Texas Instruments 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 17 ]

As of December 31, 2008 and 2007, net deferred income tax assets of $1.63 billion and $1.12 billion were presented in the balance

sheets, based on tax jurisdiction, as deferred income tax assets of $1.69 billion and $1.16 billion and deferred income tax liabilities of

$59 million and $49 million. The increase in net deferred income tax assets from December 31, 2007 to December 31, 2008 exceeds

the $182 million deferred tax benefit primarily due to the recording of deferred tax assets associated with postretirement benefit costs

recognized in AOCI. We make an ongoing assessment regarding the realization of U.S. and non-U.S. deferred tax assets. While these

assets are not assured of realization, our assessment is that a valuation allowance is not required for the remaining balance of the

deferred tax assets. This assessment is based on our evaluation of relevant criteria including the existence of (a) deferred tax liabilities

that can be used to absorb deferred tax assets, (b) taxable income in prior carryback years and (c) future taxable income.

We have aggregate U.S. and non-U.S. tax loss carryforwards of approximately $225 million, of which $59 million expire through the

year 2025.

Provision has been made for deferred taxes on undistributed earnings of non-U.S. subsidiaries to the extent that dividend payments

from these subsidiaries are expected to result in additional tax liability. The remaining undistributed earnings (approximately $2.75 billion

at December 31, 2008) have been indefinitely reinvested; therefore, no provision has been made for taxes due upon remittance of these

earnings. It is not feasible to determine the amount of unrecognized deferred tax liability on these unremitted earnings.

Cash payments made for income taxes (net of refunds) were $772 million, $733 million and $1.83 billion for the years ended

December 31, 2008, 2007 and 2006.

Uncertain tax positions: We operate in a number of tax jurisdictions and are subject to examination of our income tax returns by tax

authorities in those jurisdictions who may challenge any item on these tax returns. Because the matters challenged by authorities are

typically complex, their ultimate outcome is uncertain. We recognize accrued interest related to uncertain tax positions and penalties as

components of OI&E. Effective January 1, 2007, we adopted the provisions of FIN 48. FIN 48 differs from the prior standards in that it

requires companies to determine that it is “more likely than not” that a tax position will be sustained by the appropriate tax authorities

before any benefit can be recorded in the financial statements.

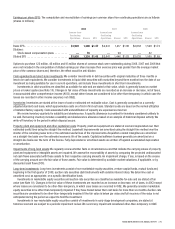

The following table summarizes the changes in the total amounts of uncertain tax positions for 2008 and 2007:

2008 2007

Balance, January 1 ........................................................................ $137 $158

Additions based on tax positions related to the current year ......................................... 18 21

Additions for tax positions of prior years ........................................................ 17 39

Reductions for tax positions of prior years....................................................... (24)(44)

Settlements with tax authorities .............................................................. —(37)

Balance, December 31 ..................................................................... $148 $137

Interest income (expense) recognized in the year ended December 31 ................................. $(6)$22

Accrued interest as of December 31 ........................................................... $11 $ 1

Of the $148 million liability for uncertain tax positions as of December 31, 2008, $121 million represents tax positions that, if

recognized, would impact the effective tax rate. If these tax positions were recognized, $70 million of deferred tax assets primarily

related to the procedures for relief from double taxation would also be recognized.

As of December 31, 2008, the statute of limitations remains open for U.S. federal tax returns for 1999 and following years. Our

returns for the years 2000 through 2006 are the subject of tax treaty procedures for relief from double taxation; and our returns for the

years 2003 through 2006 will be the subject of an appeals proceeding in 2009. Cases currently before the United States Tax Court could

have an impact on the determination of our uncertain tax positions and the outcome of the 2009 appeals proceeding. It is reasonably

possible that the appeals proceeding will be completed within the next 12 months.

In foreign jurisdictions, the years open to audit represent the years still subject to the statute of limitations. Years still open to audit

by foreign tax authorities in major jurisdictions include Germany (2003 onward), France (2006 onward), Japan (2001 onward) and

Taiwan (2003 onward).

We are unable to estimate the range of any reasonably possible increase or decrease in uncertain tax positions that may occur

within the next 12 months resulting from the eventual outcome of the years currently under audit or appeal. However, we do not

anticipate any such outcome will result in a significant change to our financial condition or results of operations.