Sonic 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

What a tremendous year 2004 was for Sonic and all associated with the

Sonic brand! This past fiscal year was one of building momentum, punctuated

by great excitement and enthusiasm. In looking back, Sonic's solid

performance and the strength of our business during the year were more than

gratifying. From any perspective – from virtually any point of view – fiscal 2004

was a great year for Sonic!

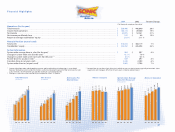

The most direct indication of our momentum in 2004 can be seen in our record

financial results for the year. Net income increased 21% to $63 million or $1.02 per

diluted share. Total revenues rose 20% to $536 million. Importantly, the increases we

witnessed in net income and total revenues for 2004 not only exceeded those of the

previous year, but also were ahead of the average annual growth rate for the past five

years. Additionally, this was the fifth consecutive year that our earnings represented

a return on equity of more than 20%. Now, that's momentum!

For some time now,we have discussed our strategy for growth in terms of a multi-

layered approach, with several aspects of our business combining to fuel earnings

and provide balance to our operations. Our solid top-line growth in 2004 reflected an

ongoing acceleration in same-store sales – at 6.5% system-wide, same-store sales

were significantly ahead of our target range for the year and reached their highest

level since 1999. These results highlighted the success of our sales-driving strategies,

including a steady stream of exciting new product news, which spanned the entire

spectrum of our diverse menu and included choices that keep us relevant and in step

with consumers' changing tastes and preferences. Also, these strategies added

synergy in building traffic across non-traditional day parts, particularly in the morning

with breakfast and after dinner with our Frozen Favorites® desserts menu.

Another momentum-building element of our strategy involves using the

growing clout of our System Marketing Fund to support our efforts to connect with

consumers in fresh and innovative ways and take the message of the Sonic brand to

new customers. Next year, our media spending is set to rise to over $120 million from

approximately $110 million in 2004. Moreover, we plan to nearly double to $60

million the portion of these expenditures directed to national media initiatives,

primarily cable advertising, which has proven to be particularly effective for us in

developing markets and allows us to present multiple messages to a variety of

customers, thereby enhancing relevance.

Of course, a key factor driving our growth is the continued expansion of our

chain in both core and developing markets,with the majority of new drive-ins being

opened by franchisees. In fiscal 2004, franchisees opened a single-year record 167

new drive-ins, which, together with the 21 partner drive-ins we opened, pushed our

chain to 2,885 restaurants by year's end. Coincidentally, the strength of our

franchise development also continues to drive higher franchising income. In

addition to greater franchise fees related to new drive-in openings last year, our

unique ascending royalty rate generated substantial growth in royalty income for

fiscal 2004.

Although the bulk of our development in 2004 occurred on the franchise side of

our business, rest assured that we devoted substantial time and energy to improving

the performance of our partner drive-ins during the past year. Through these efforts,

we made substantial progress in 2004 to boost average volumes at our partner drive-

ins and close the gap between those and average volumes at franchise drive-ins. At

the same time, these steps helped increase drive-in level profits and enhance the

performance of our partner drive-ins.

Prompted by Pattye Moore's decision to depart from the company subsequent to

year's end in order to spend more time with her family, we recently announced several

important changes in our management team. We are gratified that, when faced with

these circumstances, the ample experience and leadership qualifications of our people

provided ready candidates to keep Sonic's great momentum going. Scott McLain,with

Sonic since 1996 and formerly our Executive Vice President and Chief Financial Officer,

was promoted to President of Sonic Industries, our franchising subsidiary. Mike Perry,

with Sonic since 1998 and formerly Senior Vice President of Sonic Restaurants, Inc.

("SRI"), our partnership drive-in operating subsidiary, was promoted to President of SRI.

Steve Vaughan, who joined Sonic in 1992 and was Vice President of Planning & Analysis

and Treasurer, was promoted to Vice President and Chief Financial Officer. I have great

confidence in these officers and welcome them to their new and expanded roles

within our company.

To Our Stockholders

p.2