Texas Instruments 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2006 ANNUAL REPORT

8

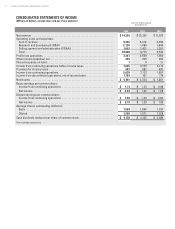

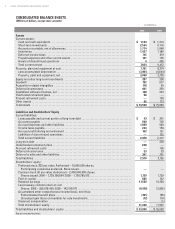

DECEMBER 31,

2006 2005

Assets

Current assets:

Cash and cash equivalents ............................................................. $1,183 $1,214

Short-term investments ................................................................ 2,534 4,116

Accounts receivable, net of allowances ................................................. 1,774 1,648

Inventories ........................................................................... 1,437 1,185

Deferred income taxes ................................................................. 741 619

Prepaid expenses and other current assets .............................................. 181 135

Assets of discontinued operations ...................................................... 4495

Total current assets ................................................................... 7,854 9,412

Property, plant and equipment at cost ..................................................... 7,751 8,374

Less accumulated depreciation ......................................................... (3,801) (4,644)

Property, plant and equipment, net ...................................................... 3,950 3,730

Equity and other long-term investments ................................................... 287 236

Goodwill ............................................................................... 792 677

Acquisition-related intangibles ........................................................... 118 60

Deferred income taxes ................................................................... 601 393

Capitalized software licenses, net ........................................................ 188 243

Overfunded retirement plans ............................................................. 58 —

Prepaid retirement costs ................................................................. —199

Other assets ............................................................................ 82 113

Total assets ............................................................................ $13,930 $15,063

Liabilities and Stockholders’ Equity

Current liabilities:

Loans payable and current portion of long-term debt ...................................... $43 $301

Accounts payable ..................................................................... 560 702

Accrued expenses and other liabilities .................................................. 1,029 948

Income taxes payable .................................................................. 284 154

Accrued profit sharing and retirement ................................................... 162 121

Liabilities of discontinued operations .................................................... —151

Total current liabilities ................................................................. 2,078 2,377

Long-term debt ......................................................................... —329

Underfunded retirement plans ............................................................ 208 —

Accrued retirement costs ................................................................ —136

Deferred income taxes ................................................................... 23 23

Deferred credits and other liabilities ...................................................... 261 261

Total liabilities .......................................................................... 2,570 3,126

Stockholders’ equity:

Preferred stock, $25 par value. Authorized – 10,000,000 shares.

Participating cumulative preferred. None issued ........................................ ——

Common stock, $1 par value. Authorized – 2,400,000,000 shares.

Shares issued: 2006 – 1,739,108,694; 2005 – 1,738,780,512................................ 1,739 1,739

Paid-in capital ........................................................................ 885 742

Retained earnings ..................................................................... 17,529 13,394

Less treasury common stock at cost.

Shares: 2006 – 289,078,450; 2005 – 142,190,707 ......................................... (8,430) (3,856)

Accumulated other comprehensive income (loss), net of tax:

Postretirement benefit plans.......................................................... (351) (65)

Unrealized gain (loss) on available-for-sale investments ................................. (12) (16)

Unearned compensation ............................................................... —(1)

Total stockholders’ equity .............................................................. 11,360 11,937

Total liabilities and stockholders’ equity ................................................... $13,930 $15,063

See accompanying notes.

CONSOLIDATED BALANCE SHEETS

(Millions of dollars, except share amounts)