Sunoco 2007 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2007 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Results of Operations

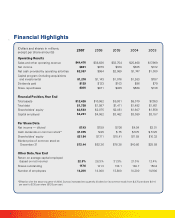

Earnings Profile of Sunoco Businesses (after tax)

(Millions of Dollars) 2007 2006 2005

Refining and Supply $772 $881 $947

Retail Marketing 69 76 30

Chemicals 26 43 94

Logistics 45 36 22

Coke 29 50 48

Corporate and Other:

Corporate expenses (67) (58) (84)

Net financing expenses and other (41) (49) (45)

Issuance of Sunoco Logistics Partners L.P. limited

partnership units 90 ——

Asset write-downs and other matters (32) ——

Income tax matters ——18

Phenol supply contract dispute —— (56)

Consolidated net income $891 $979 $974

Analysis of Earnings Profile of Sunoco Businesses

In 2007, Sunoco earned $891 million, or $7.43 per share of common stock on a diluted

basis, compared to $979 million, or $7.59 per share, in 2006 and $974 million, or $7.08 per

share, in 2005.

The $88 million decrease in net income in 2007 was primarily due to higher expenses

($116 million), a provision for asset write-downs and other matters recognized in 2007

($32 million), lower margins in Sunoco’s Refining and Supply ($44 million) and Retail

Marketing ($12 million) businesses and lower income attributable to the Coke business

($21 million) primarily due to lower tax benefits. Partially offsetting these negative factors

were a gain recognized in 2007 related to the prior issuance of Sunoco Logistics Partners

L.P. limited partnership units ($90 million), higher gains on asset divestments ($11

million), higher earnings from the Logistics business ($9 million), lower net financing ex-

penses ($8 million) and a lower effective income tax rate ($14 million).

In 2006, the $5 million increase in net income was primarily due to higher margins in

Sunoco’s Refining and Supply ($73 million) and Retail Marketing ($50 million) busi-

nesses, a benefit attributable to LIFO inventory profits in Sunoco’s Refining and Supply

business ($16 million) and the absence of a loss associated with a phenol supply contract

dispute ($56 million). Partially offsetting these positive factors were higher expenses ($75

million), including fuel charges and refinery operating expenses; lower margins from

Sunoco’s Chemicals business ($67 million); and lower production of refined products ($48

million).

10