Tesco 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC 3

The Group continued to generate strong operating

cash flows. Net cash inflow from operating activities

increased by 23.9% to £2,942m (2003 – £2,375m).

Working capital improvements contributed £0.5bn

to cash flow this year, and whilst £50m is due to

the 53rd week, the rest is due to growth in the

business and management focus.

Group net debt in the year decreased by £647m

to £4,090m (2003 – £4,737m). Gearing decreased

to 51% (2003 – 73%).

Post-tax return on capital employed increased to

10.5% from 10.2% last year.

GROUP INTEREST AND TAXATION Net interest payable

was £223m (2003 – £180m). Interest cover is

now 8.2 times compared to 8.6 times last year.

Ta x has been charged at an effective rate of

31.1% (2003 – 30.5%). Prior to accounting for the

net loss on disposal of fixed assets, integration

costs and goodwill amortisation, our underlying tax

rate was 29.5% (2003 – 29.6%).

SHAREHOLDER RETURNS AND DIVIDENDS Underlying

diluted earnings per share (excluding net loss on

disposal of fixed assets, integration costs and

goodwill amortisation) increased by 16.7% to

16.31p (2003 – 13.98p).

The Board has proposed a final dividend of 4.77p

(2003 – 4.33p) giving a total dividend for the year

of 6.84p (2003 – 6.20p).This represents an increase

of 10.3% in line with our policy of strong dividend

growth while continuing to build cover.

Total recognised gains and losses in the year were

£943m (2003 – £968m), comprising profit for the

year of £1,100m and losses on foreign currency

translation of £157m.

Group shareholders’ funds, before minority

interests, increased by £1,429m. This was due to

retained profits of £584m, new shares issued less

expenses of £1,002m and losses on foreign

currency translation of £157m. As a result, return

on shareholders’ funds was 23.6%.

Total shareholder return, which is measured as the

percentage change in the share price plus the

dividend, has been 66.1% over the last five years,

compared to the FTSE 100 average of (16.5)%.

Over the last three years it has been 3.4%,

compared to the FTSE 100 average of (17.1)%.

In the last year, total shareholder return in Tesco

was 58.6% compared to the FTSE 100 average

of 25.2%.

UK Sales grew by 16.3% to £26,876m (2003 –

£23,101m as restated). On a 52-week basis, UK sales

grew by 14.2% to £26,381m. Of this, 6.7% came

from existing stores and 7.5% from net new stores.

Underlying operating profit in the UK was 17.7%

higher at £1,526m (2003 – £1,297m) and operating

margin increased to 6.2%.

The tesco.com operations achieved sales of

£577m (2003 – £447m) and excluding USA and

South Korea start-up losses, made a profit of

£28m (2003 – £12m).

As part of our store development programme we

opened 64 new stores comprising eight Extras,

20 Superstores, four Metro, 30 Express and two

T&S Stores. Including extensions and refits, we

opened an additional 1.8m sq ft of new space

and expect to open a further 1.4m sq ft in the

coming year.

INTERNATIONAL Sales are up 29%, with strong

volume growth. Profits have grown strongly by 44%,

and operating margins have increased from 4.5%

last year to 5.1%.

REST OF EUROPE In the Rest of Europe sales rose

by 27.5% to £3,834m (2003 – £3,007m as

restated) and contributed an underlying operating

profit of £184m, up from £141m last year.

Sales in the Republic of Ireland, at constant

exchange rates, grew by 10%. We have 82 stores,

giving us 1.9m sq ft and have plans for a further

eight stores next year.

In Central Europe we opened 22 hypermarkets

in the year giving us 110 in total.

ASIA In the year, our Asian businesses had sales

of £2,847m (2003 – £2,172m as restated), up

31.1% on the previous year and made an underlying

operating profit of £122m (2003 – £71m).

In Asia, we opened 22 stores in the year, giving

us 179 in total.

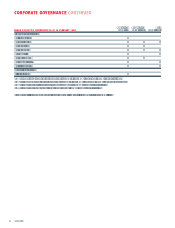

1 year 3 years 5 years

TOTAL SHAREHOLDER RETURN

RELATIVE TO THE FTSE 100

82.6

82.6

20.5

20.5

33.4

33.4

00 01 0302

UK SALES GROWTH %

(restated)

7.7

8.8

8.4

7.3

4.0

4.0

04

16.3 14.2

6.7

6.7

6.0

6.0

4.7

4.7

4.1

4.1

TOTAL

LIKE-FOR-LIKE

53rd WEEK

00 01 0302

UK SALES AREA OPENED

000 sq ft

1,433

1,433

04

1,778

1,296

1,296

1,298

1,298

1,216

1,216