Travelzoo 2008 Annual Report Download - page 11

Download and view the complete annual report

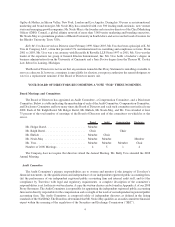

Please find page 11 of the 2008 Travelzoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(5) Based solely on information reported on a Schedule 13G/A filed with the SEC on January 27, 2009 by

JPMorgan Chase & Co. As of December 31, 2008, 1,771,739 shares were beneficially held by JPMorgan

Chase & Co. of which it possessed sole voting power to 1,570,091 shares and sole dispositive power to

1,771,739 shares.

Section 16(a) Beneficial Ownership Reporting Compliance

Under Section 16(a) of the Securities Exchange Act of 1934, the Company’s directors, executive officers and

the beneficial holders of more than 10% of the Company’s common stock are required to file reports of ownership

and changes in ownership with the SEC. Such directors, executive officers and beneficial holders of more than 10%

of the Company’s common stock are required by SEC regulations to furnish the Company with copies of all

Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such forms furnished to the Company

or written representations from reporting persons, we believe that during fiscal 2008, all Section 16(a) filing

requirements were satisfied on a timely basis.

Code of Ethics

We have adopted a code of ethics that applies to our Chief Executive Officer, our Chief Financial

Officer, and our Controller for North America. This code of ethics is posted on our Web site located at

corporate.travelzoo.com/governance. We intend to satisfy the disclosure requirement under Item 10 of Form 8-K

regarding an amendment to, or waiver from, a provision of this code of ethics by posting such information on our

Web site, at the address and location specified above. A copy of the code of ethics is also available in print to

stockholders and interested parties without charge upon written request delivered to our Corporate Secretary at

Travelzoo Inc., 590 Madison Avenue, 37th Floor, New York, NY 10022.

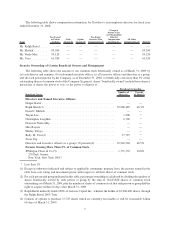

Executive Compensation

Compensation Discussion and Analysis

Overview of Compensation Program

The following Compensation Discussion and Analysis, or “CD&A,” describes our overall compensation

philosophy and the primary components of our compensation program. Furthermore, the CD&A explains the

process by which the Compensation Committee or “Committee” determined the 2008 compensation for our Chief

Executive Officer, Chief Financial Officer and other most highly compensated officers. We refer to these

individuals collectively as the “named executives” or the “named executive officers.”

Compensation Philosophy and Objectives

The fundamental objectives of our executive compensation program are to attract and retain highly qualified

executive officers, motivate these executive officers to materially contribute to our long-term business success, and

align the interests of our executive officers and stockholders by rewarding our executives for individual and

corporate performance based on targets established by the Committee.

We believe that achievement of these compensation program objectives enhances long-term profitability and

stockholder value. The elements utilized to help achieve the Committee’s objectives include the following:

•Accountability for Individual Performance. Compensation should in large part depend on the named

executive’s individual performance in order to motivate and acknowledge the key contributors to our

success.

•Recognition for Business Performance. Compensation should take into consideration our overall financial

performance and overall growth.

•Attracting and Retaining Talented Executives. Compensation should generally reflect the competitive

marketplace and be designed to attract and retain superior employees in key competitive positions.

8