THQ 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011

ANNUAL

REPORT

Table of contents

-

Page 1

2011 ANNUAL REPORT -

Page 2

...future. As a result, the Company is poised for signiï¬cant net sales growth and proï¬tability in ï¬scal 2012 and beyond, with a robust portfolio of major owned and licensed franchises and rapidly growing digital revenues. Fiscal 2011 Driven by Successful New Launches In ï¬scal 2011, we reported... -

Page 3

... the second ï¬scal quarter. This expands the Warhammer 40,000 universe to Xbox 360 and PlayStation 3 for the ï¬rst time. The game has an innovative range and melee combat system positioning it to be one of the best action games of the year. Scheduled to arrive this holiday is Saints Row the Third... -

Page 4

... Rock Studios, creators of the hit franchise Left 4 Dead, on a new original property. Additionally, we plan on announcing and unveiling other key titles for ï¬scal 2013 and beyond. Aggressive Focus on Digital Content We expect digital revenues to roughly double from ï¬scal 2011 to ï¬scal 2012... -

Page 5

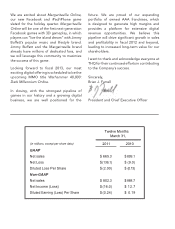

... to increased long-term value for our shareholders. I want to thank and acknowledge everyone at THQ for their continued efforts in contributing to the Company's success. Sincerely, Brian J. Farrell President and Chief Executive Ofï¬cer GAAP Net sales Net Loss Diluted Loss Per Share Non-GAAP Net... -

Page 6

... of the last business day of the registrant's most recently completed second fiscal quarter, October 2, 2010, was approximately $273.1 million. The number of shares outstanding of the registrant's common stock as of June 3, 2011 was approximately 68,327,422. The registrant's 2011 Proxy Statement is... -

Page 7

(This page has been left blank intentionally.) -

Page 8

...of Equity Securities Selected Consolidated Financial Data Item 6. Management's Discussion and Analysis of Financial Condition and Results of Operations Item 7. Item 7A. Quantitative and Qualitative Disclosures About Market Risk Consolidated Financial Statements and Supplementary Data Item 8. Changes... -

Page 9

(This page has been left blank intentionally.) -

Page 10

... including Company of Heroes, Darksiders, Homefront, Red Faction, Saints Row, and racing games based on our MX vs. ATV brand; • core games based on licensed properties including the Ultimate Fighting Championship ("UFC"), World Wrestling Entertainment ("WWE"), and Games Workshop's Warhammer 40,000... -

Page 11

... Game Studios to publish the studio's premier video game title, Devil's Third, for the Xbox 360 and PS3. The game is currently scheduled for release in fiscal 2013. Our casual and lifestyle portfolio is designed around new play patterns, including uDraw, which was introduced in fiscal 2011. We plan... -

Page 12

.... Raw 2011; • in fiscal 2010, UFC 2009 Undisputed and WWE SmackDown vs. Raw 2010; and • in fiscal 2009, WWE SmackDown vs. Raw 2009, Saints Row 2, and Wall-E. Our games are based on intellectual property that is either wholly-owned by us or licensed from third parties. We develop our games using... -

Page 13

... the license term. Royalty rates are generally higher for properties with proven popularity and less perceived risk of commercial failure. We develop our products using both internal and external development resources. The internal resources consist of producers, game designers, software engineers... -

Page 14

... as well as operator help lines during regular business hours. The customer support group tracks customer inquiries, and we use this data to help improve the development and production processes. Our console-based and handheld-based video games are manufactured for us by the platform manufacturers... -

Page 15

... platform manufacturer in order to publish our games on such platform. We are currently licensed to publish, in most countries throughout the world, titles on Xbox 360; PS3, PlayStation 2, and PSP; and the Wii and DS. Additionally, we are authorized to develop and publish online content compatible... -

Page 16

...amount of net sales. Our results can also vary based on a number of factors, including title release dates, consumer demand for our products, market conditions and shipment schedules. Our largest customers worldwide include Best Buy, GameStop, Target and Wal-Mart. We also sell our products to other... -

Page 17

...a significant amount of our cash in product development and licenses and thus did not generate positive cash flow from operations in fiscal 2011. As a result, the balance of our cash, cash equivalents, and short-term investments has decreased from $271.3 million as of March 31, 2010 to $85.6 million... -

