Sunoco 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

To Our Shareholders

Health, Environment and

Safety continues to be

a top priority at Sunoco

and performance in

2007 was good, but fell

short of our expectations

for continuous

improvement in certain

areas. Refi ning and

Supply set a record for

contractor safety, while

employee safety continues to compare

favorably to industry benchmarks. However,

environmental performance was below our

goals due primarily to operating reliability

issues during major refi nery maintenance and

capital project work in the fi rst half of the year.

Following the completion of the project at the

Philadelphia catalytic cracking unit, reliability

improved and emissions of nitrogen oxide

(NOx) and sulfur dioxide (SOx) were reduced

to less than 10 percent of pre-project levels.

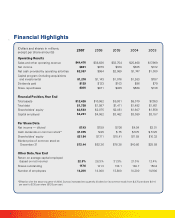

Financially, 2007 was another good year for

Sunoco. Despite signifi cant market volatility,

2007 income before special items* of $833

million refl ected another year of strong

refi ning margins and positive contributions

from our non-refi ning businesses. Earnings

and return on capital employed in 2007, while

less than the past two years, were well above

historical average performance.

Refi ning and Supply earned $772 million,

benefi ting from periods of strong margins,

particularly in the MidContinent region and

during the summer driving season. However,

a sharp rise in crude oil prices in the fourth

quarter, when product demand seasonally

slackened, eroded refi ning profi tability as we

ended the year.

Operationally, refi nery production levels

were limited in the fi rst half of 2007 due to

planned downtime for signifi cant capital

project and maintenance work throughout

our system. We completed two signifi cant

income improvement projects – a $525 million

expansion and modifi cation of the Philadelphia

refi nery’s catalytic cracking unit and a $53

million debottleneck project to expand capacity

of the Toledo refi nery’s crude distillation unit,

which together are expected to contribute

about $1 per share to annual earnings given

historical margin assumptions. We also

completed a major maintenance turnaround

at the Tulsa refi nery. These projects required

a signifi cant amount of focus and attention

to successfully complete in a challenging

construction environment.

Our refi neries operated well in the second half

of the year, and the completed capital projects

provided signifi cant fi nancial and operating

contributions. In the Northeast, we are now

able to upgrade more lower-valued residual

fuel into higher-valued gasoline and distillates

while using a more economic crude slate. In

the MidContinent, the work done at the Toledo

refi nery is enabling additional production of

light products, including record levels of jet

fuel.

Our non-refi ning businesses, in the aggregate,

earned $169 million for the year. While their

collective contribution to earnings was less

than our historical average of about $200

million, the businesses generated meaningful

cash fl ow, despite the added cost of rising

crude oil prices. Our Retail Marketing business

earned $69 million, as gains from retail site

divestments helped offset a weaker retail

gasoline market. In Chemicals, earnings

declined to $26 million due to rising feedstock

prices, which reduced margins for both

polypropylene and phenol. Logistics earned

$45 million while providing $63 million of cash

distributions to Sunoco from Sunoco Logistics

Partners L.P. (NYSE: SXL). Coke earnings of $29

million were limited due to a $20 million phase-

out of certain alternative fuel tax credits, which

occurred due to high crude oil price levels.

During 2007, we continued to grow our

Coke business, with the startup of a new

cokemaking facility in Vitória, Brazil, where

we are the operators and have a $41 million

equity investment. The plant is the largest

––––––––––––––

* Net income for 2007 amounted to $891 million, which includes a net gain from

special items of $58 million.