Southwest Airlines 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

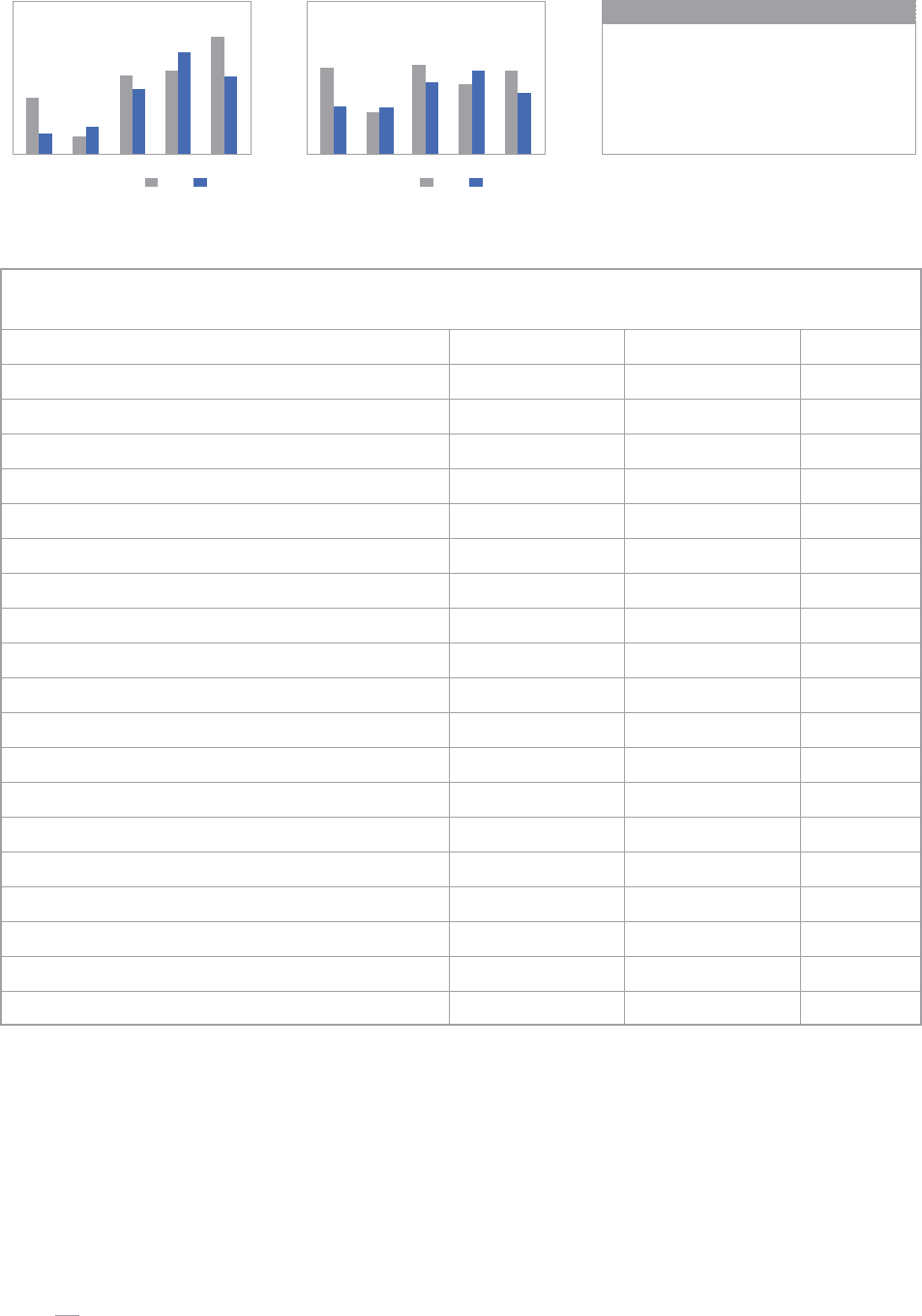

Consolidated Highlights (GAAP)

(Dollars In Millions, Except Per Share Amounts) 2007 2006 CHANGE

Operating revenues $9,861 $9,086 8.5 %

Operating expenses $9,070 $8,152 11.3 %

Operating income $791 $934 (15.3) %

Operating margin 8.0 % 10.3 % (2.3) pts.

Net income $645 $499 29.3 %

Net margin 6.5 % 5.5 % 1.0 pts.