Page 18

... lower our net sales and/or our profitability. During fiscal 2011, we entered into a multi-year extension of our long-term agreement with Games Workshop to publish games based on the Warhammer 40,000 brand which expires on December 31, 2020. Our licenses with UFC and WWE expire on December... -

Page 19

... as PS3, Xbox 360, and the Wii and DS. The following factors related to such platforms can adversely impact sales of our video games and our profitability: Popularity of platforms. According to the International Development Group, Inc. ("IDG"), an independent consulting and advisory services company... -

Page 20

... sell new games and thus lower our net sales in any given quarter. Software pricing and sales allowances may impact our net sales and profitability. Software prices for games sold for play on the PS3 and Xbox 360 are generally higher than prices for games for the Wii, handheld platforms or PC games... -

Page 21

... renewing our licenses to publish games based upon their properties that we currently publish, or not granting future licenses to us to develop games based on their other properties. If intellectual property owners continue expanding internal efforts to develop video games based upon properties that... -

Page 22

... higher during the year-end holiday buying season. Other factors that cause fluctuations in our sales and operating results include the timing of our release of new titles as well as the release of our competitors' products; the popularity of both new titles and titles released in prior periods... -

Page 23

... Policing unauthorized use of our products is difficult, and software piracy is a persistent problem, especially in some international markets. Further, the laws of some countries where our products are or may be distributed, either do not protect our products and intellectual property rights to the... -

Page 24

... of personal information could result in a loss of current or potential customers for our online offerings that require the collection of customer data. We have significant net operating loss and tax credit carryforwards ("NOLs"). If we are unable to use our NOLs, our future profitability may be... -

Page 25

... such action could adversely impact our financial results and the market price of our common stock. Catastrophic events or geo-political conditions may disrupt our business. Our net sales are derived from sales of our games, which are developed within a relatively small number of studio facilities... -

Page 26

... Global Select Market, was $4.13 per share. As of June 3, 2011 there were approximately 283 holders of record of our common stock. We have never paid cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the growth and development of our business and... -

Page 27

... and Results of Operations included elsewhere herein. The selected consolidated financial data presented below as of and for each of the fiscal years in the five-year period ended March 31, 2011 are derived from our audited consolidated financial statements. The consolidated balance sheets as... -

Page 28

... of sales: Product costs Software amortization and royalties License amortization and royalties Total cost of sales Gross Profit Operating expenses: Product development Selling and marketing General and administrative Goodwill impairment Restructuring Total operating expenses Operating income (loss... -

Page 29

... to publish the studio's premier video game title, Devil's Third, for the Xbox 360 and PS3. The game is currently scheduled for release in fiscal 2013. Building Franchises: • In fiscal 2011 we shipped more than 2.4 million units of internally developed and owned intellectual property Homefront; we... -

Page 30

... for free-to-play online games in Asian markets. As a result, we cancelled two games, eliminated certain positions, and closed our Korean support office. In the fourth quarter of fiscal 2011, we performed an assessment of our product development and publishing staffing models. This resulted in... -

Page 31

... preferences in this market, we introduced uDraw, a first-of-its kind, innovative new gaming accessory for the Wii, during holiday 2010 and plan to bring uDraw to the Xbox 360 and PS3 in holiday 2011. We expect to capitalize on the new platforms, including uDraw and the new Nintendo 3DS platform... -

Page 32

... net selling price; • a decrease in units sold of games based on kids movie-based licensed games, which was primarily because in fiscal 2011 we did not release any new titles based on the Disney•Pixar brand; and • a decrease in net sales of games based on our owned intellectual properties, due... -

Page 33

... decrease in software development amortization as a percent of net sales were higher title cancellation and impairment charges in fiscal 2011 compared to fiscal 2010. In fiscal 2011 we had charges totaling $9.9 million related to the cancellation of Company of Heroes Online and WWE Online (see "Note... -

Page 34

... our future releases. These increases were partially offset by lower personnel related costs. The increase in selling and marketing expenses as a percent of net sales was primarily due to promotional efforts to support certain titles that were released late in the fourth quarter of fiscal 2011 for... -

