Deferred Income Tax Asset (Liability... -

Page 134

... in U.K. corporate bonds and index linked U.K. government bonds. Assets for life insurance beneï¬ts payable to certain former retirees covered under the postretirement beneï¬ts plan are invested primarily within life insurance contracts issued by one of our insurance subsidiaries. The terms of... -

Page 135

...generally based on periodic studies of compensation trends. For measurement purposes at December 31, 2008 and 2007, the annual rate of increase in the per capita cost of covered postretirement health care beneï¬ts assumed for the next calendar year was 9.00 percent for beneï¬ts payable to retirees... -

Page 136

... general assets to pay medical and dental claims as they come due in lieu of utilizing plan assets for the medical and dental beneï¬t portions of our postretirement beneï¬ts plan. note 10. stockholders' Equity and Earnings per common share Common Stock During 2007, Unum Group's board of directors... -

Page 137

... Stock Unum Group has 25,000,000 shares of preferred stock authorized with a par value of $0.10 per share. No preferred stock has been issued to date. Earnings Per Common Share Net income per common share is determined as follows: 2008 Year Ended December 31 2007 (in millions of dollars, except... -

Page 138

...000 shares were available at December 31, 2008. The stock options have a maximum term of ten years after the date of grant and generally vest after three years. Under the stock plan of 1999, comprised of the Provident Companies, Inc. stock plan of 1999 and the UnumProvident Corporation stock plan of... -

Page 139

... was reported as additional paid-in capital and deferred compensation, a contra equity account. The value of this contra equity account at the adoption of SFAS 123(R) was $13.8 million. Performance Restricted Stock Units (PRSUs) PRSU activity is summarized as follows: Weighted Average Grant Date... -

Page 140

... based on the dividend rate at the date of grant. • Risk-free interest rate of 2.93 percent and 4.67 percent, respectively, based on the yield of treasury bonds at the date of grant. ESPP ESPP activity is summarized as follows: Year Ended December 31 2008 2007 2006 Number of Shares Sold Weighted... -

Page 141

... recoverable relates to business reinsured either with companies rated A- or better by A.M. Best Company, with overseas entities with equivalent ratings or backed by letters of credit or trust agreements, or through reinsurance arrangements wherein we retain the assets in our general account. Less... -

Page 142

... and management of a closed block of group long-term disability claims through a reinsurance arrangement with Royal London Mutual Insurance Society Limited. As a result of the assumption, Unum UK received cash of £24.5 million, recorded £0.4 million in accrued premiums receivable, assumed reserves... -

Page 143

...-term Care Voluntary Beneï¬ts 471.5 580.7 446.8 4,963.0 Unum UK Group Long-term Disability Group Life Individual Disability 675.9 174.6 38.8 889.3 Colonial Life Accident, Sickness, and Disability Life Cancer and Critical Illness 606.9 157.4 213.0 977.3 Individual Disability - Closed Block Corporate... -

Page 144

Unum 2008 notes to consolidated financial statements Selected operating statement data by segment is presented as follows: Individual Disability - Closed Block (in millions of dollars) Unum US Unum UK Colonial Life Corporate and Other Total Year Ended December 31, 2008 Total Premium Income ... -

Page 145

... segment: (in millions of dollars) Unum US Unum UK Colonial Life Total Year Ended December 31, 2008 Beginning of Year Capitalized Amortization Foreign Currency and Other End of Year Year Ended December 31, 2007 Beginning of Year Cumulative Effect of Accounting Principle Change - Note 1 Capitalized... -

Page 146

Unum 2008 notes to consolidated financial statements Assets by segment are as follows: December 31 (in millions of dollars) 2008 2007 By segment Unum US Unum UK Colonial Life Individual Disability - Closed Block Corporate and Other total $20,440.9 2,865.4 2,446.9 14,353.0 9,311.2 $49,417.4 $21,... -

Page 147

... in the Tennessee Circuit Court and subsequently removed to federal court. The complaint alleges claims against Unum Group and certain subsidiaries on behalf of a putative class of long-term disability insurance policyholders who did not obtain their coverage through employer sponsored plans and who... -

Page 148

... Florida, Maine, Massachusetts, North Carolina, South Carolina, and Tennessee. The subpoenas and/or information requests relate to, among other things, compliance with ERISA relating to our interactions with insurance brokers and to regulations concerning insurance information provided by us to plan... -

Page 149

... antitrust laws, RICO, ERISA, and various state common law requirements by engaging in alleged bid rigging and customer allocation and by paying undisclosed compensation to insurance brokers to steer business to defendant insurers. Defendants ï¬led a motion to dismiss the complaint on November 29... -

Page 150

... claims arise from the sale of corporate-owned life insurance policies to Public Service Company of Colorado by Mallon in 1984 and 1985. These policies were reinsured to Reassure America Life Insurance Company, a subsidiary of Swiss Reinsurance Company, as of July 2000. In response to the complaint... -

Page 151

...the payment of ordinary dividends from our U.S. insurance subsidiaries, excluding Tailwind Re and Northwind Re, during 2009. The ability of Tailwind Re and Northwind Re to pay dividends to their parent companies, Tailwind Holdings and Northwind Holdings, wholly-owned subsidiaries of Unum Group, will... -

Page 152

... quarterly results of operations for 2008 and 2007: 2008 (in millions of dollars, except share data) 4th 3rd 2nd 1st Premium Income Net Investment Income Net Realized Investment Gain (Loss) Total Revenue Income Before Income Tax Net Income Net Income Per Common Share Basic Assuming Dilution $1,917... -

Page 153

Unum 2008 report of independent registered public accounting firm Board of Directors and Stockholders Unum Group and Subsidiaries We have audited the accompanying consolidated balance sheets of Unum Group and subsidiaries as of December 31, 2008 and 2007, and the related consolidated statements of ... -

Page 154

... fairly reflect the Company's transactions and dispositions of assets; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with U.S. generally accepted accounting principles; (iii) provide reasonable assurance that... -

Page 155

... registered public accounting firm The Board of Directors and Stockholders Unum Group and Subsidiaries We have audited Unum Group and subsidiaries' internal control over ï¬nancial reporting as of December 31, 2008, based on criteria established in Internal Control-Integrated Framework issued... -

Page 156

..., or pandemics, new trends and developments in medical treatments, and the effectiveness of claims management operations. • Increased competition from other insurers and financial services companies due to industry consolidation or other factors. • Legislative, regulatory, or tax changes, both... -

Page 157

... Glendale, CA 91203 800 424 2008 1200 Colonial Life Blvd. Columbia, SC 29210 803 798 7000 Milton Court Dorking, Surrey RH4 3LZ England 011 44 1306 887766 Unum life insurance company of america Portland, Maine corporate information Susan N. Roth Corporate Secretary 1 Fountain Square Chattanooga, TN... -

Page 158

Unum group 1 fountain square chattanooga, tn 37402 www.unum.com ©2009 Unum group. all rights reserved. Unum is a registered trademark and marketing brand of Unum group and its insuring subsidiaries. g-73975 (04-09) 10% all the paper used in this annual report is Elemental chlorine free. the ...