Net income per share——basic $.85 $.63 34.9 %

Net income per share——diluted $.84 $.61 37.7 %

Stockholders’ equity $6,941 $6,449 7.6 %

Return on average stockholders’ equity 9.6 % 7.6 % 2.0 pts.

Stockholders’ equity per common share outstanding $9.44 $8.24 14.6 %

Revenue passengers carried 88,713,472 83,814,823 5.8 %

Revenue passenger miles (RPMs) (000s) 72,318,812 67,691,289 6.8 %

Available seat miles (ASMs) (000s) 99,635,967 92,663,023 7.5 %

Passenger load factor 72.6 % 73.1 % (0.5) pts.

Passenger revenue yield per RPM 13.08 ¢ 12.93 ¢ 1.2 %

Operating revenue yield per ASM 9.90 ¢ 9.81 ¢ 0.9 %

Operating expenses per ASM 9.10 ¢ 8.80 ¢ 3.4 %

Size of eet at yearend 520 481 8.1 %

Fulltime equivalent Employees at yearend 34,378 32,664 5.2 %

$700

$600

$500

$400

$300

$200

$372

$226$215$248

$484

$425

$499

$578

$645

$471

Net Margin GAAP

10%

8%

6%

4%

2%

non-GAAP

See table for a reconciliation of non-GAAP to GAAP results.

Net Income (in millions) GAAP non-GAAP

See table for a reconciliation of non-GAAP to GAAP results.

Reconciliation of Reported Amounts to non-GAAP Items

(See Note on page 14.) (unaudited)

$372 $215 $484

Net income, as reported

(in millions)

$645

$471

$425

(59)(2) 11

Impact of fuel contracts, net (197)88

$499

-

(144) -

Impact of government

grant proceedings, net -

-22-

Other net (9) 23

$578$226 $248

Net income——non-GAAP

2003 2004 2005 2006 2007

20032004 2005 2006 2007 2003 2004 2005 2006 2007

6.3%

3.8%

3.3% 3.8%

5.5%

6.4% 5.6% 6.5% 6.5%

4.8%

Southwest Airlines Co. provides single-class, comfortable air transportation which targets both business and leisure travelers.

SWA is a profitable, highly efficient, high-quality airline with a schedule that fits our Customers’ needs. Our warm, caring, and

spirited Employees deliver an outstanding Customer Experience for our Valued Customers. The Company, incorporated in Texas,

commenced Customer Service on June 18, 1971, with three Boeing 737 aircraft serving three Texas cities——Dallas, Houston, and

San Antonio. At yearend 2007, Southwest operated 520 Boeing 737 aircraft and provided service to 64 airports in 32 states

throughout the United States. Southwest has one of the lowest operating cost structures in the domestic airline industry

and consistently offers low and simple fares. We currently offer 3,400+ flights a day. Southwest has had the best cumulative

Customer Satisfaction record among those carriers with whom we compete since the Department of Transportation has kept

these statistics. LUV is our stock exchange symbol, selected to represent both our home at Dallas Love Field and the unique,

warm, and LUVing relationships among Employees, Shareholders, and Customers.

Table of contents

-

Page 1

... spirited Employees deliver an outstanding Customer Experience for our Valued Customers. The Company, incorporated in Texas, commenced Customer Service on June 18, 1971, with three Boeing 737 aircraft serving three Texas cities--Dallas, Houston, and San Antonio. At yearend 2007, Southwest operated... -

Page 2

... in our gate areas; an enhanced boarding procedure; a new Business SelectTM fare; perks to our Rapid Rewards® program; and a new look to our low-fare offerings on southwest.com® . At year's end, we are proud to report that Southwest Airlines truly can make your travel experience more productive so... -

Page 3

... modified and simplified our fare structure and southwest.com® presentation. This change, along with our new boarding process, enabled us to offer Business Select, which allows Customers to be among the first to board the aircraft; earn additional Rapid Rewards credit; and receive a complimentary... -

Page 4

... rejoined the Southwest schedule in January 2006 and has proved to be a very large and rapidly developing market. In our May 2008 schedule, we will grow to 79 daily departures from just 13 in January 2006. Likewise, we restarted service to San Francisco International Airport in August 2007. We are... -

Page 5

Checking in with family to coordinate birthday party Packed running shoes and shorts for workout Searching for recipes for tomorrow night's dinner Charging laptop for afternoon presentation To make our gate areas more productive for our business and family travelers alike, Southwest has added ... -

