Telstra 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 Telstra annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

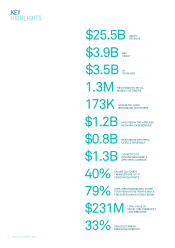

FULL YEAR RESULTS

AND OPERATIONS REVIEW

REPORTED RESULTS

In financial year 2013 sales revenue

increased by 1.1 per cent or $270 million

to $25,502 million and total income

increased by 1.9 per cent or $477 million

to $25,980 million.

Operating expenses (before depreciation

and amortisation) increased by

0.5 per cent or $81 million to

$15,350 million.

Labour expenses decreased by 3.3 per

cent to $4,803 million driven by lower

labour substitution and other labour

expenses. Excluding TelstraClear from

both periods, labour expenses declined

by 2.0 per cent.

With our growing customer base and

increased handset sales, directly variable

costs (DVCs) or goods and services

purchased increased by 3.4 per cent

to $6,389 million. Network payments

expense continued to decline.

Other expenses increased by 0.8 per cent

to $4,158 million driven by an increase

in service contract expense to support

operational initiatives, and the loss

recognised on the sale of TelstraClear.

This was offset by an overall decrease

in impairment expenses.

Earnings before interest, tax,

depreciation and amortisation

(EBITDA) increased by 3.9 per cent

to $10,629 million. EBITDA margins

increased by 1.1 percentage points to

41.7 per cent. Earnings before interest

and tax (EBIT) increased by 9.8 per cent

to $6,391 million.

Net finance costs increased by

2.4 per cent to $909 million as a result

of revaluation impacts offset to a large

extent by net borrowing costs decreasing

from lower market interest rates.

Reported profit after tax increased by

12.9 per cent to $3,865 million. Basic

earnings per share (EPS) increased

by 11.6 per cent from 27.5 cents to

30.7 cents.

<h[[YWi^Óeme\+"&(*c_bb_edmWi

generated in the year. Accrued capital

expenditure was $3,792 million or

14.9 per cent of sales.

On 8 August 2013, the Directors of Telstra

resolved to pay a fully franked final

dividend of 14 cents per share bringing

the total dividend to 28 cents per share

for the 2013 financial year. Shares

will trade excluding entitlement to the

dividend on 19 August 2013 with payment

on 20 September 2013.

SUMMARY FINANCIAL RESULTS

FY13

$m

FY12

$m

Change

%

Sales revenue 25,502 25,232 1.1

Total income 25,980 25,503 1.9

Operating expenses 15,350 15,269 0.5

EBITDA 10,629 10,234 3.9

Depreciation

and amortisation 4,238 4,412 (3.9)

EBIT 6,391 5,822 9.8

Net finance costs 909 888 2.4

Tax 1,617 1,510 7.1

Net profit after tax 3,865 3,424 12.9

Attributable net profit 3,813 3,405 12.0

Accrued capex(1) 3,792 3,591 5.6

<h[[YWi^Óem 5,024 5,197 (3.3)

Earnings per share

(cents) 30.7 27.5 11.6

Dividend payout ratio (%) 91 102 n/m

(1) Accrued capital expenditure is defined as additions to property,

equipment and intangible assets, including capital lease additions,

measured on an accrued basis.

RESULTS ON A GUIDANCE BASIS*

FY13 FY13 guidance

Total income 3.3% Low single digit growth

EBITDA 4.8% Low single digit growth

Capex/sales 14.9% Around 15%

<h[[YWi^Óem $5.2 billion $4.75-$5.25 billion

Dividend 28c fully franked 28c fully franked

GUIDANCE VERSUS REPORTED RESULTS*

FY13 FY13 FY13 FY12

Reported

results

$m

Adjustments

$m

Guidance

basis

$m

Guidance

basis

$m

Total

income 25,980 (164) 25,816 25,001

EBITDA 10,629 127 10,756 10,264

Free

YWi^Óem 5,024 152 5,176 n/m

*Adjusted for TelstraClear trading results and sale and spectrum payments.

Please refer to the guidance versus reported results reconciliation on

page 203. This reconciliation forms part of the Full Year Results and

Operations Review, and has been reviewed by our auditors.

12 Telstra Annual Report 2013