Unum 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Unum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report FUTURE READY

Table of contents

-

Page 1

2007 Annual Report FUTURE READY -

Page 2

... on cash ï¬,ow hedges, which also tend to ï¬,uctuate depending on market conditions and general economic trends, is an important measure. 4 7 8 10 12 14 16 17 Letter from the CEO Financial Strength for the Future Future Ready Unum US Unum UK Colonial Life Board of Directors and Senior Ofï¬cers... -

Page 3

... and new answers - a world where beneï¬ts are as much about helping businesses become more productive as they are about protecting people and their livelihoods. Unum is FUTURE READY with forward-thinking beneï¬t solutions that enable businesses to attract and keep the best employees, manage... -

Page 4

The makeup of the workforce is changing Creating the need for beneï¬ts solutions to meet a diverse population. Employees choices and Unum Is Ready With 2 -

Page 5

Healthcare costs are rising rapidly are faced with more decisions Continuing to put more pressure on employers' beneï¬ts budgets. As the cost and responsibility for beneï¬ts is being shifted to individuals. Solutions 3 -

Page 6

... claims management within our group long-term disability business. In addition, both Unum UK and Colonial Life again generated record earnings in 2007. Unum UK is a leading employee beneï¬ts provider in the United Kingdom and continues to capitalize on an underpenetrated income protection market... -

Page 7

... At Unum, we have spent the last several years working closely with regulators to implement enhanced claim practices. We have also been a leader in establishing improved disclosure of sales compensation. We are working hard to ensure our products, services and practices anticipate market changes and... -

Page 8

... and online services that we believe will transform the marketplace. In Unum UK, where employers and employees face similar challenges to those in the U.S., we are expanding our product portfolio to include voluntary beneï¬ts. And in Colonial Life, we believe the investment we are making in a new... -

Page 9

... Future A Conversation with Chief Financial Ofï¬cer Bob Greving Q: Unum's results exceeded Wall Street estimates in 2007, and the company is stronger than perhaps at any other time in its history. How does this ï¬nancial strength translate to preparedness for the future? A: I believe Unum is well... -

Page 10

... of beneï¬ts products and solutions, but also through the caring service its beneï¬ts specialists provide to customers during some of the most difï¬cult times in their lives. According to independent research, Unum's customer satisfaction remained at record levels last year, an indication... -

Page 11

...professional and leadership development, including launching a number of initiatives aimed at fortifying its bench strength. Employee satisfaction remains at all-time highs, too, as Unum was once again named one of the best places to work in its home states of Maine, South Carolina and Tennessee. 9 -

Page 12

Unum US FUTURE READY With Beneï¬ts That Build Meaningful Connections 10 -

Page 13

... United States, protecting millions of people and their families in the event of illness or injury. It is the market leader in both group and individual disability insurance and group long-term care, as well as one of the largest providers of group life and voluntary workplace beneï¬ts - products... -

Page 14

Unum UK FUTURE READY With Beneï¬t Solutions That Fit The New Workplace 12 -

Page 15

...a market that has traditionally relied on government-funded programs to manage the ï¬nancial impact of disability and critical illness. In the process, Unum is working to help individuals understand that they need to take personal responsibility to provide for what may happen in the future. Unum is... -

Page 16

Colonial Life FUTURE READY With A Personal Approach To Employee Beneï¬ts 14 -

Page 17

...as well as any possible gaps that may exist in their coverage. State-of-the-art enrollment systems and best-in-class service after the sale are also key components of Colonial Life's value in the marketplace. In 2007, for instance, the company introduced a new enrollment system that offers ï¬,exible... -

Page 18

... Robert C. Greving Executive Vice President, Chief Financial Officer and Chief Actuary E. Liston Bishop III General Counsel (Interim) B. Franklin Williamson Senior Vice President, Capital Management and Chief Investment Officer Randall C. Horn President and Chief Executive Officer Colonial Life... -

Page 19

... Income (Loss) 92 Notes to Consolidated Financial Statements 140 Reports of Independent Registered Public Accounting Firm and Management's Annual Report on Internal Control Over Financial Reporting 143 Cautionary Statement Regarding Forward-Looking Statements 144 Corporate Information Unum 2007... -

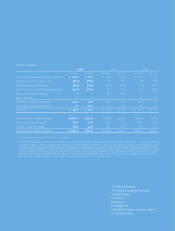

Page 20

... in Reserves for Future Beneï¬ts (1) Commissions Interest and Debt Expense and Cost Related to Early Retirement of Debt (2) Other Expenses Total Income (Loss) from Continuing Operations Before Income Tax and Cumulative Effect of Accounting Principle Change Income Tax (Beneï¬t) (4) Income (Loss... -