Page 35

... reflecting the loss allocable to equity interests in THQ*ICE LLC that were not owned by THQ. Fiscal 2010 net sales were primarily driven by sales of our first game based on the UFC franchise, UFC 2009 Undisputed, as well as WWE SmackDown vs. Raw 2010 and catalog titles. Net sales increased $69... -

Page 36

...30, 2009 on Xbox 360 and PS3, at a premium price (e.g. MSRP of $59.99 in the United States). This title was the primary driver of our net sales in fiscal 2010 and had a higher average selling price compared to sales of our titles released in fiscal 2009. The increase in net sales of new releases due... -

Page 37

...to sales of UFC 2009 Undisputed on Xbox 360 and PS3, at a premium price (e.g. MSRP of $59.99 in the United States). This title was the primary driver of our net sales in fiscal 2010 and had a higher average selling price compared to titles released in fiscal 2009. Cost of Sales-Software Amortization... -

Page 38

... was primarily due to decreases in internal development spending primarily resulting from actions taken as part of our fiscal 2009 business realignment, including our more focused product strategy and the closure of several of our studios. Selling and Marketing (amounts in thousands) $131,954 14... -

Page 39

... our development studios, and the streamlining of our corporate organization in order to support the new product strategy, including reductions in worldwide personnel. As a result of these initiatives, we recorded restructuring charges of $5.7 million in fiscal 2010, and $12.3 million in fiscal 2009... -

Page 40

...a result of expected cash collections during fiscal 2012 related to the March 2011 release of Homefront and the scheduled fiscal 2012 releases of core games such as Red Faction Armageddon, Warhammer 40,000: Space Marine, and Saints Row: The Third, we expect to generate significant positive cash flow... -

Page 41

... 2011 fourth quarter title releases, including Homefront. As a result of expected cash collections during fiscal 2012 related to the March 2011 release of Homefront and the scheduled fiscal 2012 releases of core games such as Red Faction Armageddon, Warhammer 40,000: Space Marine, and Saints Row... -

Page 42

...." We continue to focus on managing our development and operating costs to look for additional efficiencies and cost savings in order to improve future earnings. As a result, we may incur future restructuring and other charges if further changes are made to our current operating structure. We may... -

Page 43

... the development, marketing, sale or use of our games, including any claims for copyright or trademark infringement brought against such manufacturer. As a result, we bear a risk that the properties upon which the titles of our games are based, or that the information and technology licensed from... -

Page 44

... ratio of current gross sales to total projected gross sales. Licenses and Software Development Impairment Analysis. We evaluate the future recoverability of our capitalized licenses and software development on a quarterly basis in connection with the preparation of our financial statements. In this... -

Page 45

... information related to license and software development impairments. Revenue Recognition. We recognize net sales for packaged software when title and risk of loss transfers to the customer, provided that we have no significant remaining support obligations and that collection of the resulting... -

Page 46

...information about fair value measurements. ASU 2011-04 is effective for interim and annual periods beginning after December 15, 2011, which will be our quarter ending March 31, 2012. The adoption is not expected to have a material impact on our results of operations, financial position or cash flows... -

Page 47

...March 31, 2011, we had no outstanding balances under the Bank of America Credit Facility or under the UBS Credit Agreement, which was terminated, pursuant to its terms, on July 2, 2010. We transact business in many different foreign currencies and are exposed to financial market risk resulting from... -

Page 48

The report of Independent Registered Public Accounting Firm, consolidated financial statements and notes to consolidated financial statements follow below. 39 -

Page 49

... of Directors and Stockholders of THQ Inc., Agoura Hills, California We have audited the accompanying consolidated balance sheets of THQ Inc. and subsidiaries (the "Company") as of April 2, 2011 and April 3, 2010, and the related consolidated statements of operations, total equity and cash flows for... -

Page 50

...22) THQ Inc. stockholders' equity: Preferred stock, par value $0.01, 1,000,000 shares authorized Common stock, par value $0.01, 225,000,000 shares authorized as of March 31, 2011; 68,300,482 and 67,729,952 shares issued and outstanding as of March 31, 2011 and March 31, 2010, respectively Additional... -

Page 51

... of sales: Product costs Software amortization and royalties License amortization and royalties Total cost of sales Gross profit Operating expenses: Product development Selling and marketing General and administrative Goodwill impairment Restructuring Total operating expenses Operating loss Interest... -

