True Value 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 True Value annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 ANNUAL REPORT

Table of contents

-

Page 1

2009 ANNUAL REPORT -

Page 2

.... Listed are some of the financial benefits you enjoyed as a co-op member throughout 2009. 2009 Total Member Benefits Patronage Dividend/ Cash Patronage Dividend/ Notes, Stock Promotional Discounts Dating & Anticipation Market Spiffs/Racking Marketing/ Promotional Credits DTV Credits & Loans Free... -

Page 3

... pursued during 2009: • People: Building curriculum designed to help True Value win at retail, training retailers and store managers via True Value University's Fundamentals of Retail Success and offering regional courses focused on the key drivers that influence consumer buying decisions. Over... -

Page 4

... and circulars designed to drive the door and POSderived customer insights that inform our inventory management, merchandising and marketing strategies. True Value is investing in tools to increase our retailers' sales, set our brand apart and deliver top- and bottom-line results. 2010 OUTLOOK... -

Page 5

...including social media, online circulars, a new local Web site solution, an e-commerce site and a new e-marketing platform. • Refreshing True Value Rewards to keep it compelling for consumers and profitable and easier to implement for our stores. • Implementing store-specific customer experience... -

Page 6

... online courses. Relationship building is at the core of our business. When shoppers leave True Value, they walk out the door with more than just product. They've connected with a retailer or store associate who has encountered a similar project and offered them the advice they needed to get the job... -

Page 7

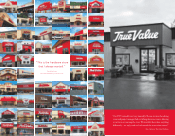

..., customer shopping experience fun. Stores that adopt DTV continue to outperform existing True Value stores by 10 percent annually. And by choosing DTV, these retailers aren't just investing in their stores; they're investing in their businesses' future. True Value Company 2009 Annual Report 7 -

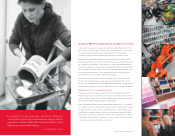

Page 8

... department into a one-stop destination. With impressive color selection and quality products, we have everything customers need to complete their paint projects. Helping customers brighten their homes brightens my day." Bob gutierrez, true Value Hardware 8 True Value Company 2009 Annual Report -

Page 9

... ProduCt seleCtmon ms Central to suCCess Inside each True Value store, customers can find everything they need for their project, all in one shopping trip. That's because True Value pays close attention to customer preferences and market trends, and stocks its shelves with compelling, value-priced... -

Page 10

... Gutierrez True Value Hardware, Placerville, Calif. "Our DTV remodel went very smoothly. The on-site merchandising teams and project managers had everything down to a science, allowing us to focus on running the store. We wouldn't have done anything differently - we only wish we had started the... -

Page 11

... teams and project managers allowed the Gutierrezes to run their business and oversee the three-month remodel. Increased lighting dramatically improved the store ambiance. By relocating and remerchandising their Just Ask Rental Department, the couple gained 2,000 square feet for 9,000 new products... -

Page 12

... 4 Director Designations 2009 1. store owner 2. outside Director 3. chief executive officer 4. chairman of the board 5. Vice chairman of the board board Committees 2009 6. audit committee 7. compensation committee 8. corporate governance committee * committee chair CORPORATE OFFICERS listeD leFt... -

Page 13

... of stores. True Value of Bethel, Bethel, Conn. Nuts and Bolts, Overland Park, Kan. Belgrade True Value Hardware, Belgrade, Mont. Helms True Value Hardware, Selah, Wash. Wallace Thompson True Value, Rusk, Texas Drillen True Value Hardware, South Portland, Maine True Value Hardware, Placerville... -

Page 14

8600 W. Bryn Mawr Ave. Chicago, IL 60631-3505 773.695.5000 www.truevaouecompany.com ©2010 True Vaoue Company -

Page 15

2009 FINANCIAL REPORT -

Page 16

...that pace in 2010. Management utilizes a variety of key performance measures to monitor the financial health and performance of True Value's business. These measures are comparable store product sales to members ("Comp Store Sales") and net member attrition (two drivers of Net revenue), gross margin... -