Page 21

... related to the restructuring of the individual disability - closed block; and reserve strengthening of $894.0 million in 2003 for Unum US group disability. (2) Included are costs related to early retirement of debt of $58.8 million and $25.8 million in 2007 and 2006, respectively. (3) Includes the... -

Page 22

... the profitability of our Unum US group disability line of business; • Ensure that all of our other product lines and businesses that are performing well continue to do so; • Continue to execute our capital management strategy; and • Successful completion of the claim reassessment process in... -

Page 23

... transfer to Northwind Re, our traditional U.S. insurance subsidiaries were able to release excess statutory capital previously supporting this reinsured closed block business. The excess capital was transferred to Unum Group from the ceding companies through extraordinary dividends. This capital... -

Page 24

... on all ERISA claims was granted. Discovery in the case remains stayed while the court considers the proper procedure for handling of the remaining state law claims and plaintiffs pursue their appeal. • We executed a settlement agreement resolving the plan beneficiary class action, or 401... -

Page 25

.... We released $10.3 million for Unum US group longterm disability and $2.5 million for our Individual Disability - Closed Block segment. 8. These second quarter of 2007 adjustments to our claim reassessment costs decreased 2007 before-tax operating earnings for our Unum US group disability line of... -

Page 26

... debentures due 2015. On October 31, 2007, Northwind Holdings, a newly formed Delaware limited liability company and a wholly-owned subsidiary of Unum Group, issued $800.0 million of ï¬,oating rate, insured, senior, secured notes due 2037 in a private offering. The notes bear interest at a ï¬,oating... -

Page 27

... tax liability related to our U.K. operations. Other During the ï¬rst quarter of 2008, we established a new non-insurance company, Unum Ireland Limited, which is an indirect wholly-owned subsidiary of Unum Group. The purpose of Unum Ireland Limited is to expand our information technology resource... -

Page 28

... disclosure and provide information on our Company website about our broker compensation programs. Under these policies, any customer who wants speciï¬c broker compensation related information can obtain this information by contacting our Broker Compensation Services at a toll-free number. Other... -

Page 29

....8 million before tax, or $16.9 million after tax. In November 2006, Tailwind Holdings, a Delaware limited liability company and a wholly-owned subsidiary of Unum Group, issued $130.0 million of ï¬,oating rate, insured, senior, secured notes in a private offering. The payment of principal, interest... -

Page 30

... DOI for the use of new individual and group disability policy forms, which became available for sale on November 1, 2005. The California settlement also incorporated the claim reassessment process contained in the 2004 multistate settlement agreements. California claimants were included in the... -

Page 31

... for the Unum US segment group disability line of business and supplemental and voluntary lines of business $37.4 million and $3.3 million, respectively, and the Individual Disability - Closed Block segment $34.3 million. The ongoing costs of changes in the claims handling process and governance... -

Page 32

... individual disability, individual and group long-term care, and voluntary beneï¬ts products in our Unum US segment; individual disability products in our Unum UK segment; disability and cancer and critical illness policies in our Colonial Life segment; and, the Individual Disability - Closed Block... -

Page 33

.... We continue to service a block of group pension products, which we have not ceded, and the policy reserves for these products are based on expected mortality rates and retirement rates. Expected future payments are discounted at interest rates reï¬,ecting the anticipated investment returns for the... -

Page 34

...the Colonial Life lines of business are: 1) the timing, rate, and amount of estimated future claim payments; and 2) the estimated expenses associated with the payment of claims. The following table displays policy reserves, incurred claim reserves, and IBNR claim reserves by major product line, with... -

Page 35

... 2007 Gross Claim Reserves Incurred IBNR % Total (1) Total Reinsurance Ceded Total Net Group Disability $ - Group Life and Accidental Death & Dismemberment 73.9 Individual Disability - Recently Issued 458.4 Long-term Care 2,478.2 Voluntary Beneï¬ts 853.1 Unum US Segment Unum UK Segment Colonial... -

Page 36

... on our level of reserves because many of our product lines provide beneï¬t payments over an extended period of time. 1. The discount rate, which is used in calculating both policy reserves and incurred and IBNR claim reserves, is the interest rate that we use to discount future claim payments to... -

Page 37

... the variance for both the group long-term disability line of business and the Individual Disability - Closed Block segment is the claim resolution rate. We believe that these ranges provide a reasonable estimate of the possible changes in reserve balances for those product lines where we believe it... -

Page 38

... include certain commissions, other agency compensation, selection and policy issue expenses, and ï¬eld expenses. Acquisition costs that do not vary with the production of new business, such as commissions on group products which are generally level throughout the life of the policy, are excluded... -

Page 39

... Market conditions. • Rating agency actions. • Bid and offering prices and the level of trading activity. • Adverse changes in estimated cash flows for securitized investments. • Any other key measures for the related security. Our review procedures include, but are not limited... -

