Sunoco 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report

Table of contents

-

Page 1

2007 Annual Report -

Page 2

... barrels per day of reï¬ning capacity, nearly 4,700 retail sites selling gasoline and convenience items, approximately 5,500 miles of crude oil and reï¬ned product owned and operated pipelines and 38 product terminals, Sunoco is one of the largest independent reï¬ner-marketers in the United... -

Page 3

... crude oil prices. Our Retail Marketing business earned $69 million, as gains from retail site divestments helped offset a weaker retail gasoline market. In Chemicals, earnings declined to $26 million due to rising feedstock prices, which reduced margins for both polypropylene and phenol. Logistics... -

Page 4

... capital structure for SunCoke Energy would add value for Sunoco shareholders. As we enter 2008, we will retain our focus on Health, Environment and Safety as the cornerstone of all that we do and on the preparation of our workforce to meet the challenges of the future. Our employee incentive plans... -

Page 5

... unit performance in employee and contractor safety. Annually, Sunoco publishes its Health, Environment and Safety Review and CERES Report using the Global Reporting Initiative Version 3 Sustainability Reporting Guidelines as a basis. The 2007 report will be issued at the Annual Shareholders Meeting... -

Page 6

... (comprised of the Philadelphia and Marcus Hook, PA reï¬neries and the Eagle Point reï¬nery in Westville, NJ) and MidContinent Reï¬ning (comprised of the Toledo, OH and Tulsa, OK reï¬neries). Reï¬ning and Supply has crude oil processing capacity of 910 thousand barrels per day and the capacity... -

Page 7

...its general partner interest, of Sunoco Logistics Partners L.P . (NYSE: SXL), a publicly traded master limited partnership. Coke SunCoke Energy manufactures high-quality coke for use by steel manufacturers in the production of blast-furnace steel. Aggregate annual production from its Indiana Harbor... -

Page 8

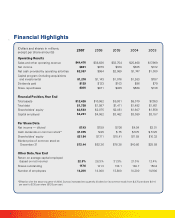

...Return on average capital employed (based on net income) Shares outstanding Number of employees 22.3% 117.6 14,200 28.3% 121.3 14,000 31.3% 133.1 13,800 21.0% 138.7 14,200 12.4% 150.8 14,900 *Effective with the second quarter of 2008, Sunoco increased the quarterly dividend on its common stock... -

Page 9

... ethanol-blended gasoline in 2006 and 2007, generally tight industry refined product inventory levels on a days-supply basis and strong global refined product demand coupled with refinery maintenance/capital improvement downtime, which led to reductions in spare industry refining capacity. Chemical... -

Page 10

...-sulfur gasoline and on-road diesel fuel requirements. In the Retail Marketing business: • Continued the Retail Portfolio Management program during 2007, which selectively reduced its invested capital in Company-owned or leased sites, while retaining most of the gasoline sales volumes attributable... -

Page 11

... 2008. Sunoco also: • Repurchased 4.0, 12.2 and 6.7 million shares during 2007, 2006 and 2005, respectively, of its outstanding common stock for $300, $871 and $435 million, respectively. Sunoco expects to continue to repurchase Company common stock from time to time depending on prevailing market... -

Page 12

... Earnings Profile of Sunoco Businesses (after tax) (Millions of Dollars) 2007 2006 2005 Refining and Supply Retail Marketing Chemicals Logistics Coke Corporate and Other: Corporate expenses Net financing expenses and other Issuance of Sunoco Logistics Partners L.P. limited partnership units Asset... -

Page 13

... its Tulsa refinery and sells these products to other Sunoco businesses and to wholesale and industrial customers. Refining operations are comprised of Northeast Refining (the Marcus Hook, Philadelphia and Eagle Point refineries) and MidContinent Refining (the Toledo and Tulsa refineries). 2007 2006... -

Page 14

... chemical plants in Philadelphia, PA and Haverhill, OH; polypropylene at facilities in LaPorte, TX, Neal, WV and Bayport, TX; and cumene at the Philadelphia, PA refinery and the Eagle Point refinery in Westville, NJ. In addition, propylene is upgraded and polypropylene is produced at the Marcus Hook... -