Page 6

...Fuel and Related Taxes Travel Agency Other VO: Freedom to choose on Southwest Airlines. SFX: Ding VO: You are now free to move about the country. 2003 2004 2005 2006 2007 Operating Expenses Per Available Seat Mile Passenger Revenues (in millions) and Distribution Method ©2008 Southwest Airlines... -

Page 7

... player for decompression jog after meeting Decided to see movie after reading positive review Will catch up on latest novel Has time to enjoy cup of coffee Business travelers enjoy our comfy new leather boarding gate seating, complete with side tables and power ports for laptop computers, phones... -

Page 8

... fare classes was a brand-new product called Business Select that allows Customers to be among the first to board, receive extra Rapid Rewards credit, and enjoy a free cocktail onboard. TM Boeing 737-700 Firm Orders, Options, and Purchase Rights *Currently plan to reduce fleet by 22 aircraft... -

Page 9

... Huge geography fan gets window seat when boarding first Hasn't stressed because she's had her number in line since Thursday To give business and personal travelers a few more minutes to relax and be more productive, Southwest introduced a new way to board designed for a calmer gate experience. -

Page 10

... all, Southwest Airlines was built for the business traveler. Our high frequency, point-to-point service allows for more direct nonstop routings, minimizing connections, delays, and total trip time. Approximately 78 percent of Southwest's Customers fly nonstop. We... -

Page 11

10 Had plenty of time to buy toy at the airport gift shop Will use her Rapid Rewards credits to visit him at college Daddy was only gone for one day, but I missed him the whole time! -

Page 12

... by group and number now and just call you up. GUY SITTING: Do you see anybody else standing in line? was instituted largely by strategic decisions made early in our history to fly a single aircraft type; operate an efficient point-to-point route system; and utilize our assets in... -

Page 13

...generated energy through a contract between Mohawk and Community Wind Energy. Southwest's Top Ten Airports--Daily Departures (at yearend) 241 250 225 200 1 75 1 50 1 25 1 00 Orlando Los Angeles Dallas Love Oakland Houston Baltimore/ Hobby Washington Phoenix Chicago Midway Las Vegas 227 200 172 137... -

Page 14

... Stock Price Ranges and Dividends Southwest's common stock is listed on the New York Stock Exchange and is traded under the symbol LUV. The high, low, and close sales prices of the common stock on the Composite Tape and the quarterly dividends per share paid on the common stock were: PERIOD 2007... -

Page 15

...) Fulltime equivalent Employees at yearend Size of fleet at yearend (1) (1) Includes leased aircraft (2) Includes effect of reclassification of revenue reported in 1999 and 1998 related to the sale of flight segment credits from Other to Passenger due to the accounting change in 2000 (3) Certain... -

Page 16

.... Factors include, among others, (i) the price and availability of aircraft fuel; (ii) the Company's ability to timely and effectively prioritize its initiatives and its related ability to timely implement and maintain the necessary information technology systems and infrastructure to support these... -

Page 17

...SOUTHWEST AIRLINES CO. GENERAL OFFICES P.O. Box 36611 Dallas, Texas 75235-1611 FINANCIAL INFORMATION A copy of the Company's Annual Report on Form 10-K as filed with the U.S. Securities and Exchange Commission (SEC) is included herein. Other financial information can be found on Southwest's web site... -

Page 18

... by reference to the closing sale price of the common stock on the New York Stock Exchange on June 29, 2007, the last trading day of the registrant's most recently completed second fiscal quarter. Number of shares of common stock outstanding as of the close of business on January 30, 2008: 735... -

Page 19

...Item 9A. Controls and Procedures ...Item 9B. Other Information ...Item 10. Item 11. Item 12. Item 13. Item 14. PART III Directors, Executive Officers, and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters... -

Page 20

... boarding method for flights; • Commencement of a significant gate re-design to enhance the airport experience for Customers; • Introduction of a new fare structure, including a "Business Select" product; • Introduction of enhancements to the Company's Rapid Rewards frequent flyer program... -

Page 21

...ticket between Dallas Love Field and any U.S. destination (while still requiring the Customer to make a stop in a Wright Amendment State), and reduced the maximum number of gates available for commercial air service at Dallas Love Field from 32 to 20. Southwest currently uses 15 gates at Dallas Love... -