Page 40

... discount (interest) rate and the long-term rate of return on plan assets. We also use, as applicable, expected increases in compensation levels and a weighted-average annual rate of increase in the per capita cost of covered beneï¬ts, which reï¬,ects a health care cost trend rate. 38 Unum 2007... -

Page 41

...ï¬t payment stream to a present value. We set the discount rate assumption at the measurement date for each of our retirement related beneï¬t plans to reï¬,ect the yield of a portfolio of high quality ï¬xed income debt instruments matched against the timing and amounts of projected future bene... -

Page 42

..., non-guaranteed obligation, and current regulations do not require speciï¬c funding levels for these beneï¬ts, which are comprised of retiree life, medical, and dental beneï¬ts. It is our practice to use general assets to pay medical and dental claims as they come due in lieu of utilizing plan... -

Page 43

... assets and discount rate discussed above will not affect the cash contributions we are required to make to our U.S. pension and OPEB plans because we have met all minimum funding requirements set forth by the Employee Retirement Income Security Act of 1974 (ERISA). We had no regulatory contribution... -

Page 44

... dollars) 2007 % Change 2006 % Change 2005 Revenue Premium Income Net Investment Income Net Realized Investment Gain (Loss) Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Interest and Debt Expense Cost Related to Early Retirement of Debt... -

Page 45

... investment income, versus a partial year during 2005, on the bonds transferred to us in conjunction with the third quarter of 2005 recapture of a ceded closed block of individual disability business. We expect that our portfolio yield will continue to gradually decline until the market rates on new... -

Page 46

... of in force policies written in prior years as well as current new sales. Premiums for fully insured products are reported as premium income. Fees for ASO products (those where the risk and responsibility for funding claim payments remain with the customer and we only provide services) are included... -

Page 47

..., or case persistency, for our Unum US group market on an aggregate basis. See "Segment Results" as follows for additional discussion of sales by segment. Segment Results Our reporting segments are comprised of the following: Unum US, Unum UK, Colonial Life, Individual Disability - Closed Block... -

Page 48

...group life and accidental death and dismemberment products, and supplemental and voluntary lines of business. The supplemental and voluntary lines of business are comprised of recently issued disability insurance, group and individual long-term care insurance, and voluntary beneï¬ts products. Unum... -

Page 49

... to focus on the multi-life individual disability business, with almost 94 percent of total 2007 sales for this line of business occurring in the multi-life market. Long-term care sales were generally in line with our strategy for this product line, with growth in the group product and a decline in... -

Page 50

... of total 2006 sales for our individual disability line of business occurred in the multi-life market. Long-term care sales were generally in line with our strategy for this product line, with growth in the group product and a decline in sales for individual long-term care. Voluntary beneï¬ts... -

Page 51

..., except ratios) 2007 % Change 2006 % Change 2005 Operating Revenue Premium Income Group Long-term Disability Group Short-term Disability Total Premium Income Net Investment Income Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Deferral... -

Page 52

... our business mix strategy. Net investment income increased in 2007 in comparison to the prior year due to the growth in the level of assets supporting these lines of business, partially offset by the impact of the lower yield resulting from the lower interest rate environment and a decrease in bond... -

Page 53

...of dollars, except ratios) 2007 % Change 2006 % Change 2005 Operating Revenue Premium Income Group Life Accidental Death & Dismemberment Total Premium Income Net Investment Income Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Deferral of... -

Page 54

... risk selection strategy. The decrease in net investment income relative to 2005 resulted primarily from a decline in the level of assets supporting these lines of business. The group life line reported a slightly increased beneï¬t ratio in 2006 due primarily to an increased average claim size and... -

Page 55

... Unum US supplemental and voluntary product lines. Year Ended December 31 (in millions of dollars, except ratios) 2007 % Change 2006 % Change 2005 Operating Revenue Premium Income Individual Disability - Recently Issued Long-term Care Voluntary Beneï¬ts Total Premium Income Net Investment Income... -

Page 56

... product lines declined compared to the prior year. Net investment income increased relative to the prior year primarily from growth in the level of assets supporting these lines of business. The interest adjusted loss ratio for the individual disability - recently issued business decreased in 2007... -

Page 57

..., except ratios) 2007 % Change 2006 % Change 2005 Operating Revenue Premium Income Group Long-term Disability Group Life Individual Disability Total Premium Income Net Investment Income Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions... -

Page 58

...of pounds) 2007 % Change 2006 % Change 2005 Operating Revenue Premium Income Group Long-term Disability Group Life Individual Disability Total Premium Income Net Investment Income Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Deferral of... -

Page 59

...due primarily to sales of group and individual disability products and stable persistency for those two lines of business, partially offset by lower sales for group life and continued lower persistency relative to the levels of 2005 and early 2006. Net investment income increased in 2007 relative to... -