Page 15

... third quarter of 2005, an arbitrator ruled that Sunoco was liable in an arbitration proceeding for breaching a supply agreement concerning the prices charged to Honeywell International Inc. ("Honeywell") for phenol produced at Sunoco's Philadelphia chemical plant from June 2003 through April 2005... -

Page 16

... in Sunoco Logistics Partners L.P., which includes its 2 percent general partnership interest (see "Capital Resources and Liquidity-Other Cash Flow Information" below). 2007 2006 2005 Income (millions of dollars) Pipeline and terminal throughput (thousands of barrels daily)*: Unaffiliated customers... -

Page 17

Coke The Coke business, through SunCoke Energy, Inc. (formerly, Sun Coke Company) and its affiliates (individually and collectively, "SunCoke Energy"), currently makes high-quality, blast-furnace coke at its Indiana Harbor facility in East Chicago, IN, at its Jewell facility in Vansant, VA, at its ... -

Page 18

...associated cogeneration power plant at SunCoke Energy's Haverhill site (see below), collectively are expected to increase Coke's annual after-tax income to approximately $80-$85 million for 2008. In February 2007, SunCoke Energy entered into an agreement with two customers under which SunCoke Energy... -

Page 19

... idled phenol line at Chemicals' Haverhill, OH plant which was permanently shut down; recorded a $7 million after-tax loss related to the sale of Chemicals' Neville Island, PA terminal facility, which included an accrual for enhanced pension benefits associated with employee terminations and... -

Page 20

... totaled $174 million and related primarily to the divestment of retail gasoline outlets. During the 2005-2006 period, Sunoco Logistics Partners L.P. issued a total of 7.1 million limited partnership units in a series of public offerings, generating $270 million of net proceeds. Coincident with... -

Page 21

...Management currently believes that future cash generation will be sufficient to satisfy Sunoco's ongoing capital requirements, to fund its pension obligations (see "Pension Plan Funded Status" below) and to pay the current level of cash dividends on Sunoco's common stock. However, from time to time... -

Page 22

... During August 2007, $115 million was drawn against the new facility, which was used to repay the then outstanding borrowings under the former facility. The new facility is available to fund the Partnership's working capital requirements, to finance acquisitions, and for general partnership purposes... -

Page 23

... timing of the transaction. Sunoco has various obligations to purchase in the ordinary course of business: crude oil, other feedstocks and refined products; convenience store items; transportation and distribution services, including pipeline and terminal throughput and railroad services; and fuel... -

Page 24

... thousand barrels per day. In 2008, additional work is planned at this facility to expand crude processing capability by an additional 5 thousand barrels per day. The Refining and Supply capital plan for the 2007-2009 period includes a project at the Philadelphia refinery to reconfigure a previously... -

Page 25

... ultra-low-sulfur-diesel fuel production capability, $40 million for other refinery upgrade projects, $100 million related to growth opportunities in the Logistics business, including amounts attributable to projects to increase crude oil storage capacity at the Partnership's Nederland terminal... -

Page 26

... across the Company. The 2005 capital expenditures consisted of $260 million for base infrastructure and maintenance, $49 million for refinery turnarounds, $404 million to comply with the Tier II low-sulfur gasoline and on-road diesel fuel requirements, $94 million for other environmental projects... -

Page 27

...requirements (completed in 2006), the Consent Decrees pertaining to certain alleged Clean Air Act violations at the Company's refineries and, in 2008 and 2009, the project at the Tulsa refinery to enable the production of diesel fuel that meets new product specifications. Pollution abatement capital... -

Page 28

...following table summarizes the changes in the accrued liability for environmental remediation activities by category: (Millions of Dollars) Refineries Retail Sites Chemicals Facilities Pipelines and Terminals Hazardous Waste Sites Other Total At December 31, 2004 Accruals Payments Other At December... -

Page 29

... has been met. Future costs for environmental remediation activities at the Company's retail marketing sites also will be influenced by the extent of MTBE contamination of groundwater, the cleanup of which will be driven by thresholds based on drinking water protection. Though not all groundwater is... -

Page 30

... on prices created by the changes in the level of off-road diesel fuel production. In connection with the phase-in of these off-road diesel fuel rules, Sunoco intends to commence an approximately $400 million capital project at the Tulsa refinery, which includes a new 24 thousand barrels-per-day... -