Page 17

... in the levels at which members purchase merchandise and services from True Value, increases in market share of the various other entities that compete in the hardware industry or a continued decline in the general U.S. economy. A key driver of True Value's profitability is its overall Gross margin... -

Page 18

...was in low margin direct ship sales which is not in proportion to True Value's historical sales mix. In addition, the combined lower product sales volume to the members drove lower product purchases by True Value which resulted in unfavorable rebates and discounts of $9,021. 2009 Financial Report 3 -

Page 19

...level. True Value's average interest rate and daily outstanding debt level were lower by 2.4% and $32,967, respectively, compared to 2008. $ Ne3 Margin Increase Ne3 margin 2009 2008 For the Year Ended Percent to Net Revenue $92,784 5.1% $93,913 4.7% $(1,129) For the Year Ended Percent to Net... -

Page 20

...Management attributes this decline to a mild winter season, a late arrival of spring weather in many areas of the country and the economic recession, partially offset by a 53rd week of revenue of approximately $21,000 in True Value's 2008 fiscal year. Gross margin for the year ended January 3, 2009... -

Page 21

... payment of the patronage dividend and the redemption of Class A and Class B common stock in 2007, 2008 and 2009, and applied the net excess cash provided by operating and investing activities to reducing its debt in 2007 and 2009. True Value's net working capital at January 2, 2010, January 3, 2009... -

Page 22

...or intense competition from chain stores, discount stores, home centers and warehouse stores. Included in the accounts receivable amounts at January 2, 2010, was $22,785 for receivables from True Value Vendors, primarily related to unpaid amounts for annual rebate programs which are based on various... -

Page 23

... benefits, True Value may have to increase its provision for expenses. The assumptions used to determine True Value's pension obligations for all plans were as follows for the years ended: January 2, January 3, 2010 2009 Measurement Date Weighted average assumptions: Discount rate Lump sum rate... -

Page 24

... position of True Value Company and its subsidiaries at January 2, 2010 and January 3, 2009, and the results of their operations and their cash flows for each of the three years in the period ended January 2, 2010 in conformity with accounting principles generally accepted in the United States of... -

Page 25

... management or other employees who have a significant role in True Value's internal control over financial reporting. TRUE VALUE COMPANY Lyle G. Heidemann President and Chief Executive Officer Date: March 10, 2010 David A. Shadduck Senior Vice President and Chief Financial Officer 10 True Value... -

Page 26

... of our Board of Directors. True Value's management, based on their assessment, has concluded that, as of January 2, 2010, True Value's internal control over financial reporting was effective. TRUE VALUE COMPANY Lyle G. Heidemann President and Chief Executive Officer Date: March 10, 2010 David... -

Page 27

... maturities Deferred gain on sale leaseback Pension Other long-term liabilities Redeemable nonqualified Class B nonvoting common stock, $100 par value; 170,621 and 177,602 shares issued and fully paid Total long-term liabilities and deferred credits Total liabilities and deferred credits 91,064 33... -

Page 28

...3he Years Ended 2010 2009 2007 Net revenue Cost of revenue Gross margin Operating expenses: Logistics and manufacturing expenses Selling, general and administrative expenses Other income, net Operating income Interest expense to members Third-party interest expense Net margin before income taxes... -

Page 29

...investing activities Financing activities: Payment of patronage dividend Payment of notes, long-term debt and lease obligations Decrease in drafts payable Increase/(decrease) in revolving credit facility, net Proceeds from sale of Redeemable Class A common stock and subscriptions receivable Purchase... -

Page 30

... loss Balances a3 and for 3he year ended January 3, 2009 Net margin Reclass stock presented for redemptions to liabilities Amortization of deferred patronage Patronage dividend Class B stock applied against loss allocation Class A stock purchases Pension liability adjustment for deferred actuarial... -