Page 60

... group disability product targeted to our core market segment, and in our individual business we plan to emphasize our own brand sales in those markets where we presently hold a strong position. We also intend to launch an initiative to provide Unum UK with industry leading services, processes... -

Page 61

... The Colonial Life segment includes insurance for accident, sickness, and disability products, life products, and cancer and critical illness products issued primarily by Colonial Life & Accident Insurance Company and marketed to employees at the workplace through an agency sales force and brokers... -

Page 62

... claim payment remained constant in 2007 relative to the prior year. The life line of business reported a decrease in the rate of incurred claims for 2007, although the aggregate claim expense increased due to the larger block of business. The cancer and critical illness product line also reported... -

Page 63

...in the number of new accounts over the prior year, offset partially by a decrease in the average new case size, which resulted in lower annualized premium per case sold. Colonial Life's sales increased in 2006 compared to 2005 due to increases in both public sector and commercial market segments. In... -

Page 64

Management's Discussion and Analysis of Financial Condition and Results of Operations Individual Disability - Closed Block Segment The Individual Disability - Closed Block segment generally consists of those individual disability policies in force before the substantial changes in product offerings,... -

Page 65

...transfer to Northwind Re, we released excess statutory capital previously supporting this reinsured closed block business. As a result, the capital allocated to our Individual Disability - Closed Block segment declined, with a resulting decrease in net investment income due to the lower asset levels... -

Page 66

... group pension, health insurance, and individual annuities. We expect operating revenue and income resulting from the products that are not actively marketed to decline over time as these business lines wind down, and we expect to reinvest the capital supporting these lines of business in the future... -

Page 67

... amortized into income based upon expected future premium income on the traditional insurance policies ceded and estimated future gross proï¬ts on the interest-sensitive insurance policies ceded. A portion of the ceded corporate-owned life insurance block of business surrendered during 2007. The... -

Page 68

... remaining assets can be held in publicly traded investment-grade corporate securities, mortgage-backed securities, bank loans, asset-backed securities, government and government agencies, and municipal securities. • We intend to manage the risk of losses due to changes in interest rates by... -

Page 69

... assets, partially offset by a lower yield due to the investment of new cash at lower rates than that of our overall portfolio yield and a decline in the level of prepayment income on mortgage-backed securities. The overall yield in our investment portfolio was 6.66 percent as of December 31, 2007... -

Page 70

... of $15.0 million on bonds issued by a large media company. The company was the subject of a leveraged buyout that placed a large amount of debt on the balance sheet during 2007. Because of our outlook for the future business prospects of this issuer, the length of time these securities had been in... -

Page 71

... ceded corporate-owned life insurance block of business. The investment income on ceded policy loans is not included in income. Therefore, the termination of this fully ceded business had no impact on our net investment income. Distribution of Invested Assets December 31 2007 2006 Investment-Grade... -

Page 72

... Gain Basic Industry Canadian Capital Goods Communications Consumer Cyclical Consumer Non-Cyclical Derivatives Hedging Available-for-Sale Energy (Oil & Gas) Financial Institutions Mortgage/Asset-Backed Sovereigns Technology Transportation U.S. Government Agencies and Municipalities Utilities Total... -

Page 73

... rates or changes in market or sector credit spreads which occurred subsequent to acquisition of the bonds. The following table shows the length of time the investment-grade ï¬xed maturity bonds had been in a gross unrealized loss position as of December 31, 2007. Unrealized Loss on Investment... -

Page 74

..., 2007 (in millions of dollars) Fixed Maturity Bonds Fair Value Gross Unrealized Loss Length of Time in a Loss Position Investment-Grade U.S. Government Sponsored Mortgage Funding Company Principal Protected Equity Linked Note Total Below-Investment Grade United Kingdom Based Financial Institution... -

Page 75

...The fixed maturity bond of the U.S. government sponsored mortgage funding company was issued by the Federal Home Loan Mortgage Corporation. The bond was rated AAA by S&P as of December 31, 2007, with no negative outlook by rating agencies or in analysts' reports. The change in the market value of... -

Page 76

... a review of individual loans and the overall loan portfolio, considering the value of the underlying collateral. Investment valuation allowances for real estate held for sale are established based on a review of speciï¬c assets. If a decline in value of a mortgage loan or real estate investment is... -

Page 77

... and investment income, as well as maturities and sales of invested assets, provide the primary sources of cash. Debt and/or securities offerings provide an additional source of liquidity. Cash is applied to the payment of policy beneï¬ts, costs of acquiring new business (principally commissions... -

Page 78

... only on new sales, but on renewals of existing business, renewal price increases, and stable persistency. Investment income growth is dependent on the growth in the underlying assets supporting our insurance reserves and on the level of portfolio yield rates. Increases in commissions and operating... -

