Starwood 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

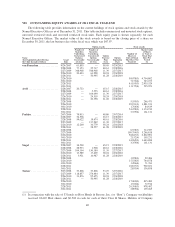

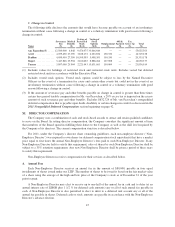

employee stock options and restricted stock did not receive this consideration while the market price of

shares was reduced to reflect the payment of this consideration directly to the holders of the Class B Shares.

In order to preserve the value of the Company’s options immediately before and after the Host transaction,

the Company adjusted its stock options to reduce the strike price and increase the number of stock options

using the intrinsic value method based on the share price immediately before and after the transaction. The

option information provided reflects the number of options granted and the option exercise prices after these

adjustments were made. As of December 31, 2011, this impacts Mr. Prabhu’s holdings only.

(2) These options generally vest in equal installments on the first, second, third and fourth anniversary of their

grant. As of September 4, 2010, Mr. Siegel’s 2008, 2009, 2010 and 2011 awards vest quarterly in equal

installments over four years due to his retirement-eligible status, as defined in the LTIP. As of December 15,

2014, Mr. Prabhu’s awards will vest quarterly due to his retirement-eligible status, as defined in the LTIP.

(3) For awards granted in 2008, the restricted stock or restricted stock units generally vest 75% on the third

anniversary and 25% on the fourth anniversary of the date of grant. For awards granted in 2009, 2010 and

2011, the restricted stock or restricted stock units generally vest 100% on the third anniversary of their

grant. As of September 4, 2010, Mr. Siegel’s 2008, 2010 and 2011 awards vest quarterly in equal

installments due to his retirement eligible status, as defined in the LTIP.

(4) These restricted stock units vest in equal installments on the first, second and third fiscal year-ends

following the date of grant, and are distributed on the earlier of: (a) the third fiscal year-end or (b) a

termination of employment. Shares underlying the restricted stock units that vested as of December 31,

2011, but which shares will not be distributed to the Named Executive Officers until either December 31,

2012 or 2013, are non-forfeitable with respect to each Named Executive Officer and will be included in the

2011 Option Exercises and Stock Vested table for the year in which they are settled.

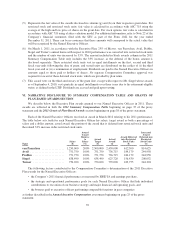

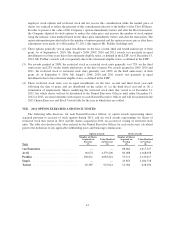

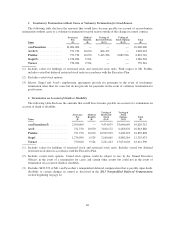

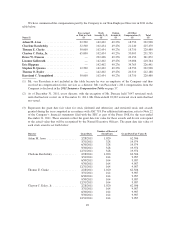

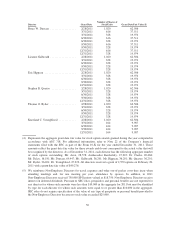

VIII. 2011 OPTION EXERCISES AND STOCK VESTED

The following table discloses, for each Named Executive Officer, (i) option awards representing shares

acquired pursuant to exercise of stock options during 2011; and (ii) stock awards representing (A) shares of

restricted stock that vested in 2011 and (B) shares acquired in 2011 on account of vesting of restricted stock

units. The table also discloses the value realized by the Named Executive Officer for each such event, calculated

prior to the deduction of any applicable withholding taxes and brokerage commissions.

Option Awards Stock Awards

Name

Number of Shares

Acquired on

Exercise

(#)

Value Realized

on Exercise

($)

Number of Shares

Acquired on

Vesting

(#)

Value Realized

on Vesting

($)

van Paasschen ......................... — — 88,662 4,017,527

Avril ................................. 96,074 4,379,200 84,088 4,168,058

Prabhu ............................... 108,621 4,083,261 55,111 3,143,017

Siegel ................................ — — 43,852 2,186,718

Turner ............................... 18,385 925,041 12,984 628,296

41