Toro 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 Toro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

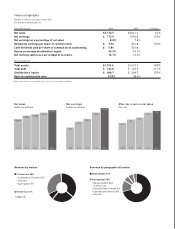

The following table shows total consolidated net sales and net and government customers, and in some markets for resale to

earnings for each fiscal quarter as a percentage of the total fiscal dealers. We also sell some professional segment products directly

year. to government customers, rental companies, and agricultural irriga-

tion dealers, as well as to end-users in certain international mar-

kets. Select residential/commercial irrigation and lighting products

Fiscal 2014 Fiscal 2013

are sold to professional irrigation and lighting distributors/dealers,

Net Net Net Net

and certain retail irrigation products are sold directly to home cen-

Quarter Sales Earnings Sales Earnings

ters. Products for the rental and specialty construction market are

First 21% 15% 22% 20%

Second 34 50 34 51 sold directly to dealers and rental companies. Toro and Exmark

Third 26 29 25 26 landscape contractor products are also sold directly to dealers in

Fourth 19 6 19 3 certain regions of North America. BOSS snow and ice manage-

ment products are sold to distributors and dealers for resale to

Effects of Weather contractors.

From time to time, weather conditions in particular geographic Residential products, such as walk power mowers, riding prod-

regions or markets may adversely or positively affect sales of ucts, and snow throwers, are generally sold directly to home cen-

some of our products and field inventory levels and result in a ters, dealers, hardware retailers, and mass retailers. In certain

negative or positive impact on our future net sales. If the percent- markets, these same products are sold to distributors for resale to

age of our net sales from outside the U.S. increases, our depen- hardware retailers and dealers. Home solutions products are pri-

dency on weather in any one part of the world decreases. None- marily sold directly to home centers, mass retailers, and hardware

theless, weather conditions could materially affect our future net retailers. We also sell select residential products over the Internet.

sales. Internationally, residential products are sold directly to dealers and

mass merchandisers in Australia, Canada, and select countries in

Working Capital Europe. In most other countries, residential products are mainly

Our businesses are seasonally working capital intensive and sold to distributors for resale to dealers and mass retailers.

require funding for purchases of raw materials used in production; During fiscal 2014, we owned two domestic distribution compa-

replacement parts inventory; payroll and other administrative costs; nies. Our primary purposes in owning domestic distributorships are

capital expenditures; establishment of new facilities; expansion, to facilitate ownership transfers while improving operations and to

renovation, and upgrading of existing facilities; as well as for test and deploy new strategies and business practices that could

financing receivables from customers that are not financed with be replicated by our independent distributors.

Red Iron. We fund our operations through a combination of cash Our distribution systems are intended to assure quality of sales

and cash equivalents, cash flows from operations, short-term bor- and market presence, as well as to provide effective after-

rowings under our credit facilities, and long-term debt. Cash man- purchase service and support. We believe our distribution network

agement is centralized, and intercompany financing is used, wher- provides a competitive advantage in marketing and selling our

ever possible, to provide working capital to wholly owned products, in part, because our primary distribution network is

subsidiaries as needed. In addition, our credit facilities are availa- focused on selling and marketing our products, and because of the

ble for additional working capital needs, acquisitions, or other long-term relationships they have established and experienced per-

investment opportunities. sonnel they utilize to deliver high levels of customer satisfaction.

Our current marketing strategy is to maintain distinct brands and

Distribution and Marketing brand identification for Toro, Exmark, Irritrol, Hayter, Pope,

We market the majority of our products through approximately 35 Unique Lighting Systems, Lawn-Boy, Lawn Genie, and BOSS

domestic and 110 international distributors, as well as a large num- products.

ber of outdoor power equipment dealers, irrigation dealers and dis- We advertise our residential products during appropriate sea-

tributors, hardware retailers, home centers, and mass retailers in sons throughout the year mainly on television, on the radio, in

more than 90 countries worldwide. We also added approximately print, and via the Internet. Professional products are advertised

two distributors and 150 dealers to our distribution network with mainly in print and through direct mail programs, as well as on the

our recent acquisition of the BOSS professional snow and ice Internet. Most of our advertising emphasizes our products, brands,

management business. and other valuable trademarks. Advertising is purchased by us, as

Professional products are sold to distributors/dealers primarily for well as through cooperative programs with distributors, dealers,

resale to golf courses, sports fields, industrial facilities, contractors, hardware retailers, home centers, and mass retailers.

9