Page 79

...ows of $3.5 million related to the GENEX acquisition of Independent Review Services, Inc. Policy loans, as reported in our consolidated balance sheet, declined during 2007 due to the surrender of a portion of our ceded corporate-owned life insurance block of business. The termination of this fully... -

Page 80

... regulatory approval from the insurance department of its state of domicile to pay dividends of $35.0 million to Tailwind Holdings. The payment of dividends to the parent company from our subsidiaries also requires the approval of the individual subsidiary's board of directors. The ability of Unum... -

Page 81

... beginning of 2007. On October 31, 2007, Northwind Holdings issued $800.0 million ï¬,oating rate, insured, senior, secured notes in a private offering. Recourse for the payment of principal, interest, and other amounts due on the notes will be limited to the assets of Northwind Holdings, consisting... -

Page 82

... raise funds from the offering of any individual security covered by the shelf registration as well as any combination thereof, subject to market conditions and our capital needs. See Note 9 of the "Notes to Consolidated Financial Statements" for additional information. 80 Unum 2007 Annual Report -

Page 83

...ï¬t payments related to these plans, discounted with respect to interest and reï¬,ecting expected future service, as appropriate. See Note 10 of the "Notes to Consolidated Financial Statements" and "Critical Accounting Estimates" contained herein for additional information. Unum 2007 Annual Report... -

Page 84

...of a company to meet its senior debt obligations. Financial strength ratings are speciï¬c to each individual insurance subsidiary and reï¬,ect each rating agency's view of the overall ï¬nancial strength (capital levels, earnings, growth, investments, business mix, operating performance, and market... -

Page 85

... for Unum Group and the ï¬nancial strength ratings for each of our traditional insurance subsidiaries as of the date of this ï¬ling. AM Best Fitch Moody's S&P Issuer Credit Ratings Financial Strength Ratings Provident Life & Accident Provident Life & Casualty Unum Life of America First Unum Life... -

Page 86

... to compute the overall change in market value. The changes in the fair values of long-term debt were determined using discounted cash ï¬,ows analyses. Because we actively manage our investments and liabilities, actual changes could be less than those estimated above. 84 Unum 2007 Annual Report -

Page 87

... for identifying, measuring, reporting, and managing insurance and operational risks within their respective areas, consistent with corporate risk tolerance levels. Market and credit risk are jointly managed and executed by our asset/liability and investment committees. Unum 2007 Annual Report 85 -

Page 88

...cost: $34,629.2; $33,414.1) Mortgage Loans Real Estate Policy Loans Other Long-term Investments Short-term Investments Total Investments Other Assets Cash and Bank Deposits Accounts and Premiums Receivable Reinsurance Recoverable Accrued Investment Income Deferred Acquisition Costs Goodwill Property... -

Page 89

December 31 (in millions of dollars) 2007 2006 Liabilities and Stockholders' Equity Liabilities Policy and Contract Beneï¬ts Reserves for Future Policy and Contract Beneï¬ts Unearned Premiums Other Policyholders' Funds Income Tax Payable Deferred Income Tax Short-term Debt Long-term Debt Other ... -

Page 90

..., except per share data) 2007 2006 2005 Revenue Premium Income Net Investment Income Net Realized Investment Gain (Loss) Other Income Total Revenue Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Interest and Debt Expense Cost Related to Early Retirement of... -

Page 91

...Retained Earnings Balance at Beginning of Year Net Income Dividends to Stockholders ($0.30 per common share) Cumulative Effect of Accounting Principle Changes - Note 1 Balance at End of Year Treasury Stock Balance at Beginning and End of Year Deferred Compensation...7,363.9 Unum 2007 Annual Report 89 -

Page 92

... Activities Maturities and Beneï¬t Payments from Policyholder Accounts Short-term Debt Repayments Issuance of Long-term Debt Long-term Debt Repayments Cost Related to Early Retirement of Debt Issuance of Common Stock Dividends Paid to Stockholders Other, Net Net Cash Provided (Used) by Financing... -

Page 93

....7) Change in Adjustment to Reserves for Future Policy and Contract Beneï¬ts, Net of Reinsurance (net of tax expense (beneï¬t) of $34.0; $50.5; $(10.0)) Change in Foreign Currency Translation Adjustment (net of tax beneï¬t of $-; $0.3; $0.2) Change in Unrecognized Pension and Postretirement Bene... -

Page 94

... services. We market our products primarily to employers interested in providing beneï¬ts to their employees. We have three major business segments: Unum US, Unum UK, and Colonial Life. Our other segments are the Individual Disability - Closed Block (previously referred to as Individual Income... -

Page 95

... loan's contractual interest rate. Included in policy loans are $2,422.0 million and $3,238.1 million of policy loans ceded to reinsurers at December 31, 2007 and 2006, respectively. Other Long-term Investments, primarily private equity fund limited partnerships, are generally carried at cost plus... -