Page 31

..., during the second quarter of 2006, Sunoco discontinued the use of MTBE and increased its use of ethanol in gasoline. This change by Sunoco and other refiners in the industry has price and supply implications in the marketplace. In December 2007, another law was enacted which increases automobile... -

Page 32

... contracts at the time the positions are closed is recognized in net income when the hedged items are recognized in net income, with Sunoco's margin reflecting the differential between the gasoline sales prices hedged to a fixed price and the cost of fixed-price ethanol purchases. Net gains (losses... -

Page 33

.... Sunoco also has market risk exposure for changes in interest rates relating to its retirement benefit plans (see "Critical Accounting Policies-Retirement Benefit Liabilities" below). Sunoco generally does not use derivatives to manage its market risk exposure to changing interest rates. Dividends... -

Page 34

...determination of expense and benefit obligations for Sunoco's postretirement health care benefit plans. The discount rates used to determine the present value of future pension payments and medical costs are based on a portfolio of high-quality (AA rated) corporate bonds with maturities that reflect... -

Page 35

... rate of return on plan assets is designed to be a long-term assumption. It generally will differ from the actual annual return which is subject to considerable year-to-year variability. As permitted by existing accounting rules, the Company does not recognize currently in pension expense the... -

Page 36

...using discount rates commensurate with the risks associated with the assets being reviewed for impairment. Sunoco had an asset impairment totaling $8 million after tax during 2007. The impairment related to the permanent shutdown of a previously idled phenol line at the Company's Haverhill, OH plant... -

Page 37

... regulatory closure. Sunoco owns or operates certain retail gasoline outlets where releases of petroleum products have occurred. Federal and state laws and regulations require that contamination caused by such releases at these sites and at formerly owned sites be assessed and remediated to meet the... -

Page 38

.... Important factors that could cause actual results to differ materially from the forward-looking statements include, without limitation: • Changes in refining, marketing and chemical margins; • Variation in petroleum-based commodity prices and availability of crude oil and feedstock supply or... -

Page 39

...• Changes in financial markets impacting pension expense and funding requirements; • Risks related to labor relations and workplace safety; • Nonperformance or force majeure by, or disputes with, major customers, suppliers, dealers, distributors or other business partners; • General economic... -

Page 40

...financial statements in accordance with generally accepted accounting principles. The Company's management assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2007. In making this assessment, the Company's management used the criteria set forth in... -

Page 41

... responsibility is to express an opinion on the effectiveness of the Company's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan... -

Page 42

... for employee stock compensation plans and defined benefit pension and other postretirement plans in 2006. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Sunoco, Inc. and subsidiaries' internal control over financial reporting... -

Page 43

... consumer excise taxes) Interest income Gain related to issuance of Sunoco Logistics Partners L.P. limited partnership units (Notes 1 and 15) Other income (loss), net (Notes 2, 3 and 4) Costs and Expenses Cost of products sold and operating expenses Consumer excise taxes Selling, general and... -

Page 44

...December 31 Sunoco, Inc. and Subsidiaries 2007 2006 Assets Current Assets Cash and cash equivalents Accounts and notes receivable, net Inventories (Note 6) Deferred income taxes (Note 4) Total Current Assets Investments and long-term receivables (Note 7) Properties, plants and equipment, net (Note... -

Page 45

...Phenol supply contract dispute loss (payment) Proceeds from power contract restructuring Depreciation, depletion and amortization Deferred income tax expense Minority interest share of Sunoco Logistics Partners L.P. income Payments in excess of expense for retirement plans Changes in working capital... -

Page 46

... dividend payments Purchases for treasury Issued under management incentive plans Net increase in equity related to unissued shares under management incentive plans Other Total At December 31, 2006 Cumulative effect adjustment for change in accounting for uncertainty of income taxes (net of related... -

Page 47

... Company sells a broad mix of merchandise such as groceries, fast foods and beverages at its convenience stores, operates common carrier pipelines and provides terminalling services through a publicly traded limited partnership and provides a variety of car care services at its retail gasoline... -

