Staples 2002 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2002 Staples annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

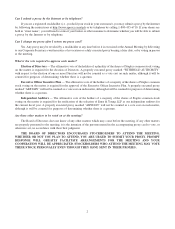

FISCAL YEAR 2003 EXECUTIVE OFFICER INCENTIVE PLAN BENEFITS

Name and Position

Fiscal Year 2003

Target Award

(% of 2003 Base Salary)

Fiscal Year 2003

Bonus Dollar Value

(Minimum/Maximum)

Ronald L. Sargent ..................................

President & Chief Executive Officer

100% $0/$2,000,000

Thomas G. Stemberg ...............................

Chairman & Chairman of the Board

100% $0/$2,000,000

Joseph S. Vassalluzzo ...............................

Vice Chairman

60% $0/$646,464

Basil L. Anderson ..................................

Vice Chairman

60% $0/$563,418

John J. Mahoney ....................................

Exec. Vice President & Chief

Administrative Officer

60% $0/$640,140

Executive Group (8 persons) ........................ 45%–100% $0/$6,913,022

Non-Executive Director Group (1) .................. — —

Non-Executive Officer Employee Group (1) ........ — —

(1) Not eligible to participate in the Executive Officer Incentive Plan.

Amendments and Termination

The Incentive Plan may be amended or terminated by either the Board of Directors or the Compensation Committee,

provided that (i) no amendment or termination of the Incentive Plan after the end of a Plan Year may adversely affect the

rights of executive officers with respect to their bonus awards for that Plan Year, and (ii) no amendment which would require

stockholder approval under Section 162(m) of the Code may be effected without such stockholder approval.

Federal Income Tax Consequences

Payments received by executive officers under the Incentive Plan will be income subject to tax at ordinary income rates

when received. Since the Incentive Plan is intended to comply with the requirements of Section 162(m) of the Code, if the

Plan is approved by stockholders at the Annual Meeting, the bonus payments made in accordance with the terms of the

Incentive Plan will be deductible for Staples and not subject to disallowance under Section 162(m) of the Code.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE APPROVAL OF THE

COMPANY’S EXECUTIVE OFFICER INCENTIVE PLAN.

PROPOSAL3—RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors, at the recommendation of the Audit Committee, has selected the firm of Ernst & Young LLP

as our independent auditors for the current fiscal year. Ernst & Young LLP has served as our independent auditors since

our inception. Although stockholder approval of the Board of Directors’ selection of Ernst & Young LLP is not required

by law, the Board of Directors believes that it is advisable to give stockholders an opportunity to ratify this selection. If

this proposal is not approved at the Annual Meeting, the Board of Directors may reconsider its selection.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have the opportunity

to make a statement if they desire to do so and will also be available to respond to appropriate questions from stockholders.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE RATIFICATION OF ERNST

& YOUNG LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE CURRENT FISCAL YEAR.

9