Page 96

... do not vary with the production of new business, such as commissions on group products which are generally level throughout the life of the policy, are excluded from deferral. Deferred acquisition costs are subject to recoverability testing at the time of policy issue and loss recognition testing... -

Page 97

... rates, after consideration for defaults and investment expenses, for the assets supporting the liabilities for the various product lines. Unlike policy reserves, claim reserves are subject to revision as current claim experience and projections of future experience change. Unum 2007 Annual Report... -

Page 98

...translation gain or loss is generally reported in accumulated other comprehensive income, net of deferred tax. Accounting for Participating Individual Life Insurance: Participating policies issued by one of our subsidiaries prior to its 1986 conversion from a mutual to a stock life insurance company... -

Page 99

... provisions are generally applied only to share-based awards granted subsequent to adoption. Prior to adoption of SFAS 123(R), the unrecognized compensation cost related to nonvested stock awards was reported as additional paid-in capital and deferred compensation, a contra equity account. The value... -

Page 100

...in Note 1, the sale of GENEX closed effective March 1, 2007, and we recognized an after-tax gain of $6.2 million on the sale, which is included in income from discontinued operations in our statements of income. We intend to continue to purchase certain disability management services for a period of... -

Page 101

...of investment maturities with amounts due under insurance contracts. Short-Term and Long-Term Debt: Fair values are obtained from independent pricing services or discounted cash ï¬,ow analyses based on current incremental borrowing rates for similar types of borrowing arrangements. Unum 2007 Annual... -

Page 102

... 2006 Fair Value Assets Fixed Maturity Securities Available-for-Sale Derivatives Hedging Available-for-Sale DIG Issue B36 Embedded Derivatives Mortgage Loans Policy Loans Other Long-term Investments Short-term Investments Liabilities Policyholders' Funds Deferred Annuity Products Other Short-term... -

Page 103

...States Government and Government Agencies and Authorities States, Municipalities, and Political Subdivisions Foreign Governments Public Utilities Mortgage/Asset-Backed Securities Derivatives Hedging Available-for-Sale All Other Corporate Bonds Redeemable Preferred Stocks...Unum 2007 Annual Report 101 -

Page 104

... Loss Fair Value Unrealized Loss Description United States Government and Government Agencies and Authorities Foreign Governments Public Utilities Mortgage/Asset-Backed Securities Derivatives Hedging Available-for-Sale All Other Corporate Bonds Redeemable Preferred Stocks Total $ 1,068.3 278.4 871... -

Page 105

... and future business prospects and trends of earnings. • The valuation of the security's underlying collateral. • Relevant industry conditions and trends relative to their historical cycles. • Market conditions. • Rating agency actions. • Bid and offering prices and the level... -

Page 106

... also holds a defeasance swap contract for highly rated bonds to provide principal protection for the investments. The fair values of the underlying forward and swap contracts equaled $79.8 million as of December 31, 2007, and are reported as ï¬xed maturity securities in the consolidated balance... -

Page 107

... 31 (in millions of dollars) 2007 2006 2005 Fixed Maturity Securities Mortgage Loans Real Estate Policy Loans Other Long-term Investments Short-term Investments Gross Investment Income Less Investment Expenses Less Investment Income on PFA Assets Net Investment Income $2,315.2 64.3 0.5 12.7 6.8 49... -

Page 108

...table summarizes the timing of anticipated settlements of interest rate swaps outstanding at December 31, 2007, whereby we receive a ï¬xed rate and pay a variable rate. The weighted average interest rates assume current market conditions. (in millions of dollars) 2008 2009 2010 2011 2012 2013 Total... -

Page 109

... date. The difference in the book value transferred out of the deposit asset account, which was $1,472.7 million, and the market value recorded equaled the embedded derivative market value component of $149.0 million. The time value component of $9.4 million was recognized as a realized investment... -

Page 110

... years 2010, 2011, and 2012. Amortization of value of business acquired is included in other expenses in the consolidated statements of income. Dispositions In March 2007, we completed the sale of GENEX. See Note 2 for further discussion. During 2005, we completed the sale of Unum UK's Netherlands... -

Page 111

... discount rate used during 2007, 2006, and 2005. Our "Incurred Related to Prior Years" includes adjustments to reserves for our claim reassessment process. We entered into settlement agreements with various state insurance regulators in the fourth quarter of 2004 and with the California Department... -

Page 112

... unpaid claims and claim adjustment expenses is as follows: December 31 (in millions of dollars) 2007 2006 2005 Policy and Contract Beneï¬ts Reserves for Future Policy and Contract Beneï¬ts Total Less: Life Reserves for Future Policy and Contract Beneï¬ts Accident and Health Active Life Reserves... -