Page 22

... investments to address the impact of these types of regulations, including investments in facilities, equipment, and technology to process Customers efficiently and restore the airport experience. The Company's Automated Boarding 3 Passes and self service kiosks have reduced the number of lines in... -

Page 23

... hub. Point-to-point service allows for more direct nonstop routing than the hub and spoke system, 4 minimizing connections, delays, and total trip time. As a result, approximately 78 percent of Southwest's Customers fly nonstop. Southwest's average aircraft trip stage length in 2007 was 629 miles... -

Page 24

...the best boarding pass number available (generally, an "A" boarding pass). Customers on this "A-List" are also automatically checked in for their flight in advance of departure. During 2007, Southwest also introduced a new Freedom Award, which allows Rapid Rewards Members the opportunity to exchange... -

Page 25

...may market and sell tickets under its code designator (TZ) for certain flights on Southwest. Any flight bearing a Southwest code designator that is operated by ATA is disclosed in Southwest's reservations systems and on the Customer's flight itinerary, boarding pass, and ticket, if a paper ticket is... -

Page 26

... industry are: • Fares; • Customer Service; • Costs; • Frequency and convenience of scheduling; • Frequent flyer benefits; and • Efficiency and productivity, including effective selection and use of aircraft. Southwest currently competes with other airlines on all of its routes. Some of... -

Page 27

... Attendants Ramp, Operations, Provisioning, and Freight Agents Stock Clerks Mechanics Customer Service and Reservations Agents Aircraft Appearance Technicians Flight Dispatchers Flight Simulator Technicians Flight/Ground School Instructors and Flight Crew Training Instructors Southwest Airlines... -

Page 28

...its efforts to improve future profitability, the Company offered an early retirement program to certain of its Employees. A total of 608 of approximately 8,500 eligible Employees elected to participate in the program. Additional Information About Southwest Southwest was incorporated in Texas in 1967... -

Page 29

... automated systems and technology to operate its business, enhance Customer Service and back office support systems, and increase Employee productivity, including the Company's computerized airline reservation system, flight operations systems, telecommunication systems, website at www.southwest.com... -

Page 30

... to expand and update its information technology infrastructure in response to its growth and changing needs is increasingly important to the operation of its business generally and the implementation of its new initiatives. Any issues with transitioning to upgraded or replacement systems, or any... -

Page 31

... 425 aircraft were owned. Average Age (Yrs) Number of Aircraft Number Owned Number Leased Unresolved Staff Comments Properties The following table details information on the 520 aircraft in the Company's fleet as of December 31, 2007: 737 Type Seats -300 ...-500 ...-700 ...Totals ... 137... -

Page 32

...The Company leases the land and structures on a long-term basis for its maintenance centers (located at Dallas Love Field, Houston Hobby, Phoenix Sky Harbor, and Chicago Midway), its flight training center at Dallas Love Field (which houses seven 737 simulators), and its corporate headquarters, also... -

Page 33

...Chief Executive Officer President and Secretary Executive Vice President - Strategy and Technology Executive Vice President - Law, Airports, and Public Affairs Michael G. Van de Ven ...Executive Vice President - Chief of Operations Davis S. Ridley ...Senior Vice President - Marketing Laura H. Wright... -

Page 34

...'s common stock is listed on the New York Stock Exchange and is traded under the symbol "LUV." The following table shows, for the periods indicated, the high and low sales prices per share of the Company's common stock, as reported on the NYSE Composite Tape, and the cash dividends per share paid on... -

Page 35

... indices and assumes reinvestment of dividends. The stock performance shown on the graph below represents historical stock performance and is not necessarily indicative of future stock price performance. COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN AMONG SOUTHWEST AIRLINES CO., S&P 500 INDEX, AND... -

Page 36

...per share, diluted ...Cash dividends per common share . . Total assets at period-end ...Long-term obligations at periodend ...Stockholders' equity at period-end . . Operating Data: Revenue passengers carried ...Enplaned passengers ...Revenue passenger miles (RPMs) (000s)...Available seat miles (ASMs... -

Page 37

... * Implemented a new Customer boarding method for flights to significantly reduce the average time a Customer spends waiting in line at the gate, while retaining the Company's famous open seating policy once aboard the aircraft. * Introduced a new fare structure including a "Business Select" product... -

