Stein Mart 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

The restatement of our financial statements has consumed a significant amount of our time and resources and may have a

material adverse effect on our reputation, business and stock price. As described earlier, we have restated our prior financial

statements. The restatement process was highly time and resource-intensive and involved substantial attention from management and

significant legal and accounting costs. Furthermore, we cannot guarantee that we will have no inquiries from the Securities and Exchange

Commission (“SEC”) regarding our restated financial statements or matters relating thereto. Any future inquiries from the SEC as a result

of the restatement of our historical financial statements will, regardless of the outcome, likely consume a significant amount of our

resources in addition to those resources already consumed in connection with the restatement itself. Further, many companies that have

been required to restate their financial statements have experienced a decline in stock price and shareholder lawsuits related thereto.

We have identified material weaknesses in our internal control over financial reporting which may, if not remediated, result in

additional material misstatements in our financial statements. Our management is responsible for establishing and maintaining

adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934. As

disclosed in Item 9A, “Controls and Procedures,” management identified material weaknesses in our internal control over financial

reporting related to inventory markdowns, leasehold improvements, compensated absences (paid vacation), indirect overhead cost

capitalization, software asset amortization periods and retirements, control environment and information technology communication. A

material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a

reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a

timely basis. As a result of material weaknesses, our management concluded that our internal control over financial reporting and related

disclosure controls and procedures were not effective based on criteria set forth by the Committee of Sponsoring Organizations of the

Treadway Commission. We are actively engaged in developing a remediation plan designed to address these material weaknesses. If our

remedial measures are insufficient to address the material weaknesses, or if additional material weaknesses or significant deficiencies in

our internal control are discovered or occur in the future, our financial statements may contain material misstatements and we could be

required to restate our financial results.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Stores

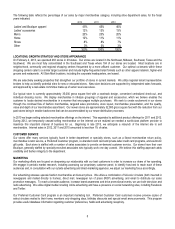

The following table summarizes our store count activity during the last three fiscal years:

2012 2011 2010

Stores at beginning of year 262 264 267

Stores opened during the year 6 3 2

Stores closed during the year (5) (5) (5)

Stores at end of year 263 262 264

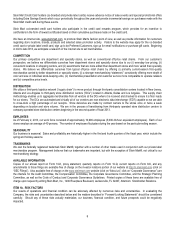

As of February 2, 2013, our stores operated in the following 29 states:

State Number of Stores

State Number of Stores

Alabama 9 Missouri 3

Arizona 10 Nevada 4

Arkansas 2 New Jersey 4

California 19 New York 3

Colorado 3 North Carolina 20

Florida 44 Ohio 8

Georgia 13 Oklahoma 4

Illinois 4 Pennsylvania 4

Indiana 7 South Carolina 12

Kansas 2 Tennessee 13

Kentucky 2 Texas 43

Louisiana 8 Utah 1

Massachusetts 1 Virginia 12

Michigan 1 Wisconsin 1

Mississippi 6