Page 31

... "Inventories"). CONSOLIDATION The Consolidated Financial Statements include the accounts of True Value and all wholly owned subsidiaries. RePORTING YeAR True Value's fiscal year ends the Saturday closest to December 31. Fiscal year 2009 ended on January 2, 2010 and contained 52 weeks. Fiscal year... -

Page 32

... tax assets will only be realized to the extent net future earnings, after the distribution of the patronage dividend to the members, are retained and after accumulated net operating losses are exhausted by True Value. True Value and its subsidiaries file income tax returns in the United States... -

Page 33

... issued to members in partial payment of the annual patronage dividend. There is no existing market for True Value common stock and there is no expectation that any market will develop. Accordingly, no earnings per share information is presented in the Consolidated Financial Statements. Standards... -

Page 34

... 2009, respectively. Warehouse, general and administrative costs incurred for 2009 and 2008, were $90,743 and $92,349, respectively. The weighted average of stated interest rates on total debt was 5.65% and 5.3% as of January 2, 2010 and January 3, 2009, respectively. At January 2, 2010, True Value... -

Page 35

... of True Value as specified by its board of directors. Historically, True Value has offered the members who own the subordinated promissory notes with a scheduled maturity in December of the current year the option to extend the maturity of their notes at a new rate and term. For 2009, and... -

Page 36

... common stock"). The By-Laws provide True Value the right to allow a member to meet the stock ownership requirements for True Value's Redeemable Class B nonvoting common stock by the issuance of Redeemable Class B nonvoting common stock in payment of the year-end patronage dividend. The shares... -

Page 37

... Value undertakes to purchase, and the member is required to sell to True Value, all of the member's Redeemable Class A voting common stock and Redeemable Class B nonvoting common stock at par value. In accordance with True Value's By-Laws, payment for the Redeemable Class A 22 True Value Company -

Page 38

... board of directors authorized an additional 5% over the base 5% of the net patronage source income, as a reasonable reserve, to reduce the accumulated deficit account. Patronage dividends related to the year ended January 2, 2010, were $57,264. True Value's By-Laws and the Internal Revenue Service... -

Page 39

... extent net future earnings, after the distribution of the patronage dividend to the members, are retained and after accumulated net operating losses are exhausted by True Value. The significant components of True Value's deferred tax assets and liabilities were as follows for fiscal years: January... -

Page 40

... True Value's programs to provide interest free or low interest bearing loans to members to open new stores, make store expansions or remodel stores. The loans are for periods of five or ten years and are generally repaid through the members' non Class B common stock portion of the annual patronage... -

Page 41

... used to determine True Value's net periodic pension cost for all plans were as follows for the years ended: January 2, January 3, December 29, 2010 2009 2007 Measurement Date Weighted average assumptions: Discount rate Expected return on assets Rate of compensation increase 1/3/2009 12/29/2007... -

Page 42

...6,794 6,649 6,733 7,077 6,825 29,950 The assumptions used to determine True Value's pension obligations for all plans were as follows for the years ended: January 2, January 3, 2010 2009 Weighted average assumptions: Discount rate Lump sum rate 5.50% 5.00% 6.25% 5.00% 2009 Financial Report 27 -

Page 43

... Morgan Pension Discount Curve. The J.P. Morgan Pension Discount Curve was developed using high-quality corporate bonds. The plan assumes a future lump sum conversion rate of 5.00% in the calculation of the PBO as of January 2, 2010 and January 3, 2009. For all frozen plan participants, the benefits... -

Page 44

... the Paint Manufacturing and Distribution segment based on the segment's merchandising sales to total True Value merchandising sales ratio, True Value's distribution warehousing costs to gross sales ratio, and ratios relating to certain assets and liabilities, respectively. 2009 Financial Report 29 -

Page 45

8600 W. Bryn Mawr Ave. Chicago, IL 60631-3505 773.695.5000 www.truevaluecompany.com © 2010 True Value Company Recycled Supporting responsible use of forest resources www.fsc.org Cert no. SW-COC-002680 © 1996 Forest Stewardship Council 100%