Sonic 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

Table of contents

-

Page 1

-

Page 2

... sector. Sonic Drive-Ins feature signature items, offering madewhen-you-order Toaster® Sandwiches, hamburgers and other sandwiches, Extra-Long Cheese Coneys, handbattered Onion Rings, Tater Tots, and a variety of Frozen Favorites® desserts and Fountain Favorites® drinks, including Cherry Limeades...

-

Page 3

... partner and franchise drive-in information, is a non-GAAP measure. We believe system-wide information is useful in analyzing the growth of the Sonic brand as well as our revenues, since franchisees pay royalties based on a percentage of sales. Changes in same-store sales based on drive-ins open...

-

Page 4

... the past year. Through these efforts, we made substantial progress in 2004 to boost average volumes at our partner driveins and close the gap between those and average volumes at franchise drive-ins. At the same time, these steps helped increase drive-in level profits and enhance the performance of...

-

Page 5

...strategies and initiatives that framed a successful year for Sonic in 2004 have set the stage for our ongoing momentum in sales and profits and exciting growth in our business. The phenomenon we witnessed last year - with our franchisees enjoying significantly higher profits, our company-store drive...

-

Page 6

p.4

-

Page 7

... to drive our sales to record levels in 2004. With something to satisfy everyone, all through the day, our customers continue to vote "yes" for Sonic, which contributed to strong same-store sales growth, increased traffic, higher average tickets, and greater drive-in profits for the company and...

-

Page 8

... will nearly double in dollars next year to half of the $120 million in total planned media spending, accomplishes several things. First, in concert with our traditional monthly promotions and local market advertising, it allows us to provide a matrix of products and messages to specific consumer...

-

Page 9

...from our PartnerNet extranet, and from people responding to our local advertising. Clearly, our customers are getting the message."

Network Cable (millions) '05E '04 '03 '02 '01 '00

Total Media Expenditures (millions) ``````` $60 / $120 $32 / $110 Increasing Marketing $20 / $100 Expenditures, with...

-

Page 10

... Group Sonic Franchisee, Las Cruces, New Mexico "Sales and profits were fantastic last year, and that kind of performance instills a real sense of confidence for franchisees...confidence to invest in new drive-ins, upgrade our restaurants, and add the people needed to support new day part programs...

-

Page 11

... a direct ownership interest in those drive-ins, average sales volumes historically have lagged those of franchise driveins. In 2004, we continued to invest in restaurant-level operations and, most significantly, implemented a new sales incentive plan for our partner managers modeled after the best...

-

Page 12

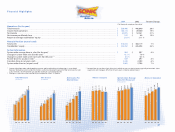

Selected Financial Data

2004

2003

Year ended August 31, 2002

(In thousands except per share data)

2001

2000

Income Statement Data: Partner Drive-In sales ...$ Franchise Drive-Ins: Franchise royalties ...Franchise fees ...Other ...Total revenues ...Cost of drive-in sales ...Selling, general and...

-

Page 13

... and sales volumes of Franchise Drive-Ins. Initial franchise fees and franchise royalties are directly affected by the number of Franchise Drive-In openings. Overview of Business Performance. Business performance was strong during fiscal year 2004 as net income increased 20.6% and earnings per share...

-

Page 14

...including leverage of our corporate-level expenses and positive operating cash flow. At our Partner Drive-Ins, we have put in place long-term initiatives designed to help us close the $100,000 plus sales gap in average unit volumes between Partner Drive-Ins and Franchise Drive-Ins. To a large degree...

-

Page 15

...03 million by stores open the full reporting periods of fiscal years 2003 and 2002. During fiscal year 2004, same-store sales at Partner Drive-Ins exceeded the samestore sales performance of Franchise Drive-Ins. The increase in average unit volume was even stronger - growing 10.9% during the year as...

-

Page 16

...in operation: Total at beginning of period Opened Acquired from (sold to) company, net Closed Total at end of period Franchise Drive-In sales Percentage increase Effective royalty rate Average sales per Franchise Drive-In Change in same-store sales - new method (2) Change in same-store sales - prior...

-

Page 17

...our store-level partners' pro-rata share of earnings from our partnership program, increased by $5.5 million during fiscal year 2004 as the increase in average dollar profit per store more than offset the decline in drive-in-level margins. During fiscal year 2003, lower average unit profits combined...

-

Page 18

... of the Company by assessing the level of funds available for share repurchases, acquisitions of Franchise Drive-Ins, and repayment of debt. We expect free cash flow to exceed $40 million for fiscal year 2005. We have an agreement with a group of banks that provides us with a $125.0 million line of...

