Toshiba 2005 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2005 Toshiba annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130th Anniversary Toshiba Corporation 1

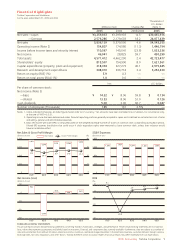

Financial Highlights

Toshiba Corporation and Subsidiaries

For the years ended March 31, 2005 and 2004

Thousands of

U.S. dollars

Millions of yen Change (%) (Note 1)

2005 2004 2005/2004 2005

Net sales—Japan ¥3,259,853 ¥3,399,903 (4.1) $30,465,916

—Overseas 2,576,286 2,179,603 18.2 24,077,439

Net sales 5,836,139 5,579,506 4.6 54,543,355

Operating income (Note 2) 154,807 174,586 (11.3) 1,446,794

Income before income taxes and minority interest 110,567 145,041 (23.8) 1,033,336

Net income 46,041 28,825 59.7 430,290

Total assets 4,571,412 4,462,200 2.4 42,723,477

Shareholders‘ equity 815,507 754,990 8.0 7,621,561

Capital expenditures (property, plant and equipment) 318,394 227,273 40.1 2,975,645

Research and development expenditures 348,010 336,714 3.4 3,252,430

Return on equity (ROE) (%) 5.9 4.3 — —

Return on total assets (ROA) (%) 1.0 0.6 — —

Yen U.S. dollars

Per share of common stock:

Net income (Note 3)

—basic ¥ 14.32 ¥ 8.96 59.8 $ 0.134

—diluted 13.53 8.96 51.0 0.126

Cash dividends 5.00 3.00 66.7 0.047

Number of employees (Thousands) 165 161 2.5% —

Notes: 1. Unless indicated otherwise, all dollar figures herein refer to U.S.currency. Yen amounts have been translated into U.S.dollars, for convenience only,

at the rate of ¥107=U.S.$1.

2. Operating income has been determined under financial reporting practices generally accepted in Japan and is defined as net sales less cost of sales

and selling, general and administrative expenses.

3. Basic net income per share (EPS) is computed based on the weighted-average number of shares of common stock outstanding during each period.

Diluted EPS assumes the dilution that could occur if stock acquisition rights were exercised to issue common stock, unless their inclusion would

have an antidilutive effect.

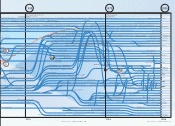

01/3 02/3 03/3 04/3 05/3 01/3 02/3 03/3 04/3 05/3

01/3 02/3 03/3 04/3 05/3

6,000

4,500

3,000

1,500

0

40

30

20

10

0

1,600

1,200

800

400

0

10

0

-10

-20

-30

-40

(%)

01/3 02/3 03/3 04/3 05/3

100

0

-100

-200

-300

5,951

96.2

27.4

24.5

26.7 27.0 26.4

5,349

-254.0

5,656

18.5

5,580

28.8

5,836

46.0

1,396

9.1

-29.0

2.9 4.3 5.9

1,437 1,394 1,330 1,385

Net Sales & Gross Profit Margin

(Billions of yen) Net Sales Gross Profit Margin (Billions of yen)

Net Income (Loss)

(Billions of yen) (%)

SG&A Expenses

ROE

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements concerning Toshiba’s future plans, strategies, and performance. These forward-looking statements are not historical

facts, rather they represent assumptions and beliefs based on economic, financial, and competitive data currently available. Furthermore, they are subject to a number of

risks and uncertainties that, without limitation, relate to economic conditions, worldwide megacompetition in the electronics business, customer demand, foreign currency

exchange rates, tax rules, regulations, and other factors. Toshiba therefore wishes to caution readers that actual results may differ materially from our expectations.