Page 52

...shares Conversion of stock unit awards Cancellation of restricted stock Stock-based compensation Taxes related to stock options Sale of noncontrolling interest Comprehensive income (loss): Net loss Other comprehensive income (loss... - - $ 5,861 (461,000) 310,238 555 (157) 617...financial statements. 43 -

Page 53

... of available-for-sale investments Other long-term assets Acquisitions, net of cash acquired Net proceeds from sale of discontinued operations Purchases of property and equipment Net cash provided by (used in) investing activities Proceeds from issuance of common stock to employees Payment of debt... -

Page 54

... including Company of Heroes, Darksiders, Homefront, Red Faction, Saints Row, and racing games based on our MX vs. ATV brand; • core games based on licensed properties including the Ultimate Fighting Championship ("UFC"), World Wrestling Entertainment ("WWE"), and Games Workshop's Warhammer 40,000... -

Page 55

... selling them in the near term and are reported at fair value, with unrealized gains and losses recognized in earnings. Investments designated as available-for-sale securities are carried at fair value based on quoted market prices or estimated based on quoted market prices for financial instruments... -

Page 56

... our consolidated balance sheets. As discussed below, gains and losses resulting from changes in fair value are accounted for depending on the use of the derivative and whether it is designated and qualifies for hedge accounting. We utilize forward contracts in order to reduce financial market risks... -

Page 57

...related to license and software development impairments. Revenue Recognition. We recognize net sales for packaged software when title and risk of loss transfers to the customer, provided that no significant vendor support obligations remain outstanding and that collection of the resulting receivable... -

Page 58

... net sales. Advertising costs, included in "Selling and marketing" expense in our consolidated statements of operations, for fiscal 2011, 2010 and 2009 are $78.0 million, $69.7 million and $77.6 million, respectively. Goodwill and Other Intangible Assets. In the three months ended December 31, 2008... -

Page 59

As of March 31, 2010 all identifiable intangible assets, other than licenses and software development, were fully amortized. Stock-based compensation. We estimate the fair value of stock options and our employee stock purchase plan on date of grant using the Black-Scholes option pricing model which ... -

Page 60

...information about fair value measurements. ASU 2011-04 is effective for interim and annual periods beginning after December 15, 2011, which will be our quarter ending March 31, 2012. The adoption is not expected to have a material impact on our results of operations, financial position or cash flows... -

Page 61

... balance sheets (see "Note 9 - Other Long-Term Assets"). Realized gains and losses on sales of available-for-sale securities are recognized in net income (loss) on the specific identification basis and are included in "Interest and other income (expense), net" in our consolidated statements... -

Page 62

...consolidated balance sheets. In October 2008, we entered into a settlement agreement with UBS Financial Services Inc. ("UBS"), the broker of certain of our ARS (the "UBS Agreement"). The UBS Agreement provided us with Auction Rate Securities Rights ("Rights") to sell such ARS to UBS at the par value... -

Page 63

... 31, 2011 and 2010 consisted of the following (amounts in thousands): Components Finished goods Inventory $ $ 3,390 28,515 31,905 $ $ 2,447 11,523 13,970 Prepaid expenses and other current assets. Prepaid expenses and other current assets at March 31, 2011 primarily consisted of product costs... -

Page 64

..."Licenses" and "Licenses, net of current portion" in our consolidated balance sheets. Additionally, as of March 31, 2011, we had commitments of $13.1 million that are not reflected in our consolidated financial statements due to remaining performance obligations of the licensor. Software Development... -

Page 65

... to our fiscal 2009 realignment plan. Other long-term assets includes our investment in Yuke's, a Japanese video game developer. We own approximately 15% of Yuke's, which is publicly traded on the Nippon New Market in Japan. This investment is classified as available-for-sale and reported at fair... -

Page 66

... expect any future charges under the fiscal 2011 third quarter realignment. Fiscal 2009 Realignment. During fiscal 2009, we updated our strategic plan in an effort to increase our profitability and cash flow generation. We significantly realigned our business to focus on fewer, higher quality games... -

Page 67

... that is not capitalized to software development is classified as "Interest and other income (expense), net" in our consolidated statements of operations and was $10,000 and $3.1 million in fiscal 2011 and fiscal 2010, respectively. The effective interest rate, before capitalization of any interest... -