Page 38

...percent increase in available seat miles compared to 2006. The Company purchased a total of 37 new Boeing 737-700 aircraft during 2007, and added another two leased 737-700s from a previous owner, resulting in the addition of 39 aircraft for the year. The Company attempted to combat high fuel prices... -

Page 39

...2007 2006 Increase (Decrease) Percent Change Salaries, wages, and benefits ...Fuel and oil...Maintenance materials and repairs ...Aircraft rentals ...Landing fees and other rentals ...Depreciation and amortization ...Other ...Total ...The Company's 2007 CASM (cost per available seat mile) increased... -

Page 40

... of jet fuel in 2007 was $1.70 compared to $1.53 in 2006, excluding fuel-related taxes and net of hedging gains. See Note 10 to the Consolidated Financial Statements. The 2007 increase in fuel prices was partially offset by steps the Company has taken to improve the fuel efficiency of its aircraft... -

Page 41

...Based on current fleet and growth plans, the Company expects a similar year-over-year comparison for first quarter 2008 on a per-ASM basis. See Note 4 to the Consolidated Financial Statements for further information on the Company's future aircraft deliveries. Other operating expenses increased $108... -

Page 42

...the Company's fleet growth, improved load factors, and higher fares, which more than offset a significant increase in the cost of jet fuel. In both 2006 and 2005, the Company recognized adjustments related to the ineffectiveness of hedges and the loss of hedge accounting for certain fuel derivatives... -

Page 43

... ...Aircraft rentals ...Landing fees and other rentals ...Depreciation and amortization ...Other ...Total ...Operating expenses per ASM increased 9.3 percent to 8.80 cents, primarily due to an increase in jet fuel prices, net of gains from the Company's fuel hedging program. The Company's average... -

Page 44

... for Customers. The vast majority of tickets are purchased prior to the day on which travel is provided and, in some cases, several 25 months before the anticipated travel date. Operating cash outflows primarily are related to the recurring expenses of operating the airline. The operating cash flows... -

Page 45

... a change in the balance of the Company's short-term investments, namely auction rate securities. Net cash used in financing activities was $493 million in 2007, primarily from the repurchase of $1.0 billion of common stock. The Company repurchased a total of 66 million shares of outstanding common... -

Page 46

... of the Company's Common Stock. Repurchases will be made in accordance with applicable securities laws in the open market or in private transactions from time to time, depending on market conditions. Critical Accounting Policies and Estimates The Company's Consolidated Financial Statements have been... -

Page 47

..., or .2%, change in Passenger revenues recognized for that period. Events and circumstances outside of historical fare sale activity or historical Customer travel patterns can result in actual refunds, exchanges, or forfeited tickets differing significantly from estimates. The Company evaluates its... -

Page 48

... by changes to the Company's maintenance program, changes in utilization of the aircraft (actual cycles during a given period of time), governmental regulations on aging aircraft, and changing market prices of new and used aircraft of the same or similar types. The Company evaluates its estimates... -

Page 49

... made at the time the hedges were initially designated have materially differed from actual results, resulting in increased volatility in the Company's periodic financial results. For example, historical data had been utilized in qualifying unleaded gasoline for SFAS 133 hedge accounting under the... -

Page 50

...133. The Company did not, however, change its method for either assessing or measuring hedge ineffectiveness. As a result of this new method for forecasting future jet fuel prices, the Company believes its hedges are more likely to be effective over the long-term. The Company also utilizes financial... -

Page 51

...fuel prices, would be made or reported based on other reasonable assumptions or conditions suggested by actual historical experience and other data available at the time estimates were made. Share-Based Compensation The Company has share-based compensation plans covering the majority of its Employee... -

Page 52

... to manage market risk through execution of a documented hedging strategy. Southwest has market sensitive instruments in the form of fixed rate debt instruments and financial derivative instruments used to hedge its exposure to jet fuel price increases. The Company also operates 95 aircraft under... -

Page 53

... Consolidated Financial Statements for further information. The Company invests available cash in certificates of deposit, highly rated money market instruments, investment grade commercial paper, auction rate securities, and other highly rated financial instruments. Because of the short-term nature... -

Page 54

... in market rates would not impact the Company's earnings or cash flow associated with the Company's publicly traded fixed-rate debt. The Company is also subject to various financial covenants included in its credit card transaction processing agreement, the revolving credit facility, and outstanding... -

