Starwood 2009 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

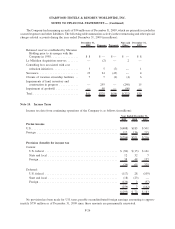

benefits of $3 million, $10 million and $3 million, for the years ended December 31, 2009, 2008, and 2007,

respectively, to establish the deferred tax assets on these types of dispositions.

In 2007, the Company recognized a net $97 million tax charge as an adjustment to a tax benefit accrued in 2006

related to a disposition transaction.

During 2008 and 2007, the Company completed certain transactions that generated capital gains for U.S. tax

purposes. These gains were offset by capital losses generated in 2006. As discussed above, the Company had not

previously accrued a benefit for the capital loss since the realization was determined to be unlikely. Therefore,

during 2008 and 2007, the Company recorded tax benefits of $31 million and $158 million, respectively, to reverse

the capital loss valuation allowance.

As a result of the implementation of FIN 48 in 2007, the Company recognized a $35 million cumulative effect

adjustment to the beginning balance of retained earnings in the period. As of December 31, 2009, the Company had

approximately $999 million of total unrecognized tax benefits, of which $73 million would affect its effective tax

rate if recognized. As discussed above, the Company expects to resolve the tax litigation related to the ITT World

Directories transaction during 2010 and expects to reduce that amount of unrecognized tax benefits by approx-

imately $499 million. It is reasonably possible that zero to substantially all of the Company’s other remaining

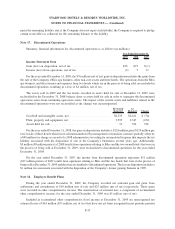

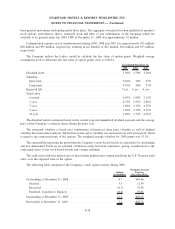

unrecognized tax benefits will reverse within the next twelve months. A reconciliation of the beginning and ending

balance of unrecognized tax benefits is as follows (in millions):

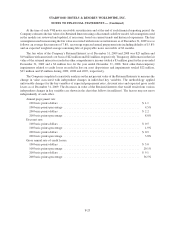

Balance at January 1, 2008................................................. $ 968

Additions based on tax positions related to the current year ....................... 41

Additions for tax positions of prior years .................................... 2

Settlements with tax authorities . . ......................................... (3)

Reductions for tax positions of prior years ................................... (4)

Reductions due to the lapse of applicable statutes of limitation .................... (1)

Balance at December 31, 2008 .............................................. $1,003

Balance at January 1, 2009................................................. $1,003

Additions based on tax positions related to the current year ....................... 4

Additions for tax positions of prior years .................................... 2

Settlements with tax authorities . . ......................................... (7)

Reductions for tax positions of prior years ................................... (1)

Reductions due to the lapse of applicable statutes of limitation .................... (2)

Balance at December 31, 2009 .............................................. $ 999

F-29

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)