TiVo 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 TiVo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

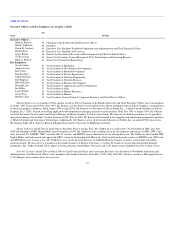

Quarterly Results of Operations

The following table represents certain unaudited statement of operations data for our eight most recent quarters ended January 31, 2004. In

management's opinion, this unaudited information has been prepared on the same basis as the audited annual financial statements and includes all

adjustments, consisting only of normal recurring adjustments, necessary for a fair representation of the unaudited information for the quarters presented. This

information should be read in conjunction with our audited consolidated financial statements, including the notes thereto, included elsewhere in this Annual

Report. The results of operations for any quarter are not necessarily indicative of results that may be expected for any future period. Prior quarters have been

reclassified in order to conform to current quarter classifications.

Three Months Ended

Jan 31,

2004

Oct 31,

2003

Jul 31,

2003

Apr 30,

2003

Jan 31,

2003

Oct 31,

2002

Jul 31,

2002

Apr 30,

2002

(unaudited, in thousands except per share data)

Revenues

Service revenues $ 19,083 $16,018 $13,757 $12,702 $ 11,350 $ 10,185 $ 9,510 $ 8,216

Technology revenues 2,126 6,656 3,649 3,366 2,365 2,556 14,344 1,644

Hardware revenues 25,537 24,479 8,057 14,809 14,511 16,220 11,109 3,780

Rebates, revenue share, and other payments to channel (4,114) (3,897) 1,209 (2,357) (5,212) (3,968) — (600)

Net revenues 42,632 43,256 26,672 28,520 23,014 24,993 34,963 13,040

Costs of Revenues

Cost of service revenues 5,252 4,370 3,909 4,174 4,719 3,852 4,387 4,161

Cost of technology revenues 2,496 4,464 3,020 3,629 2,110 1,442 3,189 1,292

Cost of hardware revenues 26,687 25,413 8,558 14,178 14,048 15,588 11,346 3,665

Total costs of revenues 34,435 34,247 15,487 21,981 20,877 20,882 18,922 9,118

Gross margin 8,197 9,009 11,185 6,539 2,137 4,111 16,041 3,922

Operating Expenses

Research and development 5,474 5,432 5,789 5,472 6,319 4,875 4,518 5,002

Sales and marketing 4,742 5,704 4,502 3,999 3,965 4,333 9,042 30,777

General and administrative 4,508 3,949 4,061 3,778 3,365 3,752 3,589 3,759

Loss from operations (6,527) (6,076) (3,167) (6,710) (11,512) (8,849) (1,108) (35,616)

Interest income 135 133 116 114 149 89 146 4,099

Interest expense and other (5,672) (1,330) (1,311) (1,274) (21,003) (2,609) (1,965) (1,992)

Loss before income taxes (12,064) (7,273) (4,362) (7,870) (32,366) (11,369) (2,927) (33,509)

Provision for income taxes (297) (115) (25) (12) (164) (150) (111) —

Net loss (12,361) (7,388) (4,387) (7,882) (32,530) (11,519) (3,038) (33,509)

Less: Series A redeemable convertible preferred stock dividend — — — — — — — (220)

Less: Accretion to redemption value of convertible preferred

Stock — — — — — — — (1,445)

Net loss attributable to common stockholders $(12,361) $ (7,388) $ (4,387) $ (7,882) $(32,530) $(11,519) $ (3,038) $(35,174)

Net loss per share

Basic and diluted $ (0.18) $ (0.11) $ (0.07) $ (0.12) $ (0.56) $ (0.23) $ (0.06) $ (0.74)

Weighted average shares used to calculate basic and diluted net loss per

share 69,055 68,226 65,834 64,021 58,496 51,041 47,994 47,344

18