US Bank 2003 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2003 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

U.S. Bancorp, headquartered in Minneapolis, is the 8th largest financial services holding company in the United States

with total assets exceeding 189 billion at year-end 2003.

Through U.S. Bank®and other subsidiaries, U.S. Bancorp serves 11.6 million customers, primarily through 2,243

full-service branch offices in 24 states. Customers also access their accounts and conduct all or part of their banking

transactions through 4,425 U.S. Bank ATMs, U.S. Bank Internet Banking and telephone banking. In addition, a network

of specialized U.S. Bancorp offices and representatives across the nation serves customers inside and outside our 24-state

footprint through comprehensive product sets that meet the financial needs of customers beyond basic core banking.

Backed by expertise and advanced technology, these sophisticated U.S. Bancorp products and services include large

corporate services, payment services, private banking, personal and institutional trust services, corporate trust services,

specialized large-scale government banking services, mortgage, commercial credit vehicles, and financial and asset

management services.

Major lines of business provided by U.S. Bancorp through U.S. Bank and other subsidiaries include Consumer Banking

Payment Services Private Client, Trust & Asset Management and Wholesale Banking. U.S. Bank is home of the exclusive

U.S. Bank Five Star Service uarantee.

corporate

profile

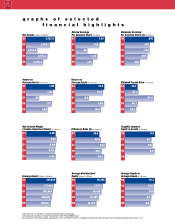

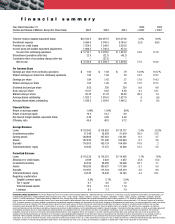

Ranking 8th largest bank in the U.S.

Asset size 189 billion

Deposits 119 billion

Loans 118 billion

Earnings per share diluted 1.93

Return on average assets 1.99

Return on average equity 19.2

Tangible common equity 6.5

Efficiency ratio 45.6

Customers 11.6 million

Primary banking region 24 states

Bank branches 2,243

ATMs 4,425

NYSE USB

At year-end 2003

S A CORP AT A LA CE