Page 113

..., our U.S. life insurance subsidiaries distributed as dividends the remaining balance of their policyholders' surplus account to the holding company during 2005. This resulted in the elimination of a future potential tax of approximately $80.1 million which had not previously been provided for in... -

Page 114

... been considered to be permanently reinvested, we had not previously provided U.S. income taxes. During 2005, we repatriated $454.8 million in unremitted foreign earnings from our U.K. subsidiary. We recorded current taxes payable of approximately $15.3 million on those previously unremitted foreign... -

Page 115

... state income tax returns in the United States and in foreign jurisdictions. We are under continuous examination by the Internal Revenue Service (IRS) with regard to our U.S. federal income tax returns. The current IRS examination covers our tax years 2002 through 2004 with a revenue agent's report... -

Page 116

...million in 2011, and $2,140.4 million in 2015 and thereafter. In October 2007, Northwind Holdings, LLC (Northwind Holdings), a wholly-owned subsidiary of Unum Group, issued $800.0 million of insured, senior, secured notes due 2037 (the Northwind notes) in a private offering. The Northwind notes bear... -

Page 117

... disability insurance policies issued by or reinsured by Provident Life and Accident Insurance Company, Unum Life Insurance Company of America (Unum America), and The Paul Revere Life Insurance Company (collectively, the ceding insurers) pursuant to separate reinsurance agreements between Northwind... -

Page 118

...public offering for $575.0 million. Each unit had a stated amount of $25 and initially consisted of (a) a contract pursuant to which the holder agreed to purchase, for $25, shares of Unum Group's common stock on May 15, 2006 and which entitled the holder to contract adjustment payments at the annual... -

Page 119

..., the shelf registration will enable us to raise funds from the offering of any individual security covered by the shelf registration as well as any combination thereof, subject to market conditions and our capital needs. At December 31, 2007, we had $1.0 billion remaining on our shelf registration... -

Page 120

Notes to Consolidated Financial Statements The following tables provide the changes in the beneï¬t obligation and fair value of plan assets and statements of the funded status of the plans. Pension Beneï¬ts U.S. Plans (in millions of dollars) 2007 2006 Non U.S. Plans 2007 2006 Postretirement Bene... -

Page 121

... Non U.S. Plans 2007 2006 Postretirement Beneï¬ts 2007 2006 Current Pension Liability Noncurrent Pension Liability Unfunded Liability Unrecognized Pension and Postretirement Beneï¬t Costs Net Actuarial Loss Prior Service Credit Transition Asset Deferred Income Tax Asset (Liability) Total Included... -

Page 122

..., hedge funds, commodities, below-investment-grade ï¬xed income securities, and currencies. The remainder of the assets for our U.K. plan is predominantly invested in ï¬xed interest bonds and index linked bonds. Assets for life insurance beneï¬ts payable to certain former retirees covered under... -

Page 123

... life insurance reserve for the postretirement beneï¬ts plan was 5.75 percent, which was based on full investment in ï¬xed income securities with an average book yield of 6.30 percent and 6.39 percent for 2007 and 2006, respectively. Our rate of compensation increase assumption is generally based... -

Page 124

Notes to Consolidated Financial Statements Benefit Payments The following table provides expected beneï¬t payments, which reï¬,ect expected future service, as appropriate. Pension Beneï¬ts (in millions of dollars) U.S. Plans Non U.S. Plans Postretirement Beneï¬ts 2008 2009 2010 2011 2012 2013-... -

Page 125

... 12. Stock-Based Compensation Description of Stock Plans Under the stock incentive plan of 2007, up to 35,000,000 shares of common stock are available for awards to our employees, ofï¬cers, consultants, and directors. Awards may be in the form of stock options, stock appreciation rights, restricted... -

Page 126

...employees, ofï¬cers, brokers, and directors. Awards could be in the form of stock options, stock appreciation rights, stock awards, dividend equivalent awards, or any other right or interest relating to stock. The plan was terminated in May 2007 for purposes of any further grants, other than reload... -

Page 127

... xpected life of 4.4 years, which equals the maximum term. • E xpected dividend yield of 1.24 percent, based on the dividend rate at the date of grant. • Risk-free interest rate of 3.97 percent, based on the yield of treasury bonds at the date of grant. Stock Options Stock option activity... -

Page 128

... by the SEC in Staff Accounting Bulletin No. 107, Share-Based Payment. • E xpected dividend yield of 1.57 percent, based on the dividend rate at the date of grant. • Risk-free interest rate of 4.67 percent, based on the yield of treasury bonds at the date of grant. ESPP ESPP activity is... -

Page 129

...2007, we recaptured a closed block of individual disability business, with approximately $204.3 million in reserves and $7.0 million of annual premium. During the third quarter of 2005, we recaptured a closed block of individual disability business, with approximately $1.6 billion in invested assets... -

