Stein Mart 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

x We expect SG&A savings from supply chain will be similar to 2009 savings and should slightly more than offset the addbacks of

compensation and related expenses that were temporarily lowered in 2009.

x We plan to relocate five to ten stores to better locations in their respective markets. We also plan to close four and open three

stores for a net planned decrease of one store by year-end. New stores will have negligible incremental profit benefit in 2010 as

their partial year results will be largely offset by pre-opening costs that are expensed when the stores are opened.

x Our effective tax rate will continue to fluctuate due to the impact of book/tax differences on our deferred tax valuation allowance.

x Capital expenditures are planned at approximately $30 million compared to $7.6 million in 2009. Approximately $20 million is for

system improvements, with the largest portion for a new merchandise information system. The remaining capital amounts are to

upgrade our store fixtures in connection with our new and relocated stores.

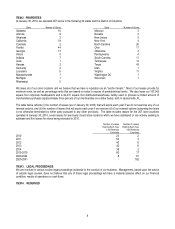

Stores

There were 267 stores open as of January 30, 2010, 276 stores as of January 31, 2009 and 280 stores as of February 2, 2008.

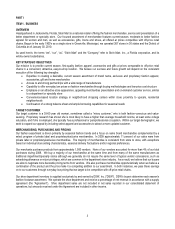

2009 2008 2007

Stores at beginning of year 276 280 268

Stores opened during the year 2 6 14

Stores closed during the year (11) (10) (2)

Stores at end of year 267 276 280

While we are always interested in looking at exceptional real estate opportunities, our focus for 2010 will primarily be on relocating

existing stores to better real estate. We are reviewing current situations where leases will be ending or have provisions for early

termination and hope to take advantage of this real estate market and lock in better locations in some markets where there is

additional opportunity.

Results of Operations

The following table sets forth each line item of the Consolidated Statements of Operations expressed as a percentage of net sales

(numbers may not add due to rounding):

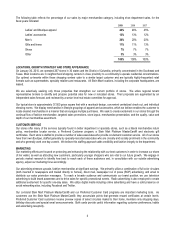

2009 2008 2007

Net sales 100.0% 100.0% 100.0%

Cost of merchandise sold 72.9 77.8 75.2

Gross profit 27.1 22.2 24.8

Selling, general and administrative expenses 25.8 29.8 26.7

Other income, net 1.5 1.5 1.5

Income (loss) from operations 2.8 (6.0) (0.4)

Interest expense, net - (0.1) (0.1)

Income (loss) before income taxes 2.8 (6.2) (0.5)

Income tax (provision) benefit (0.9) 0.8 0.1

Net income (loss) 1.9% (5.4)% (0.3)%

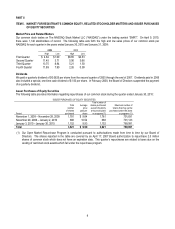

Store Closings

During 2009, 2008 and 2007, we closed 23 under-performing stores. The table below sets forth the impact on operations in each of

the presented years for stores closed in that and subsequent years (in thousands). The 2009 table presents the losses from the 11

stores that closed during 2009. The 2008 table presents the sum of the losses from the 11 stores that closed during 2009 and the 10

stores that closed during 2008; the 2007 table presents the sum of the losses from the 11 stores that closed during 2009, the 10

stores that closed during 2008 and the two stores that closed during 2007.

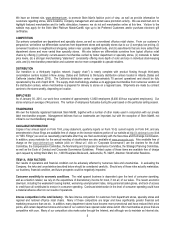

2009 2008 2007

Sales $17,226 $65,151 $86,085

Cost of merchandise sold 12,987 55,917 70,060

Gross profit 4,239 9,234 16,025

Selling, general and administrative expenses 6,429 23,059 23,009

Other income, net 203 655 840

Loss from operations $(1,987) $(13,170) $(6,144)

# of stores closed in 2007-2009 11 21 23

13