Sonic 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

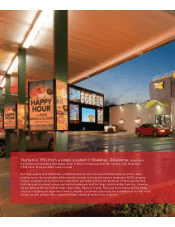

If you have followed Sonic’s story, you know that

the momentum in our business is strong. In spite

of a challenging environment for consumers and

competitive forces new and old, we continue to

accelerate the pace of our progress. Our multi-layered

growth strategy is driving the results we have achieved

so far and gives us confidence that we will continue to

optimize shareholder value in the future. Our focus on

product innovation, improved service, industry-leading

creative and media efficiency have all contributed to our

increased sales and profits. This foundation, combined

with our franchisees’ commitment and investment

in our brand, underpins our strategy to strengthen

consumer engagement and drive the business forward.

More importantly, our progress during fiscal 2014 is a

positive indicator of future success as we continue to

build our brand.

Highlights of fiscal 2014 include:

• A system-wide same-store sales increase of 3.5%;

• A 90-basis-point improvement in company drive-in

level margins;

• An ongoing increase in our drive-in development

pipeline;

• A 17% increase in earnings per share, on an

adjusted basis; and

• The initiation of a cash dividend program that

augments our other strategies to increase

shareholder value.

Most conversations about Sonic begin on the topic

of food: not only about the number of unique menu

choices, but also our relentless pursuit of high-

quality products.

Distinctive, premium products have always been a

hallmark of Sonic. From our hand-battered onion rings

and always popular Tater Tots, customers know that

Sonic is different, and different is better. Over the last

year, we introduced unique limited-time offer products

such as the Island Fire cheeseburger and chicken

sandwich along with our cheesy bread six-inch beef hot

dog. Over the summer, we complemented our 25 flavors

of Real Ice Cream Shakes with an array of 25 flavors of

Slush, some featuring Nerds® candy! Our customers

have come to count on and respond to Sonic offering

leading-edge menu items that are not only flavorful,

but fun. Our menu items, together with our Carhop

service model, increasingly put us on par with fast casual

competitors in terms of quality and service.

We are prepared to take menu innovation to new heights

with the recent opening of Sonic’s Culinary Innovation

Center. Investments like this in product innovation

and new equipment represent a redoubled effort to

bring distinctive and uniquely Sonic menu items to our

customers. With this new center, our team of culinary

professionals will bring even greater discipline to our

product development efforts for the future as we work

to surprise and delight current and new customers with

new flavors and products.

Our “Two Guys” campaign was recently ranked the most

effective in our category by a leading advertising testing

firm. Most people love them, and everyone remembers

them. This differentiated campaign separates us from

the competition and provides a powerful platform for

delivering our promotional messages.

To Our Shareholders

2

The increase in earnings per share

for scal 2014, on an adjusted basis.

17%

The number of new Sonic Drive-Ins opened

during scal 2014, reecting a nearly 50%

increase in drive-in openings versus scal

2013 and early progress on plans for 1,000

new locations over the next 10 years.

40

The amount of common

stock repurchased during

scal 2014, which represents

approximately 7% of the

total shares outstanding at

the beginning of the year.

$80M