Southwest Airlines 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

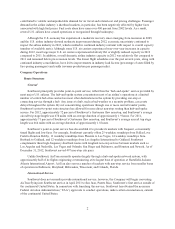

Impact of Fuel Costs on the Company’s Low-Cost Structure

In 2012, the Company again experienced significant Fuel and oil expense as fuel prices remained volatile

and at historically high levels. In addition, for the eighth consecutive year Fuel and oil expense represented the

Company’s largest or second largest cost and was the Company’s largest cost for the second consecutive year.

The table below shows the Company’s average cost of jet fuel and oil over the past ten years and during each

quarter of 2012.

Year

Cost

(Millions)*

Average

Cost Per

Gallon*

Percent of

Operating

Expenses*

2003 ........................................... $ 920 $ 0.80 16.5%

2004 ........................................... $ 1,106 $ 0.92 18.1%

2005 ........................................... $ 1,470 $ 1.13 21.4%

2006 ........................................... $ 2,284 $ 1.64 28.0%

2007 ........................................... $ 2,690 $ 1.80 29.7%

2008 ........................................... $ 3,713 $ 2.44 35.1%

2009 ........................................... $ 3,044 $ 2.12 30.2%

2010 ........................................... $ 3,620 $ 2.51 32.6%

2011 ........................................... $ 5,644 $ 3.19 37.7%

2012 ........................................... $ 6,120 $ 3.30 37.2%

First Quarter 2012 ................................ $ 1,510 $ 3.39 38.0%

Second Quarter 2012 .............................. $ 1,577 $ 3.25 37.9%

Third Quarter 2012 ................................ $ 1,528 $ 3.19 35.9%

Fourth Quarter 2012 ............................... $ 1,505 $ 3.38 36.9%

* The Company has previously reclassified fuel sales and excise taxes for the years 2003 through 2007 from

“Other operating expenses” to “Fuel and oil expense” in order to conform to the presentation for 2008

through 2012. Average fuel cost per gallon figures, as well as the percent of operating expenses, have also

been recalculated based on the reclassified information.

The Company enters into fuel derivative contracts to manage its risk associated with significant increases

in fuel prices; however, because energy prices can fluctuate significantly in a relatively short amount of time, the

Company must also continually monitor and adjust its fuel hedge portfolio and strategies to address not only fuel

price increases, but also fuel price volatility and hedge collateral requirements. Although jet fuel prices were

slightly less volatile in 2012 than in some previous years, they remain at historically high levels and continue to

be subject to extreme volatility based on a variety of factors. In addition, the cost of hedging has increased with

current sustained high jet fuel prices and the potential for volatility in the fuel market. The Company’s fuel

hedging activities are discussed in more detail below under “Risk Factors,” “Management’s Discussion and

Analysis of Financial Condition and Results of Operations,” and Note 10 to the Consolidated Financial

Statements.

Fare Structure

Southwest

Southwest offers a relatively simple fare structure that features competitive, unrestricted, unlimited,

everyday coach fares, as well as lower fares available on a restricted basis. Southwest bundles fares into three

major categories: “Wanna Get Away,” “AnytimeSM,” and “Business Select®,” with the goal of making it easier

for Customers to choose the fare they prefer.

• “Wanna Get Away” fares are generally the lowest fares and are subject to advance purchase

requirements. They are nonrefundable, but funds may be applied to future travel on Southwest. As

discussed below under “Operating Strategies and Initiatives – Ancillary Services and Fees,” during

4