Page 68

... fiscal 2011, we did not repurchase any shares of our common stock. There is no expiration date for the authorized repurchases. The components of accumulated other comprehensive income (loss) were as follows (amounts in thousands): Balance at March 31, 2008 Other comprehensive loss Balance at... -

Page 69

... 2009, respectively. Had we reported net income for fiscal 2011, 2010 and 2009, an additional 0.4 million, 0.3 million and 0.7 million shares of common stock, respectively, would have been included in the number of shares used to calculate diluted earnings per share. For our United States employees... -

Page 70

...by THQ in the settlement agreements which meets the definition of an asset that has value to a marketplace participant was the new WWE license. The fair value of the new WWE license was determined using level 3 valuation inputs; specifically, a discounted future cash flow over the eight-year term of... -

Page 71

.... For fiscal 2011, 2010 and 2009, stock-based compensation expense recognized in our consolidated statements of operations was as follows (amounts in thousands): Cost of sales - Software amortization and royalties Product development Selling and marketing General and administrative Stock-based... -

Page 72

...-free interest rate Expected lives -% 58.3% 0.2% 0.5 years -% 48.1% 0.2% 0.5 years -% 84.5% 0.2% 0.5 years -% 36.8% 1.9% 0.5 years A summary of our stock option activity for fiscal 2011, 2010 and 2009 is as follows (amounts in thousands, except per share amounts): Outstanding at March 31, 2008... -

Page 73

... over the term of the warrant. The exercise price of third-party stock warrants is equal to the fair market value of our common stock at the date of grant. No third-party stock warrants were granted or exercised during fiscal 2011, 2010 and 2009; however, warrants for 240,000 shares expired... -

Page 74

.... In fiscal 2010 and 2009 amortization expense related to these warrants was $0.1 million and $0.4 million, respectively, and was included in "Cost of sales - License amortization and royalties" expense in our consolidated statements of operations. United States and foreign income (loss) before... -

Page 75

..." and protect our net operating loss carryforwards, on May 12, 2010, we entered into a Section 382 Rights Agreement (for further information see "Note 22 - Stockholder's Rights Plan"). The tax credit carryforwards as of March 31, 2011 include research and development tax credit carryforwards of $25... -

Page 76

... balance sheet as $3.4 million in net long-term deferred tax assets. The amount of unrecognized tax benefits at March 31, 2011 includes $2.7 million of unrecognized tax benefits which, if ultimately recognized, may reduce our effective tax rate, subject to future realizability of the assets... -

Page 77

...be corroborated by observable market data for substantially the full term of the assets or liabilities. • Level 3 - Discounted cash flow analysis using unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities, as... -

Page 78

... Agreements," the fair value of the new WWE license was determined using level 3 valuation inputs; specifically, a discounted future cash flow over the eight-year term of the new license. Financial Instruments The carrying value of certain financial instruments, including cash and cash equivalents... -

Page 79

... Rights Agreement, each share of THQ common stock is accompanied by a right for the holder of such share to purchase one one-thousandth of a share of Series A Junior Participating Preferred Stock of the Company, par value $.01 (the "Preferred Stock"), at a purchase price of $35.00. If issued, each... -

Page 80

... the development, marketing, sale or use of our games, including any claims for copyright or trademark infringement brought against such manufacturer. As a result, we bear a risk that the properties upon which the titles of our games are based, or that the information and technology licensed from... -

Page 81

... one reportable segment in which we are a developer, publisher and distributor of interactive entertainment software for home video game consoles, handheld platforms and PCs. The following information sets forth geographic information on our net sales and total assets for fiscal 2011, 2010 and 2009... -

Page 82

Information about THQ's net sales by platform for fiscal 2011, 2010 and 2009 is presented below (amounts in thousands): Microsoft Xbox 360 Nintendo Wii Sony PlayStation 3 Sony PlayStation 2 Other $ 201,851 220,140 170,811 24,194 - 616,996 $ 236,816 137,219 191,393 52,816 8 618,252 ... -

Page 83

... on unreleased kids movie-based licensed titles (for additional information see "Note 7 - Licenses and Software Development"). During the fourth quarter of fiscal 2011, we determined that interest expense related to our convertible debt offering in August 2009 had not been properly capitalized... -

