Texas Instruments 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections, a replacement of APB Opinion

No. 20 and FASB Statement No. 3.” This standard provides guidance on the accounting for and reporting of accounting

changes and error corrections and will be effective for us beginning January 1, 2006. This standard applies to voluntary

changes in existing accounting principles and to new accounting standards that do not specify the transition

requirements upon adoption of those standards. Except for changes in depreciation methods, this standard will require

retrospective application of the new accounting principle to previous periods reported rather than presenting the

cumulative effect of the change as of the beginning of the period of the change. Changes in depreciation methods will be

applied on a prospective basis, meaning the effects of the change will be reflected only in current and future periods.

Corrections of errors will be reported by restating previously issued financial statements. As mentioned above, we will

change our method of depreciation on a prospective basis effective January 1, 2006.

In March 2005, the FASB issued FASB Interpretation No. 47, “Accounting for Conditional Asset Retirement Obligations –

An Interpretation of FASB Statement No. 143”, which is effective for us as of December 31, 2005. This interpretation

provides additional guidance as to when companies should record the fair value of a liability for a conditional asset

retirement obligation when there is uncertainty about the timing or method of settlement of the obligation. We have

completed the evaluation of the impact of this standard on our financial position and results of operations, and have

determined that the impact of the change was not material.

In November 2005, the FASB issued FASB Staff Position (FSP) Nos. FAS 115-1 and FAS 124-1, “The Meaning of Other-

Than-Temporary Impairment and Its Application to Certain Investments,” (FSP 115-1 and 124-1), which address the

determination as to when an investment is considered impaired, whether that impairment is other than temporary and the

measurement of an impairment loss. FSP 115-1 and 124-1 also include accounting considerations subsequent to the

recognition of an other-than-temporary impairment and require certain disclosures about unrealized losses that have not

been recognized as other-than-temporary impairments. These FSPs will be effective for us beginning January 1, 2006. We

are currently evaluating the potential impact these standards may have on our financial position and results of

operations, but do not believe the impact will be material.

2. Cash Equivalents and Short-term Investments

We generally invest cash in highly liquid debt securities that are classified as available for sale and are reflected in the

balance sheet based on their maturity dates. Investments with serial maturities are allocated to their asset classification

based on their individual expected average lives. Investments in debt securities with original maturities of three months

or less are considered to be cash equivalents. We consider investments in debt securities with remaining maturities or

average lives beyond three months as being available for use in current operations as needed and, as a result, include

those investments in short-term investments. All of these investments in debt securities are stated at fair value. We also

invest in auction rate securities. These securities have long-term underlying maturities; however, the market is highly

liquid and the securities are re-auctioned periodically, generally every seven, 28 or 35 days. Our intent is not to hold

these securities to maturity, but rather to use the frequent auction feature to sell securities to provide liquidity as needed.

Our practice is to invest in these securities for higher yields compared to those available on cash equivalents.

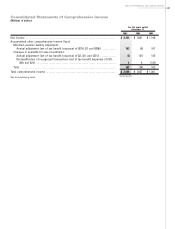

December 31, 2005 December 31, 2004

Cash Investments Cash & Cash

Equivalents Short-term

Investments Cash & Cash

Equivalents Short-term

Investments

Corporate securities ............................................ $ 61 $ 107 $ 509 $ 389

Asset-backed fixed income securities ........................... 252 1,121 1,680 3,032

Investment funds with constant net asset values ............... 468 — 238 —

U.S. government agency securities ............................. —84— 269

Tax-exempt/municipal securities

Auction rate securities ....................................... — 2,191 ——

Variable rate demand notes .................................. — 595 ——

Tax-exempt commercial paper ................................ 202 18 ——

Cash on hand ................................................... 236 — 241 —

Total ............................................................ $ 1,219 $ 4,116 $ 2,668 $ 3,690

17

TEXAS INSTRUMENTS 2005 ANNUAL REPORT