Southwest Airlines 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

The year 2007 turned out to be momentous for Southwest Airlines. We encountered a variety of financial

challenges unforeseen a year ago. Nevertheless, we were well prepared and recorded our 35th consecutive year

of profitability, a record unmatched in commercial airline history.

Our 2007 GAAP net income was $645 million, or $.84 per diluted share, compared to $499 million, or $.61 per

diluted share, for 2006. Each year includes special items (in particular inclusion of unrealized gains or losses as

required by Statement of Financial Accounting Standard No. 133, “Accounting for Derivative Instruments and

Hedging Activities” related to our successful fuel hedging activities). Excluding the special items from both

years produces a year-over-year profit decline of 18.5 percent to $471 million and earnings per diluted share

decline of 12.9 percent to $.61.

Earnings declines are always unwelcome. However, steeply rising energy prices continued to be a challenge

to overcome completely, and revenue trends, which were very encouraging in 2006, slowed considerably in

2007. Overall, domestic air traffic growth has been anemic the last two years. And while we were able to grow

unit revenues (revenues per available seat mile) by 0.9 percent in 2007 versus 2006, it was not sufficient to

offset unit cost increases of 3.3 percent (excluding special items in both years).

Jet fuel prices have been rising every year for the last five years. Our fuel hedging program has consistently

mitigated such price increases dating back to year 2000. Since then, in each year, we have striven to hedge at

least 70 percent of our consumption. In 2007, we were approximately 90 percent protected at approximately

$51 a barrel. That protection saved us $727 million last year and limited us to an 11.3 percent increase in the

economic cost per gallon, year-over-year.

It was, indeed, a wild year for energy prices. A year ago, crude oil was hovering around $50 a barrel. By fourth

quarter 2007, crude oil prices had skyrocketed to $100 a barrel. Fortunately, we are again well-hedged for 2008

with approximately 70 percent of our fuel needs protected at approximately $51 a barrel.

In general, the domestic air travel environment today reflects higher fares (to offset higher energy costs)

accompanied by more delays and cancellations. Our Brand sets us apart by offering low fares and excellent

Customer Service. In a year of multitudinous reports of poor airline service, it is notable that our ontime

performance was among the best in the industry and as good as the year before. Our flight cancellations were

no more than one percent of flights scheduled, also consistent with the year before, and we were, once again,

among the industry’s leaders in terms of Customer Satisfaction, or fewest complaints filed with the U.S. Department

of Transportation per 100,000 Customers.

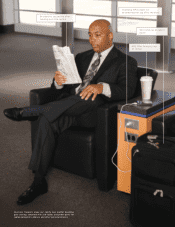

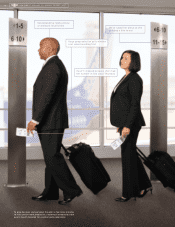

In fall 2007, we launched a major initiative to further enhance our Brand through an improved Customer

Airport Experience, as well as to drive more revenue per departure. After extensive study and Customer research,

we elected to stay with our famous open seating but to improve our boarding process with a reserved place in

the boarding line. Our new way to board reduces the time Customers spend in queue, and they love it. We also

modified and simplified our fare structure and southwest.com® presentation. This change, along with our new

boarding process, enabled us to offer Business Select,

TM which allows Customers to be among the first to board

the aircraft; earn additional Rapid Rewards credit; and receive a complimentary cocktail. In short, we now give

Customers more choices when they fly. We also enhanced our Rapid Rewards program by virtually guaranteeing

an “A” boarding pass to our most frequent flyers and by creating Freedom Awards,

TM which carry no seat restrictions

other than a few blackout dates. Customer feedback has been very positive based on the early returns.

These changes lay the foundation for future enhancements and initiatives. Our goals are to enhance the

overall Customer Experience; appeal to more business travelers; and drive more revenue per flight. We have

significant technology projects under construction, to be implemented in 2008 and 2009, that support these

2SOUTHWEST AIRLINES CO. ANNUAL REPORT 2007