Page 55

... Data SOUTHWEST AIRLINES CO. CONSOLIDATED BALANCE SHEET December 31, 2007 2006 (In millions, except share data) ASSETS Current assets: Cash and cash equivalents ...Short-term investments ...Accounts and other receivables ...Inventories of parts and supplies, at cost ...Fuel derivative contracts... -

Page 56

SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF INCOME Years Ended December 31, 2007 2006 2005 (In millions, except per share amounts) OPERATING REVENUES: Passenger ...Freight ...Other ...Total operating revenues...OPERATING EXPENSES: Salaries, wages, and benefits ...Fuel and oil ...Maintenance ... -

Page 57

SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY Years Ended December 31, 2007, 2006, and 2005 Accumulated Capital in Other Excess of Retained Comprehensive Treasury Par Value Earnings Income (Loss) Stock (In millions, except per share amounts) Common Stock Total Balance at ... -

Page 58

... Issuance of long-term debt ...Proceeds from Employee stock plans ...Payments of long-term debt and capital lease obligations ...Payments of cash dividends ...Repurchase of common stock ...Excess tax benefits from share-based compensation arrangements Other, net ... ... Net cash provided by (used in... -

Page 59

...at any point in time can fluctuate significantly. Therefore, the Company generally excludes the cash collateral deposits in its decisions related to long-term cash planning and forecasting. See Note 10 for further information on these collateral deposits and fuel derivative instruments. Accounts and... -

Page 60

... or improvements to the aircraft, changes in utilization of the aircraft (actual flight hours or cycles during a given period of time), governmental regulations on aging aircraft, changing market prices of new and used aircraft of the same or similar types, etc. The Company evaluates its... -

Page 61

... in its Rapid Rewards frequent flyer program. Funds received from the sale of flight segment credits are accounted for under the residual value method. Under this method, the Company has determined the portion of funds received for sale of flight segment credits that relate to free travel, currently... -

Page 62

... money market fund. 43 To manage risk associated with financial derivative instruments held, the Company selects and will periodically review counterparties based on credit ratings, limits its exposure to a single counterparty, and monitors the market position of the program and its relative market... -

Page 63

...investor, MatlinPatterson Global Opportunities Partners II, would provide financing to enable ATA to emerge from bankruptcy. As part of this transaction, Southwest entered into an agreement with ATA to acquire the leasehold rights to four additional leased gates at Chicago Midway Airport in exchange... -

Page 64

... facility had been fully drawn at December 31, 2007, the spread over LIBOR would have been 62.5 basis points given Southwest's credit rating at that date. The facility also contains a financial covenant requiring a minimum coverage ratio 7. Long-Term Debt 2007 2006 (In millions) of adjusted pre-tax... -

Page 65

...1. Southwest used the net proceeds from the issuance of the notes for general corporate purposes. During 2003, the Company entered into an interest rate swap agreement relating to these notes. See Note 10 for further information. In fourth quarter 1999, the Company entered into two identical 13-year... -

Page 66

...Less current portion ...Long-term portion ...The aircraft leases generally can be renewed at rates based on fair market value at the end of the lease term for one to five years. Most aircraft leases have purchase options at or near the end of the lease term at fair market value, generally limited to... -

Page 67

... to jet fuel price increases. The Company does not purchase or hold any derivative financial instruments for trading purposes. The Company has utilized financial derivative instruments for both short-term and long-term time frames. In addition to the significant protective fuel derivative positions... -

Page 68

..., was determined by the use of present value methods or standard option value models with assumptions about commodity prices based on those observed in underlying markets. Included in the above total net unrealized gains from fuel hedges as of December 31, 2007, are approximately $556 million... -

Page 69

... obligations. The credit exposure related to 50 these financial instruments is represented by the fair value of contracts with a positive fair value at the reporting date. To manage credit risk, the Company selects and periodically reviews counterparties based on credit ratings, limits its exposure... -

Page 70

...utilizing proceeds from the exercise of Employee stock options. Repurchases were made in accordance with applicable securities laws in the open market or in private transactions from time to time, depending on market conditions. During first quarter 2005, the Company completed this program. In total... -

Page 71

...shareholders, except the plan covering non-management, non-contract Employees, which had options outstanding to purchase 5 million shares of the Company's Common Stock as of December 31, 2007. The Company also has plans related to past employment agreements with its current Executive Chairman. As of... -