Page 48

... accounting rules, a minimum pension liability adjustment was required in shareholders' equity to reflect the unfunded accumulated benefit obligation relating to these plans. Effective December 31, 2006, the Company adopted SFAS No. 158, which amended Statement of Financial Accounting Standards... -

Page 49

... credit and other net tax benefits ment of Financial Accounting Standards No. 123 generated by the Company's cokemaking operations that (revised 2004), "Share-Based Payment" ("SFAS were allocated to third-party investors prior to the comNo. 123R"), utilizing the modified-prospective method. pletion... -

Page 50

...-In March 2006, Sunoco Logistics Partners L.P., the 43-percent owned consolidated master limited partnership through which Sunoco conducts a substantial portion of its logistics operations, purchased two separate crude oil pipeline systems and related storage facilities located in Texas, one from... -

Page 51

... arbitration proceeding for breaching a supply agreement concerning the prices charged to Honeywell International Inc. ("Honeywell") for phenol produced at Sunoco's Philadelphia chemical plant from June 2003 through April 2005. Damages of approximately $95 million ($56 million after tax), including... -

Page 52

...differences which comprise the net deferred income tax liability are as follows: December 31 (Millions of Dollars) 2007 2006 3. Other Income (Loss), Net (Millions of Dollars) 2007 2006 2005 Loss on phenol supply contract dispute (Note 2) Equity income: Pipeline joint ventures (Notes 2 and 7) Other... -

Page 53

... million after federal income tax benefits) related to tax positions which, if recognized, would impact the Company's effective tax rate. $38 6. Inventories December 31 2007 2006 9 28 (Millions of Dollars) (5) Crude oil (1) Petroleum and chemical products $69* Materials, supplies and other $ 341... -

Page 54

... and Amortization Annual future minimum rentals due Sunoco, as lessor, on noncancelable operating leases at December 31, 2007 for retail sites are as follows: Net Investment (Millions of Dollars) (Millions of Dollars) December 31 2007 Refining and supply Retail marketing* Chemicals Logistics Coke... -

Page 55

... weighted-average assumptions were used to determine defined benefit plans and postretirement benefit plans expense: Defined Benefit Plans (In Percentages) 2007 2006 2005 2007 Postretirement Benefit Plans 2006 2005 Discount rate Long-term expected rate of return on plan assets Rate of compensation... -

Page 56

... maximize long-term total return within prudent levels of risk through a combination of income and capital appreciation. Management currently anticipates making up to $100 million of voluntary contributions to the Company's funded defined benefit plans in 2008. The expected benefit payments through... -

Page 57

...to borrow in order to purchase shares of Company common stock. As of December 31, 2007, no such borrowings had been approved. During 2003, Sunoco formed a limited partnership with Equistar Chemicals, L.P. ("Equistar") involving Equistar's ethylene facility in LaPorte, TX. Equistar is a wholly owned... -

Page 58

... 2012. The new facility is available to fund the Partnership's working capital requirements, to finance acquisitions, and for general partnership purposes. Amounts outstanding under these facilities totaled $91 and $68 million at December 31, 2007 and 2006, respectively. The new facility contains... -

Page 59

... has sold thousands of retail gasoline outlets as well as refineries, terminals, coal mines, oil and gas properties and various other assets. In connection with these sales, the Company has indemnified the purchasers for potential environmental and other contingent liabilities related to the period... -

Page 60

... regulatory closure. Sunoco owns or operates certain retail gasoline outlets where releases of petroleum products have occurred. Federal and state laws and regulations require that contamination caused by such releases at these sites and at formerly owned sites be assessed and remediated to meet the... -

Page 61

... Sunoco, along with other refiners, manufacturers and sellers of gasoline are defendants in approximately 77 lawsuits in 18 states and the Commonwealth of Puerto Rico, which allege MTBE contamination in groundwater. Plaintiffs, who include water purveyors and municipalities responsible for supplying... -

Page 62

... until the fourth quarter of 2007 at which time the investor entitled to the preferential return recovered its investment and achieved a cumulative annual after-tax return of approximately 10 percent. After payment of the preferential return, the investors in the Indiana Harbor operations are now... -

