Starwood 2009 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

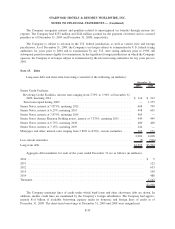

the type of loan borrowed. The margin increases range from 2.00% to 3.50% for term loans maintained as

Eurodollar Loans, 1.75% to 3.00% for revolving loans maintained as Euro Rate Loans, and 0.00% to 1.50% for Base

Rate and Canadian Prime Rate Loans. The applicable margin for the Facility Fee ranges from 0.25% to 0.50%. The

amendment further modifies the Amended Credit Facilities by (i.) restricting the Company’s ability to pay

dividends and repurchase stock depending on the Company’s free cash flow and Consolidated Leverage Ratio and

(ii.) decreasing the Company’s permitted lien basket from 10% of Net Tangible Assets (as defined in the Amended

Credit Facilities) to 5% of Net Tangible Assets. An amendment fee of 50 basis points was also paid to all consenting

lenders who approved the Amended Credit Facilities, with no amendment fee being paid on the repaid portion of the

term loan.

On May 23, 2008,the Company completed a public offering of $600 million of senior notes, consisting of

$200 million aggregate principal amount 6.25% Senior Notes (“6.25% Notes”) due February 15, 2013 and

$400 million aggregate principal amount 6.75% Senior Notes (“6.75% Notes”) due May 15, 2018 (collectively, the

“Notes”). The Company received net proceeds of approximately $596 million, which were used to reduce the

outstanding borrowings under its Revolving Credit Facilities. Interest on the 6.25% Notes is payable semi-annually

on February 15 and August 15 and interest on the 6.75% Notes is payable semi-annually on May 15 and

November 15. The Company may redeem all or a portion of the Notes at any time at the Company’s option at a price

equal to the greater of (1) 100% of the aggregate principal plus accrued and unpaid interest and (2) the sum of the

present values of the remaining scheduled payments of principal and interest discounted at the redemption rate on a

semi-annual basis at the Treasury rate plus 35 basis points for the 6.25% Notes and 45 basis points for the

6.75% Notes, plus accrued and unpaid interest. The Notes rank parri passu with all other unsecured and

unsubordinated obligations. Upon a change in control of the Company, the holders of the Notes will have the

right to require repurchase of the respective Notes at 101% of the principal amount plus accrued and unpaid interest.

Certain covenants on the Notes include restrictions on liens, sale and leaseback transactions, mergers, consoli-

dations and sale of assets.

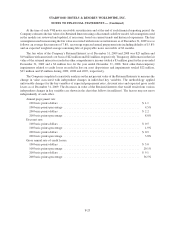

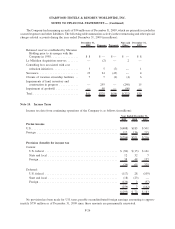

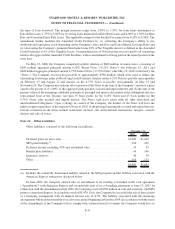

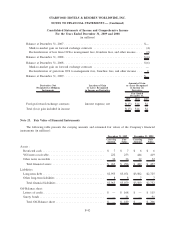

Note 16. Other Liabilities

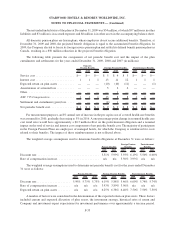

Other liabilities consisted of the following (in millions):

2009 2008

December 31,

Deferred gains on asset sales ....................................... $1,009 $1,069

SPG point liability

(a)

.............................................. 634 430

Deferred income including VOI and residential sales ...................... 33 55

Benefit plan liabilities............................................. 65 106

Insurance reserves ............................................... 46 50

Other . . ....................................................... 116 133

$1,903 $1,843

(a) Includes the actuarially determined liability related to the SPG program and the liability associated with the

American Express transaction discussed below.

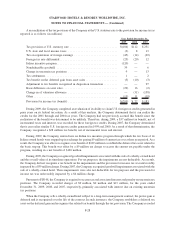

In June 2009, the Company entered into an amendment to its existing co-branded credit card agreement

(“Amendment”) with American Express and extended the term of its co-branding agreement to June 15, 2015. In

connection with the Amendment in July 2009, the Company received $250 million in cash and, in return, sold SPG

points to American Express. In accordance with ASC 470, Debt, the Company has recorded the sale of these points

as a financing arrangement with an implicit interest rate of 4.5%. The liability associated with this financing

arrangement will be reduced ratably over a five year period beginning in October 2009. In accordance with the terms

of the Amendment, if the Company fails to comply with certain financial covenants the Company would have to

F-32

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)