Page 72

... option pricing model. The following weighted-average assumptions were used for grants made under the fixed option plans for the current and prior years: 2007 2006 2005 Weighted-average risk-free interest rate ...Expected life of option (years) ...Expected stock volatility...Expected dividend yield... -

Page 73

...one of the Company's plans covering Employees not subject to collective bargaining agreements (other Employee plans). Stock option grants to the Board become exercisable over a period of three years from the grant date and have a term of 10 years. In 2001, the Board adopted the Southwest Airlines Co... -

Page 74

... 2007 Annual Meeting, the plan was amended to increase the annual number of Performance Shares to be granted to 1,000. A Performance Share is a unit of value equal to the Fair Market Value of a share of Southwest Common Stock, based on the average closing sale price of the Common Stock as reported... -

Page 75

...the amounts reported for the Company's plan. A one-percent change in all healthcare cost trend rates used in measuring the APBO at December 31, 2007, would have the following effects: 1% Increase 1% Decrease (In millions) Increase (decrease) in total service and interest costs ...Increase (decrease... -

Page 76

... ...$2,612 Fuel hedges ...884 Other ...19 Total deferred tax liabilities ...DEFERRED TAX ASSETS: Deferred gains from sale and leaseback of aircraft ...Capital and operating leases ...Accrued employee benefits ...Stock-based compensation ...State taxes ...Business partner income ...Net operating loss... -

Page 77

... the Company's financial condition, results of operations, or cash flow. Therefore, no reserves for uncertain income tax positions have been recorded pursuant to FIN 48. In addition, the Company did not record a cumulative effect adjustment related to the adoption of FIN 48. The Company's policy for... -

Page 78

..., will have a material adverse effect on the Company's financial condition, results of operations or cash flow. The Company is subject to various legal proceedings and claims arising in the ordinary course of business, including, but not limited to, examinations by the IRS. The IRS regularly... -

Page 79

... of Southwest Airlines Co. as of December 31, 2007 and 2006, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2007. These financial statements are the responsibility of the Company's management. Our... -

Page 80

... standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Southwest Airlines Co. as of December 31, 2007 and 2006, and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period... -

Page 81

... of achieving their control objectives. Management, with the participation of the Chief Executive and Chief Financial Officers, evaluated the effectiveness of the Company's internal control over financial reporting as of December 31, 2007. In making this assessment, management used the criteria set... -

Page 82

... available upon request to Investor Relations, Southwest Airlines Co., P.O. Box 36611, Dallas, TX 75235. The Company intends to disclose any amendments to or waivers of its Code of Ethics on behalf of the Company's Chief Executive Officer, Chief Financial Officer, Controller, and persons performing... -

Page 83

... as of December 31, 2007, regarding compensation plans (including individual compensation arrangements) under which equity securities of Southwest are authorized for issuance. Equity Compensation Plan Information Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants, and... -

Page 84

... common stock of Southwest (incorporated by reference to Exhibit 4.2 to Southwest's Annual Report on Form 10-K for the year ended December 31, 1994 (File No. 1-7259)). Indenture dated as of February 14, 2005, between Southwest Airlines Co. and The Bank of New York Trust Company, N.A., Trustee... -

Page 85

... 10 of Item 601 are the Company's compensation plans and arrangements. Form of Executive Employment Agreement between Southwest and certain key employees pursuant to Executive Service Recognition Plan (incorporated by reference to Exhibit 28 to Southwest Quarterly Report on Form 10-Q for the quarter... -

Page 86

....24 10.25 10.26 1991 Employee Stock Purchase Plan as amended March 16, 2006 (incorporated by reference to Exhibit 99.1 to Registration Statement on Form S-8 (File No. 333-139362)). Southwest Airlines Co. Profit Sharing Plan. Southwest Airlines Co. 401(k) Plan. Southwest Airlines Co. 1995 SWAPA Non... -

Page 87

... Chief Financial Officer. 32 Section 1350 Certification of Chief Executive Officer and Chief Financial Officer. A copy of each exhibit may be obtained at a price of 15 cents per page, $10.00 minimum order, by writing to: Investor Relations, Southwest Airlines Co., P.O. Box 36611, Dallas, Texas 75235... -

Page 88

... undersigned, thereunto duly authorized. SOUTHWEST AIRLINES CO. February 1, 2008 By: /s/ LAURA WRIGHT Laura Wright Senior Vice President - Finance, Chief Financial Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons...