Texas Instruments 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 ANNUAL REPORT

Table of contents

-

Page 1

2005 ANNUAL REPORT -

Page 2

... and analog chips, are used by our customers to create the world's most advanced communications and entertainment electronics. TI has design, manufacturing or sales operations in more than 25 countries. The company is headquartered in Dallas, Texas. Net Income/Earnings Per Share (In billions except... -

Page 3

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 01 Thomas J. Engibous Chairman of the Board Richard K. Templeton President and Chief Executive Officer To Our Shareholders 2005 was not only TI's 75th year as a company - it was also a year in which we raised our business performance to a new level. We ... -

Page 4

... began shipping a new family of DSPs, known as DaVinciâ„¢ technology, for the next generation of digital video electronics. The DaVinci product line provides an open platform of integrated components and software, allowing customers working in a variety of digital media applications to develop... -

Page 5

...$3 billion in cash. The sale will not include the radio frequency identification (RFID) systems operations, which will remain part of TI. EDUCATIONAL & PRODUCTIVITY SOLUTIONS (E&PS) The Educational & Productivity Solutions business works with educators around the world to design and market math and... -

Page 6

... developing innovations that enable cell-phone manufacturers to cost effectively deliver 3G handsets to the mass market. For example, the first OMAP-Voxâ„¢ solution, which integrates a 3G WCDMA modem with a powerful OMAP 2 applications processor, is already sampling to customers. In 2005, TI shipped... -

Page 7

... Firm on Internal Control over Financial Reporting Summary of Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations - Overview - Results of Operations - Financial Condition - Liquidity and Capital Resources - Long-term Contractual Obligations... -

Page 8

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 06 Consolidated Statements of Income (Millions of dollars, except share and per-share amounts) For the years ended December 31, 2005 2004 2003 Net revenue ...Operating costs and expenses: Cost of revenue ...Research and development (R&D) ...Selling, general ... -

Page 9

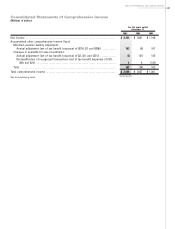

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 07 Consolidated Statements of Comprehensive Income (Millions of dollars) For the years ended December 31, 2005 2004 2003 Net income ...Accumulated other comprehensive income (loss): Minimum pension liability adjustment: Annual adjustment (net of tax beneï¬t (... -

Page 10

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 08 Consolidated Balance Sheets (Millions of dollars, except share amounts) December 31, 2005 2004 Assets Current assets: Cash and cash equivalents ...Short-term investments ...Accounts receivable, net of allowances ...Inventories ...Deferred income taxes ...... -

Page 11

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 09 Consolidated Statements of Cash Flows (Millions of dollars) 2005 For the years ended December 31, 2004 2003 Cash ï¬,ows from operating activities: Net income ...Adjustments to reconcile net income to net cash provided by operating activities: Depreciation ... -

Page 12

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 10 Consolidated Statements of Stockholders' Equity (Millions of dollars, except per-share amounts) Accumulated Other Comprehensive Income (Loss) Common Stock Paid-in Capital Retained Earnings Treasury Common Stock Unearned Compensation Balance, December ... -

Page 13

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 11 Notes to Financial Statements 1. Description of Business and Signiï¬cant Accounting Policies and Practices Business: Texas Instruments (TI) makes, markets and sells high-technology components; more than 50,000 customers all over the world buy TI products. ... -

Page 14

... sales of our products, including shipping fees, is recognized when title to the products is transferred to the customer, which usually occurs upon shipment or delivery, depending upon the terms of the sales order. Estimates of returns for product quality reasons and of price allowances (calculated... -

Page 15

...in net income for stock options, as all options granted under the plans have an exercise price equal to the market value of the underlying common stock on the date of the grant (except options granted under employee stock purchase plans and acquisition-related stock option awards). Compensation cost... -

Page 16

... compensation expense for both retirement-eligible employees and employees who become retirement eligible prior to vesting of the awards, to reï¬,ect the reduced attribution period. Assumptions: The fair values for these awards were estimated using the Black-Scholes option-pricing model with the... -

Page 17

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 15 2005 2004 2003 Long-term Plans (a) Weighted average grant date fair value, per share ...Weighted average assumptions used: Expected volatility ...Expected lives ...Risk-free interest rates ...Expected dividend yields ...Employee Plans (b) Weighted average... -

Page 18

... and 2004, include publicly traded marketable securities and private investments, which are generally non-marketable. Investments in marketable equity and debt securities are stated at fair value, which is based on market quotes where available or estimates by investment advisors or management, as... -

Page 19

...& Cash Equivalents Short-term Investments December 31, 2004 Cash & Cash Equivalents Short-term Investments Corporate securities ...Asset-backed ï¬xed income securities ...Investment funds with constant net asset values ...U.S. government agency securities ...Tax-exempt/municipal securities Auction... -

Page 20

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 18 The following table presents the aggregate maturities or average lives of cash equivalents and short-term investments at year-end 2005: Due Market Value One year or less ...One to three years ...Three to ten years ...Thereafter* ...* Maturities over 10 ... -

Page 21

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 19 5. Equity and Debt Investments Following is information on the investments at December 31, 2005 and 2004: Unrealized Cost Gains (Losses) Net Fair Value December 31, 2005 Equity investments: Marketable ...Non-marketable ...Mutual funds and other ...Total ...... -

Page 22

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 20 The following table reï¬,ects the components of acquisition-related intangible assets, excluding goodwill, that are subject to amortization: December 31, 2005 Amortized Intangible Assets Gross Carrying Amount Accumulated Amortization December 31, 2004 Gross ... -

Page 23

... a 20-year lease agreement of a new facility at the Attleboro, Massachusetts, headquarters of the Sensors & Controls segment (see Note 19 for a discussion of Leases). 9. Financial Instruments and Risk Concentration Financial Instruments: The carrying amounts and related estimated fair values of our... -

Page 24

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 22 hedge net balance sheet exposures (including $139 million to buy euros, $28 million to buy Taiwan dollars and $28 million to sell Japanese yen). Short-term investments are carried at fair value. The carrying values for other current ï¬nancial assets and ... -

Page 25

... assumed stock options granted under the Burr-Brown 1993 Stock Incentive Plan and the Radia Communications, Inc. 2000 Stock Option/Stock Issuance Plan. Unless the options are acquisition-related replacement options, the option price per share may not be less than 100 percent of the fair market value... -

Page 26

...deferred-compensation accounts established for such directors. The plan provides for the grant of a stock option to each non-employee director once per year in the period from January 2004 through 2010. Each grant is an option to purchase 15,000 shares with an option price equal to fair market value... -

Page 27

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 25 Summarized information about stock options outstanding under the various long-term plans mentioned above at December 31, 2005, is as follows: Stock Options Outstanding Range of Exercise Share Prices Number Outstanding (shares) Weighted Average Remaining ... -

Page 28

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 26 The stock options outstanding under the 2005 Plan at December 31, 2005, had an exercise price of $27.82 per share (85 percent of the fair market value of TI common stock on January 3, 2006, the date of automatic exercise). Of the total outstanding options, ... -

Page 29

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 27 U.S. Retirement Plans The principal retirement plans in the U.S include a qualiï¬ed deï¬ned beneï¬t pension plan (which is closed to new participants hired after November 1997), a deï¬ned contribution plan and an enhanced deï¬ned contribution plan. Both... -

Page 30

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 28 Effect on the Statements of Income and Balance Sheets Net periodic beneï¬t cost of the deï¬ned beneï¬t and retiree health care beneï¬t plans was as follows: U.S. Deï¬ned Beneï¬t 2005 2004 2003 Retiree Health Care 2005 2004 2003 Non-U.S. Deï¬ned Bene... -

Page 31

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 29 The measurement date for the U.S. plans is December 31. The measurement date for the non-U.S. plans is September 30. Obligation and asset data for the deï¬ned beneï¬t and retiree health care beneï¬t plans were as follows: U.S. Deï¬ned Beneï¬t 2005 2004 ... -

Page 32

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 30 The preceding table presents aggregate information for all plans reported. The following table presents the obligation and asset information for only those plans that have projected beneï¬t obligations in excess of plan assets or plans that have accumulated... -

Page 33

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 31 The expected long-term rate of return on plan assets assumptions are based upon actual historical returns, future expectations for returns for each asset class and the effect of periodic target asset allocation rebalancing. The results are adjusted for the ... -

Page 34

...(see Note 5 for a discussion of investments). As no shares of TI common stock are actually held for the account of participants, as of December 31, 2005, we have a forward purchase contract with a commercial bank to acquire 1,000,000 shares of TI common stock at a ï¬xed price of $31.38 per share at... -

Page 35

... in 2004 and 12.3 million shares in 2003. 16. Restructuring Actions 2003 Restructuring Actions Sensors & Controls Restructuring Action: In 2003, we announced a plan to move certain production lines from Attleboro, Massachusetts, to other TI sites in order to be geographically closer to customers and... -

Page 36

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 34 The following is a reconciliation of the above-mentioned restructuring accruals: 2003 Sensors & Controls Restructuring Action 2003 Semiconductor Restructuring Action Balance, Prior Actions Description Total Balance December 31, 2002 ...Charges: Severance ... -

Page 37

... of revenue in 2005. Our Sensors & Controls segment designs and manufactures sensors, electrical and electronic controls, and radio frequency identiï¬cation (RFID) systems. Our sensors operations are the market leader in pressure sensing for the heating/ventilation/air conditioning, automotive and... -

Page 38

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 36 Business Segment Information Semiconductor Sensors & Controls E&PS Corporate Activities Total Trade Revenue 2005 ...2004 ...2003 ...Intersegment Revenue 2005 ...2004 ...2003 ...Total Net Revenue 2005 ...2004 ...2003 ...Proï¬t (Loss) from Operations ... -

Page 39

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 37 18. Income Taxes During 2005, we repatriated approximately $1.29 billion of non-U.S. subsidiary earnings that qualiï¬ed under the AJCA and recognized a related tax expense of $55 million. Provision has previously been made for deferred taxes on ... -

Page 40

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 38 The primary components of deferred income tax assets and liabilities at December 31 were as follows: December 31, 2005 2004 Deferred income tax assets: Accrued retirement costs (deï¬ned beneï¬t and retiree health care) ...Inventories and related reserves ... -

Page 41

... gases. This agreement is accounted for as an operating lease. In December 2004, we completed a sale-leaseback of our facilities in Attleboro, Massachusetts, headquarters of the Sensors & Controls segment. The terms included a 20-year lease agreement for a new facility at the site to be used to... -

Page 42

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 40 20. Supplemental Cash Flow Information 2005 2004 2003 Cash Payments: Interest (net of amounts capitalized) ...Income taxes (net of refunds) ...Non-cash investing and ï¬nancing activities: Capital lease (asset and obligation) ...21. Subsequent Events $ 9 ... -

Page 43

... position of Texas Instruments Incorporated and subsidiaries at December 31, 2005 and 2004, and the consolidated results of their operations and their cash ï¬,ows for each of the three years in the period ended December 31, 2005, in conformity with U.S. generally accepted accounting principles. As... -

Page 44

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 42 Report by Management on Internal Control over Financial Reporting The management of TI is responsible for establishing and maintaining adequate internal control over ï¬nancial reporting. TI's internal control system was designed to provide reasonable ... -

Page 45

... of compliance with the policies or procedures may deteriorate. In our opinion, management's assessment that Texas Instruments Incorporated maintained effective internal control over ï¬nancial reporting as of December 31, 2005, is fairly stated, in all material respects, based on the COSO criteria... -

Page 46

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 44 Summary of Selected Financial Data (Millions of dollars, except share and per-share amounts) Years Ended December 31, 2005 2004 2003 2002 2001 Net revenue ...Operating costs and expenses ...Proï¬t (loss) from operations ...Other income (expense) net ...... -

Page 47

... the world's largest supplier of DSPs. We own and operate semiconductor manufacturing sites in the Americas, Japan, Europe and Asia. During 2005, we continued building a new semiconductor wafer manufacturing complex in Texas. We are constructing the building and infrastructure ahead of market demand... -

Page 48

..., and radio frequency identiï¬cation (RFID) systems. Our primary markets are automotive and industrial. Other targeted markets include heating, ventilation, air conditioning, refrigeration and industrial control systems. This business segment represented 9 percent of our revenue in 2005. Prices of... -

Page 49

... shipments of a new family of DSPs for digital video known as DaVinciâ„¢, our agreement to acquire radio frequency expert Chipcon Group ASA for high-performance analog, customer sampling of our multi-mode Universal Mobile Telecommunications System (UMTS) chipset for wireless cell phones, and strong... -

Page 50

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 48 Details of Financial Results For the year, our revenue reached a record $13.39 billion, an increase of 6 percent. We also set a new high for operating margin of 20.8 percent. Diluted earnings per share were $1.39 for the year. Earnings per share include ... -

Page 51

... supplying chips to the rapidly growing emerging market for low-price cell phones. We believe industry shipments of WCDMA cell-phones doubled in 2005. In 2005, about 55 percent of our 3G revenue came from sales of OMAP application processors and about 45 percent from sales of digital baseband modems... -

Page 52

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 50 For the year, Semiconductor orders increased 13 percent to $12.23 billion due to broad-based demand for our DSP and analog products. Sensors & Controls Segment Statement of Operations - Sensors & Controls For years ended December 31, 2005 2004 Net revenue ... -

Page 53

... 12 percent from 2003 due to higher broad-based demand. In the E&PS segment, revenue for 2004 increased 7 percent from 2003 on the strength of higher shipments for new graphing calculator products. Earnings per share for the year were $1.05 compared with $0.68 in 2003. Details of Financial Results... -

Page 54

... of 3G cell phones using the UMTS standard are based on our DSPs and OMAP application processors. In 2004, about 35 percent of total Semiconductor revenue came from the wireless market. • Broadband communications revenue, which includes DSL and cable modems, Voice over Internet Protocol (VoIP) and... -

Page 55

... million, or 34.0 percent of revenue, an increase of $19 million due to higher gross proï¬t. Financial Condition At the end of 2005, total cash (cash and cash equivalents plus short-term investments) was $5.34 billion, down $1.02 billion from the end of 2004. Accounts receivable of $1.81 billion at... -

Page 56

... cash investments in 2004. Capital expenditures of $1.33 billion increased by $32 million from 2004. Our capital expenditures in 2005 were primarily for assembly and test equipment, advanced wafer fabrication equipment and construction of our new 300-millimeter manufacturing facility in Richardson... -

Page 57

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 55 Long-term Contractual Obligations Contractual Obligations Total 2006 Payments Due by Period 2007/2008 2009/2010 Thereafter Long-term debt obligations (1) ...Capital lease obligations (2) ...Operating lease obligations (3) ...Software license obligations (4)... -

Page 58

... and statements of cash ï¬,ows, requires us to develop estimates of the fair value of stock-based compensation expense. The most signiï¬cant factors of that expense that require estimates or projections include the expected volatility, expected lives and estimated forfeiture rates of employee stock... -

Page 59

...excess of the carrying amount over fair value determined by either a quoted market price, if any, or a value determined by utilizing a discounted cash-ï¬,ow technique. Additionally, in the case of assets that will continue to be used in future periods, a shortened depreciable life may be utilized if... -

Page 60

... plans had an exercise price equal to the market value of the underlying common stock on the date of grant (except options granted under employee stock purchase plans and acquisition-related stock option awards). The terms for stock options offered to employees under TI employee stock purchase plans... -

Page 61

.... Our cash equivalents are debt securities with original maturities equal to or less than three months. Short-term investments are debt securities, including auction-rate securities, with original maturities greater than three months (see Note 2 to Financial Statements). Their aggregate fair value... -

Page 62

... operating results. Restructuring Actions Sensors & Controls Restructuring Action: In 2003, we announced a plan to move certain production lines from Attleboro, Massachusetts, to other TI sites in order to be geographically closer to customers and their markets and to reduce manufacturing costs... -

Page 63

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 61 Quarterly Financial Data Quarter 2005 1st 2nd 3rd 4th Net revenue ...Gross proï¬t ...Proï¬t from operations ...Net income ...Basic earnings per common share ...Diluted earnings per common share ... $ 2,972 1,336 497 $ 411 $ $ .24 .24 $ 3,239 1,521 669 $ ... -

Page 64

TEXAS INSTRUMENTS 2005 ANNUAL REPORT 62 Common Stock Prices and Dividends TI common stock is listed on the New York Stock Exchange and traded principally in that market. The table below shows the high and low closing prices of TI common stock as reported by Bloomberg L.P. and the dividends paid ... -

Page 65

... differs from projections; • Product liability or warranty claims, or recalls by TI customers for a product containing a TI part; • TI's ability to recruit and retain skilled personnel; and • Timely implementation of new manufacturing technologies, installation of manufacturing equipment and... -

Page 66

...statements without charge by writing to: Investor Relations P.O. Box 660199, MS 8657 Dallas, TX 75266-0199 STOCK EXCHANGE LISTINGS The common stock of Texas Instruments Incorporated is listed on the New York Stock Exchange and the Swiss stock exchange. Ticker symbol: TXN COMPANY HEADQUARTERS Texas... -

Page 67

... ANNUAL REPORT 65 Board of Directors, Executive Officers and TI Fellows DIRECTORS James R. Adams Retired Chairman of the Board, Texas Instruments; Retired Group President, SBC Communications Inc. David L. Boren President, The University of Oklahoma Thomas J. Engibous Chairman of the Board Wayne... -

Page 68

Texas Instruments Incorporated P.O. Box 660199 Dallas, TX 75266-0199 An Equal Opportunity Employer © Texas Instruments Incorporated, 2006 Printed in the U.S.A. on recycled paper TI-30001G www.ti.com