Texas Instruments 2014 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2014 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To our shareholders

2014 was a year of strong results – evidence of the soundness of our

strategy and a preview of the performance we believe TI can produce

in the coming years. We delivered solid growth, substantial profits

and robust cash generation, and we returned more than 100 percent

of free cash flow to our shareholders. Fueled by a passion for technology

that impacts lives, we used this financial strength to develop compelling

innovations for our customers to help them take their products to

new levels. We believe these will be hallmark traits of TI in the

years ahead.

The year’s performance is best viewed through the lens of our capital

management strategy. This strategy crystalizes how certain strategic

elements, which we have honed for years, contribute to our unique

ability to grow, generate and return cash to shareholders. So let’s

begin there.

Our beliefs: Our capital management strategy is based on the belief

that free cash flow growth is key to maximizing shareholder value over

the long term. Further, free cash flow will only be valued if it is wisely

invested in our businesses or directly returned to shareholders. Given

these beliefs, we focus on growing free cash flow over the long term.

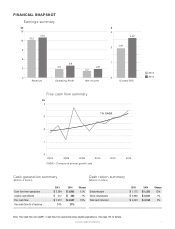

Since 2004, free cash flow has grown at a compound annual growth

rate of 7 percent, and in 2014, free cash flow was $3.5 billion, up

18 percent from the prior year.

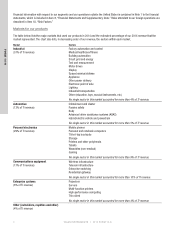

Our business model: The foundation of our capital management strategy

begins with a business model that is built on two core semiconductor

businesses, Analog and Embedded Processing. Their long product

life cycles, intrinsic diversity and need for less capital-intensive

manufacturing provide a combination of stability, profitability and strong

cash generation.

These core businesses, together, have grown an average 9 percent per

year over the last 10 years and comprised 83 percent of our revenue in

2014. Importantly, they drove annual company growth of 7 percent in

2014. This marked the fifth consecutive year of share gains for each.

Cash availability and a healthy balance sheet: We make sure that our

tax practices do not strand cash offshore, and that our balance sheet

holds an appropriate amount of cash to fund operations and meet debt

and other obligations, yet still finance future opportunities. At year-end

2014, U.S. entities owned 82 percent of our cash, and our pension plans

worldwide were 97 percent funded.

Manufacturing: Our strategy of acquiring manufacturing capacity

opportunistically and ahead of demand, combined with a product

portfolio that can be built using long-lived equipment, continues to

serve us well. It enables us to cost effectively maintain our capital

expenditures at about 4 percent of revenue, while allowing us to

become an exceptionally reliable supplier to our customers. In 2014,

we initiated plans to increase Analog production on 300-millimeter

wafers, which will provide cost advantages that will further improve

margins and cash generation over the long term.

Technology: Innovation is our lifeblood at TI, letting us deliver

breakthrough technologies to the world’s design engineers. Our R&D

investments allow us to create entirely new product categories, such

as inductance-to-digital converters; expand our product portfolio into

new areas, such as reinforced isolation, high-voltage and high-power

density solutions with silicon and gallium nitride technologies; and

improve existing capabilities, such as our InstaSPIN™ motor control

technology. In 2014, we invested $1.4 billion in R&D, substantially

more than our best competitors.

Returns to shareholders: Our business model enables us to consistently

generate more cash than we need to fund our future. In 2014, TI’s

free cash flow of $3.5 billion was 27 percent of revenue, and in the

years ahead we expect that rate can improve to 30 percent of revenue

sustainably in good economic markets.

This gets us to the final piece of our capital management strategy –

returning cash to our shareholders. Through dividends and share

repurchases, we are committed to returning 100 percent of our free

cash flow plus proceeds from stock-option exercises except that which

is needed for debt retirement. We have increased our dividends for

11 consecutive years, and we’ve reduced our shares outstanding by

39 percent since 2004. In 2014, we returned $4.2 billion to shareholders.

In conclusion: Over the years, we have created a strong company.

But our goal is to make TI stronger still. We do not intend to squander

the unique position we’ve created, one that is anchored in the diversity

of tens of thousands of products and customers for analog and

embedded processing semiconductors, bolstered by an efficient

manufacturing operation, and supported by the largest sales channels

in the industry. We intend to deliver more value to our customers, to

our shareholders and to society as we bring semiconductors to more

markets than ever before.

Richard K. Templeton

Chairman, President and

Chief Executive Officer

Note: Free cash flow (non-GAAP) = Cash flow from operations minus Capital expenditures. See page 124 for details.

Directors

Richard K. Templeton

Ralph W. Babb, Jr.

Mark A. Blinn

Daniel A. Carp

Carrie S. Cox

Board of directors, executive officers

TI Fellows

Stockholder and other information