Page 84

... Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure. Changes in internal control over financial reporting. There were no changes in our internal control over financial reporting that occurred during our fourth quarter of fiscal 2011... -

Page 85

... Exchange Commission, internal control over financial reporting is a process designed by, or under the supervision of, the Company's principal executive and principal financial officers, or persons performing similar functions, and effected by the Company's board of directors, management and other... -

Page 86

... Board (United States), the consolidated balance sheet as of April 2, 2011 and the related consolidated statements of operations, total equity and cash flows for the year then ended of the Company and our report dated June 6, 2011 expressed an unqualified opinion on those financial statements... -

Page 87

... number of shares of THQ common stock to be issued upon exercise of warrants held by non-employees. For further information related to these warrants, see "Note 19 - Stock-based Compensation" in the notes to the consolidated financial statements included in Part II - Item 8. The Company does... -

Page 88

... financial statements of the Company are included in Part II-Item 8: REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM CONSOLIDATED FINANCIAL STATEMENTS Consolidated balance sheets-March 31, 2011 and 2010 Consolidated statements of operations for the fiscal years ended March 31, 2011, 2010... -

Page 89

... 4.1 to the August 2009 8-K). Second Amended and Restated Employment Agreement dated as of December 31, 2008 between the Company and Brian J. Farrell (incorporated by reference to Exhibit 10.1 to the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2009 (the "March 2009 10... -

Page 90

... THQ Inc. Stock Unit Deferred Compensation Plan, effective as of August 18, 2005 (incorporated by reference to Exhibit 10.11 to the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2007 (the "March 2007 10-K)). Form of Severance Agreement with Executive Officers (incorporated... -

Page 91

... on December 29, 2009). Agreement dated as of December 22, 2009, between the Company and JAKKS Pacific, Inc. (incorporated by reference to Exhibit 10.3 to the Company's Current Report on Form 8-K filed on December 29, 2009). PlayStation® 2 CD-Rom / DVD-Rom Licensed Publisher Agreement, dated as of... -

Page 92

... 10.25 to the Company's Annual Report on the March 2007 10-K). Amendment to the Xbox 360 Publisher License Agreement effective as of July 8, 2008 by and between Microsoft Licensing, GP and the Company (incorporated by reference to Exhibit 10.1 to the Company's Quarterly Report on Form 10-Q for... -

Page 93

... to Exhibit 10.2 to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 2008). Amendment Letter dated November 23, 2009 to Confidential First Renewal License Agreement for Nintendo DS and Nintendo DSi (EEA, Australia and New Zealand), by and between Nintendo Co., Ltd., the... -

Page 94

...: June 6, 2011 THQ INC. By: /s/ Brian J. Farrell Brian J. Farrell, Chairman of the Board, President and Chief Executive Officer (Principal Executive Officer) THQ INC. By: /s/ Paul J. Pucino Paul J. Pucino, Executive Vice President, Chief Financial Officer (Principal Financial Officer) THQ INC. By... -

Page 95

(In thousands, except per share data) Net sales Change in deferred net revenue $ 124,237 124,316 $ 197,668 (253) $ 665,258 137,075 $ 899,137 (10,485) Operating loss Non-GAAP adjustments affecting operating loss: JAKKS preferred return rate reduction (b) JAKKS and WWE settlement (c) $ (49,571)... -

Page 96

..., long-term projected tax rate of 15% to evaluate its operating performance, as well as to forecast, plan and analyze future periods. (k) Non-GAAP earnings (loss) per share has been calculated using diluted shares before applying the "if-converted" method relative to the Notes issued in August 2009. -

Page 97

... Western content for free-to-play online games in Asian markets. This resulted in a $9.9 million write-off of capitalized software development and a $0.4 million write-off of capitalized licenses related to the cancellation of Company of Heroes Online and WWE Online. (b) Stock-based compensation... -

Page 98

... BOARD OF DIRECTORS Brian J. Farrell President and Chief Executive Ofï¬cer Chairman of the Board of Directors THQ Inc. COMMON STOCK NASDAQ Global Select Market Symbol: THQI FORM 10-K A copy of the company's annual report on Form 10-K for the ï¬scal year ended March 31, 2011 is available on THQ... -

Page 99

THQ Inc. 29903 Agoura Road Agoura Hills, CA 91301 www.thq.com