Page 63

... Net proceeds from public equity offerings Minority interest share of income* Increase attributable to Partnership management incentive plan Cash distributions to third-party investors** Balance at end of year - 56 3 (55) $ 356 110 42 2 (48) $503 160 28 5 (28) $397 * Included in selling, general... -

Page 64

... Plan ("EIP") and the Long-Term Performance Enhancement Plan II ("LTPEP II"). The EIP provides for the payment of annual cash incentive awards while the LTPEP II provides for the award of stock options, common stock units and related rights to directors, officers and other key employees of Sunoco... -

Page 65

... and permit optionees to purchase Company common stock at its fair market value on the date of grant. Under SFAS No. 123, the fair value of the stock options was estimated using the Black-Scholes option pricing model. Use of this model requires the Company to make certain assumptions regarding the... -

Page 66

... based on the closing price of the Company's shares on the date of grant. For performance-based awards, the payout of which is determined by market conditions related to stock price performance, the grant-date fair value is generally estimated using a Monte Carlo simulation model. Use of this model... -

Page 67

... related products at chemical plants in Philadelphia, PA and Haverhill, OH; polypropylene at facilities in LaPorte, TX, Neal, WV and Bayport, TX; and cumene at the Philadelphia and Eagle Point refineries. In addition, propylene is upgraded and polypropylene is produced at the Marcus Hook, PA Epsilon... -

Page 68

... refined product and crude oil pipeline joint ventures. Substantially all logistics operations are conducted through Sunoco Logistics Partners L.P. (Note 15). The Coke segment makes high-quality, blast-furnace coke at facilities located in East Chicago, IN (Indiana Harbor), Vansant, VA (Jewell... -

Page 69

...of Dollars) Refining and Supply Retail Marketing Chemicals Logistics Coke Corporate and Other Consolidated 2007 Sales and other operating revenue (including consumer excise taxes): Unaffiliated customers Intersegment Pretax segment income (loss) Income tax (expense) benefit After-tax segment income... -

Page 70

...table sets forth Sunoco's sales to unaffiliated customers and other operating revenue by product or service: (Millions of Dollars) 2007 2006 2005 Gasoline: Wholesale Retail Middle distillates Residual fuel Petrochemicals Lubricants Other refined products Convenience store merchandise Other products... -

Page 71

...Sunoco's Marcus Hook, Philadelphia, Eagle Point and Toledo refineries, excluding cumene, which is included in the Chemicals segment. Other Data Crude oil inventory* * Millions of barrels at December 31. 2007 2006 2005 2.0 2.7 2.0 Coke Segment Data* 2005 2007 2006 2005 Retail Sales* Gasoline... -

Page 72

...**: Net income: Basic Diluted Cash dividends on common stock*** Balance Sheet Data: Cash and cash equivalents Total assets Short-term borrowings and current portion of long-term debt Long-term debt Shareholders' equity Outstanding shares of common stock** Shareholders' equity per outstanding share... -

Page 73

...Per-Share Amounts and Common Stock Prices) 2007 First Quarter Second Quarter Third Quarter Fourth Quarter First Quarter Second Quarter 2006 Third Quarter Fourth Quarter Sales and other operating revenue (including consumer excise taxes) Gross profit* Net income (loss) Net income (loss) per share of... -

Page 74

... shares, this graph compares Sunoco's cumulative total return (i.e., based on common stock price and dividends), plotted on an annual basis, with Sunoco's new and former performance peer groups' cumulative total returns and the S&P 500 Stock Index (a performance indicator of the overall stock market... -

Page 75

... of the University of Pennsylvania John W. Rowe Chairman, President and CEO Exelon Corporation Ann C. Mulé Chief Governance Officer, Assistant General Counsel and Corporate Secretary John K. Wulff Chairman Hercules Incorporated; Former Member Financial Accounting Standards Board; Retired Chief... -

Page 76

... Sunoco shares, including dividend payments, the Shareholder Access and Reinvestment Plan (SHARP), stock transfer requirements, address changes, account consolidations, ending duplicate mailing of Sunoco materials, stock certificates and all other shareholder account-related matters, should contact... -

Page 77

-

Page 78

Sunoco, Inc., 1735 Market Street, Suite LL, Philadelphia, PA 19103-7583