Texas Instruments 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 19 ]

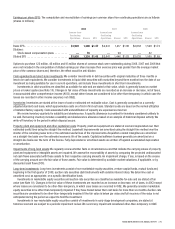

8. Cash, cash equivalents and short-term investments

Details of our cash, cash equivalents and short-term investment balances are as follows:

December 31, 2008 December 31, 2007

Cash and Cash

Equivalents

Short-term

Investments

Cash and Cash

Equivalents

Short-term

Investments

Corporate commercial paper, bonds, time deposits .................. $50 $590 $100 $25

Asset-backed commercial paper ................................ — — 457 —

U.S. government agency securities .............................. —409 390 —

U.S. Treasury securities....................................... —245 — —

Money market funds ......................................... 796 —157 —

Tax-exempt/municipal securities:

Auction-rate securities..................................... — — —1,044

Tax-exempt bonds ........................................ — — —35

Mortgage-backed securities — government

sponsored enterprise (GSE) guaranteed........................ —139 —233

Mortgage-backed securities — senior bonds ...................... —105 —241

Other..................................................... — 6 —18

Cash on hand .............................................. 200 —224 —

Total ..................................................... $1,046 $1,494 $1,328 $1,596

The primary objectives of our cash equivalent and short-term investment activities are to preserve capital and maintain liquidity while

generating appropriate returns. Our investment policy allows for only high-credit-quality securities. As of December 31, 2008, over

99 percent of our cash equivalents and short-term investments were either rated AAA, Aaa or unconditionally guaranteed by a Aaa-rated

U.S. government sponsored enterprise (GSE). The value and liquidity of these securities are generally affected by market interest rates,

as well as the ability of the issuer to make principal and interest payments when due and the normal functioning of the markets in

which they are traded. There were no material impairments of short-term investments or cash equivalents in the periods presented.

As of December 31, 2008, our cash equivalents included investments in corporate obligations guaranteed by the Federal Deposit

Insurance Corporation (FDIC) and in money market funds. Our short-term investments included corporate obligations guaranteed by

the FDIC or the Debt Management Office of the United Kingdom, discount notes issued by U.S. government agencies, U.S. Treasury

securities and mortgage-backed securities. All of the mortgage-backed securities we held as of December 31, 2008, were either

Aaa-rated or unconditionally guaranteed by a Aaa-rated U.S. GSE.

As of December 31, 2007, we held $1.04 billion of auction-rate securities at par value, which was equal to fair value as of that

date. During the first quarter of 2008, we sold $473 million of these auction-rate securities at par through the normal auction process.

Beginning in mid-February 2008, liquidity issues in the global credit markets caused the failure of auctions and uncertainty regarding

the liquidity of these securities. As a result, beginning in the first quarter of 2008, we reclassified our investments in auction-rate

securities with a par value of $571 million from short-term investments to long-term investments (see Note 9).

The following table presents the aggregate maturities of cash equivalents and short-term investments at year-end 2008:

Due Fair Value

One year or less............................................................................. $ 2,015

One to three years........................................................................... 75

Investments with serial maturities (primarily mortgage-backed securities) ................................ 250

Gross unrealized gains on cash equivalents and short-term investments were $6 million for the year ending December 31, 2008. There

were no gross unrealized gains on cash equivalents and short-term investments for the years ending December 31, 2007 and 2006.

Gross unrealized losses were $19 million, $14 million and $23 million, respectively, for these time periods. Unrealized losses for the

years ending December 31, 2008 and 2007 were primarily associated with mortgage-backed securities that have been in an unrealized

loss position for more than 12 months. Unrealized gains and losses resulted from changes in market interest rates and risk premiums

rather than changes in the credit quality of the securities. We have determined that our investment in these cash equivalents and short-

term investments are not other-than-temporarily impaired, as we have the ability and intent to hold these investments until their value

can be recovered, which may include holding them to their respective maturity dates.