Page 130

...care products, we use a distribution model which provides independent brokers and consultants with the option of direct access to a sales support center centrally located in our corporate ofï¬ces. The Unum UK segment includes group long-term disability insurance, group life products, and individual... -

Page 131

...Supplemental and Voluntary Individual Disability - Recently Issued Long-term Care Voluntary Beneï¬ts Unum UK Group Long-term Disability Group Life Individual Disability Colonial Life Accident, Sickness, and Disability Life Cancer and Critical Illness Individual Disability - Closed Block Other Total... -

Page 132

... Financial Statements Selected operating statement data by segment is presented as follows: Individual Disability - Closed Block (in millions of dollars) Unum US Unum UK Colonial Life Other Corporate Total Year Ended December 31, 2007 Total Premium Income Net Investment Income Other Income... -

Page 133

The following table provides the changes in deferred acquisition costs by segment: (in millions of dollars) Unum US Unum UK Colonial Life Other Total Year Ended December 31, 2007 Beginning of Year Cumulative Effect of Accounting Principle Change - Note 1 Capitalized Amortization Foreign Currency ... -

Page 134

...Financial Statements Assets by segment are as follows: December 31 (in millions of dollars) 2007 2006 Unum US Unum UK Colonial Life Individual Disability - Closed Block Other Corporate...'s business and aligns allocated equity with our target capital levels for regulatory and rating agency purposes... -

Page 135

... agreed to pay $40.0 million to settle all claims that were or could have been asserted by the class in the action. After the receipt of insurance proceeds, the net cost to us was $11.6 million before tax and was included in our second quarter of 2007 operating results. Unum 2007 Annual Report 133 -

Page 136

...claims through the process established under the regulatory settlement agreements. On September 4, 2007, the District Court certiï¬ed a (b)(2) class consisting of all plan participants and beneï¬ciaries insured under ERISA governed long-term disability insurance policies/plans issued by Unum Group... -

Page 137

... federal laws with respect to quoting processes, producer compensation, solicitation activities, policies sold to state or municipal entities, and information regarding compensation arrangements with brokers. We will continue to cooperate fully with all investigations. Unum 2007 Annual Report 135 -

Page 138

... class action alleging that we breached ï¬duciary duties owed to certain beneï¬ciaries under group life insurance policies when we paid certain life insurance proceeds by establishing interest-bearing Retained Asset Accounts rather than checks. On February 4, 2008, the court granted the Company... -

Page 139

Note 16. Statutory Financial Information Statutory Net Income, Capital and Surplus, and Dividends Statutory net income for U.S. life insurance companies is reported in conformity with statutory accounting principles prescribed by the National Association of Insurance Commissioners (NAIC) and adopted... -

Page 140

... weighted average price of our common stock during the term of the agreement, less a discount. If we are required to pay a price adjustment to the counterparty, we have the option of settling the adjustment in shares of our common stock or cash. Any price adjustment payable to us will be settled in... -

Page 141

..., and $211.5 million and $55.9 million after tax, respectively. • The third quarter of 2006 includes broker compensation settlement expenses of $18.5 million before tax and $12.7 million after tax. See Notes 8, 9, and 15 for further discussion of the above items. Unum 2007 Annual Report 139 -

Page 142

... for Deï¬ned Beneï¬t Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R). We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Unum Group and subsidiaries' internal control over... -

Page 143

...internal control over ï¬nancial reporting encompasses the processes and procedures management has established to (i) maintain records that, in reasonable detail, accurately and fairly reï¬,ect the Company's transactions and dispositions of assets; (ii) provide reasonable assurance that transactions... -

Page 144

... "Management's Annual Report on Internal Control over Financial Reporting." Our responsibility is to express an opinion on the company's internal control over ï¬nancial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight... -

Page 145

... Legislative, regulatory, or tax changes, both domestic and foreign, may adversely affect the businesses in which we are engaged. • Rating agency actions, state insurance department market conduct examinations and other inquiries, other governmental investigations and actions, and negative... -

Page 146

Common stock of Unum Group is traded on the New York Stock Exchange. The stock symbol is "UNM." Quarterly closing prices and dividends paid per share of common stock are as follows: Market Price High Low Dividend 2007 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 2006 1st Quarter 2nd Quarter 3rd ... -

Page 147

...7000 Milton Court Dorking, Surrey RH4 3LZ England 011 44 1306 887766 PRINCIPAL SUBSIDIARIES Colonial Life & Accident Insurance Company Columbia, South Carolina CONTACT INFORMATION Investor Relations Thomas A.H. White Senior Vice President, Investor Relations 1 Fountain Square Chattanooga, TN 37402... -

Page 148

FUTURE READY Unum Group 1 Fountain Square Chattanooga, TN 37402 www.unum.com © 2008 Unum Group. All rights reserved. Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries. G-73975 (03-08)