Starwood 2004 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

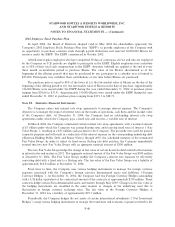

Company's net investments in these subsidiaries. The Company measures the eÅectiveness of derivatives

designated as Net Investment Hedges by using the changes in forward exchange rates because this method

best reÖects the Company's risk management strategies and the economics of those strategies in the Ñnancial

statements. Under this method, the change in fair value of the hedging instrument attributable to the changes

in forward exchange rates is reported in stockholders' equity to oÅset the translation results on the hedged net

investment. The remaining change in fair value of the hedging instrument, if any, is recognized through

income. As of December 31, 2004, the Company had one Net Investment Hedge with a U.S. dollar equivalent

of the contractual amount of $243 million that matures in June 2005. The Net Investment Hedge minimizes

the eÅect Öuctuations in foreign currency exchange rates have on a portion of the Company's net investment

in certain Euro-denominated subsidiaries (""Euro Net Investment Hedges''). The fair value of the Euro Net

Investment Hedges at December 31, 2004 was a liability of approximately $29 million.

In April 2002, in connection with the sale of $1.5 billion of the Senior Notes, the Company terminated

four interest rate swap agreements (with a notional amount of $850 million) and realized a net loss of

approximately $23 million associated with this early termination.

In September 2002, the Company terminated certain Fair Value Swaps, resulting in a $78 million cash

payment to the Company. These proceeds were used to pay down the previous revolving credit facility and will

result in a decrease to interest expense on the hedged debt through its maturity in 2007. In order to retain it's

Ñxed versus Öoating rate debt position, the Company immediately entered into the current Fair Value Swaps

on the same underlying debt as the terminated swaps.

The counterparties to the Company's derivative Ñnancial instruments are major Ñnancial institutions. The

Company does not expect its derivative Ñnancial instruments to signiÑcantly impact earnings in the next

twelve months.

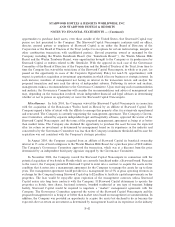

Note 19. Related Party Transactions

General. Barry S. Sternlicht, Executive Chairman and a Director of the Corporation, and Executive

Chairman and a Trustee of the Trust, may be deemed to control and has been and remains the President and

Chief Executive OÇcer of Starwood Capital since its formation in 1991.

Trademark License. An aÇliate of Starwood Capital has granted to the Company, subject to Starwood

Capital's unrestricted right to use such name, an exclusive, non-transferable, royalty-free license to use the

""Starwood'' name and trademarks in connection with the acquisition, ownership, leasing, management,

merchandising, operation and disposition of hotels worldwide, and to use the ""Starwood'' name in its corporate

name worldwide, in perpetuity.

Starwood Capital Noncompete. In connection with a restructuring of the Company in 1995, Starwood

Capital voluntarily agreed that, with certain exceptions, Starwood Capital would not compete directly or

indirectly with the Company within the United States and would present to the Company all opportunities

presented to Starwood Capital to acquire fee interests in hotels in the United States and debt interests in

hotels in the United States where it is anticipated that the equity will be acquired by the debt holder within

one year from the acquisition of such debt (the ""Starwood Capital Noncompete''). During the term of the

Starwood Capital Noncompete, Starwood Capital and its aÇliates are not permitted to acquire any such

interest, or any ground lease interest or other equity interest, in hotels in the United States without the consent

of the Board. In addition, the Company's Corporate Opportunity Policy requires that each executive oÇcer

submit to the Corporate Governance and Nominating Committee (which is currently comprised of Stephen

R. Quazzo, Ambassador Barshefsky and Bruce W. Duncan, the ""Governance Committee'') any opportunity

that the executive oÇcer reasonably believes is within the Company's lines of business or in which the

Company has an interest. Non-employee directors are subject to the same obligations with respect to

opportunities presented to them in their capacity as directors. Therefore, as a matter of practice, all

F-41