-

Page 19

... development of additional Partner Drive-Ins, stall additions, relocations of older drive-ins, store equipment and point of sale system upgrades, and enhancements to existing financial and operating information systems. We expect to fund these capital expenditures through cash flow from operations...

-

Page 20

... by Partner Drive-Ins are recorded as an expense in the Company's financial statements. Revenue Recognition Related to Franchise Fees and Royalties. Initial franchise fees are nonrefundable and are recognized in income when we have substantially performed or satisfied all material services or...

-

Page 21

... European short-term interest rates. The balance outstanding under the line of credit was $14.1 million as of August 31, 2004. The impact on our results of operations of a one-point

interest rate change on the outstanding balances under the line of credit as of the end of fiscal year 2004 would be...

-

Page 22

Consolidated Balance Sheets

August 31, 2004

(In thousands)

2003

Assets Current assets: Cash and cash equivalents ...$ Accounts and notes receivable, net ...Net investment in direct financing leases ...Inventories ...Deferred income taxes ...Prepaid expenses and other ...Total current assets ......

-

Page 23

Consolidated Statements of Income

2004 Revenues: Partner Drive-In sales ...$ Franchise Drive-Ins: Franchise royalties ...Franchise fees ...Other ...

Year ended August 31, 2003

(In thousands, except per share data)

2002

449,585 77,518 4,958 4,385 536,446

$

371,518 66,431 4,674 4,017 446,640

$

...

-

Page 24

... of employee stock options ...Purchase of treasury stock ...Net income ...Balance at August 31, 2003 ...Exercise of common stock options ...Tax benefit related to exercise of employee stock options ...Purchase of treasury stock ...Three-for-two stock split ...Net income ...Balance at August 31, 2004...

-

Page 25

... of franchise and development fees ...Franchise and development fees collected ...Provision for deferred income taxes ...Provision for impairment of long-lived assets ...Tax benefit related to exercise of employee stock options ...Other ...(Increase) decrease in operating assets: Accounts and...

-

Page 26

... Significant Accounting Policies Operations Sonic Corp. (the "Company") operates and franchises a chain of quick-service drive-ins in the United States and Mexico. It derives its revenues primarily from Partner Drive-In sales and royalty fees from franchisees. The Company also leases signs and real...

-

Page 27

..., both Partner-Drive-Ins and Franchise DriveIns must contribute a minimum percentage of revenues to a national media production fund (Sonic Advertising Fund) and spend an additional minimum percentage of gross revenues on local advertising, either directly or through Company-required participation...

-

Page 28

... in the drive-in. The net book value of a minority interest acquired by the Company in a Partner DriveIn is recorded as an investment in partnership, which results in a reduction in the minority interest liability on the Consolidated Balance Sheet. If the purchase price exceeds the net book value of...

-

Page 29

.... 148 is required for annual financial statements issued for fiscal years ending after December 15, 2002. Pursuant to the provisions of SFAS No. 123, the Company has elected to continue using the intrinsic value method of accounting for its stock-based employee compensation plans in accordance with...

-

Page 30

... 12 for information regarding shares available for grant under the 2001 Sonic Corp. Stock Option Plan and the 2001 Sonic Corp. Directors' Stock Option Plan. 3. Impairment of Long-Lived Assets As of August 31, 2004 and 2003, the Company had identified certain underperforming drive-ins whose operating...

-

Page 31

...

Total minimum lease payments Less amount representing interest averaging 13.1% in 2004 and 13.9% in 2003 Present value of net minimum lease payments Less amount due within one year Amount due after one year

Minimum lease payments receivable Less unearned income Net investment in direct financing...

-

Page 32

... 2005 through availability under its line of credit and has classified that amount as long-term debt as of August 31, 2004 on the consolidated balance sheet. Interest is payable semi-annually and accrues at 6.76%. The related agreement requires, among other things, the Company to maintain equity of...

-

Page 33

... and depreciation related to direct financing leases and different year ends for financial and tax reporting purposes State net operating losses Property, equipment and capital leases Allowance for doubtful accounts and notes receivable Deferred income from affiliated franchise fees Accrued...

-

Page 34

... employees may purchase under this plan is limited to 759,375 shares. The purchase price will be between 85% and 100% of the stock's fair market value and will be determined by the Company's board of directors. Stock Options In January 2001 the stockholders of the Company adopted the 2001 Sonic Corp...

-

Page 35

...of the independent directors not affiliated with a 15%-or-more stockholder, then each right not owned by a 15%-or-more stockholder or related parties will then entitle its holder to purchase, at the right's then current exercise price, shares of the Company's common stock having a value of twice the...

-

Page 36

...,500 6,216 83,284 31,023 52,261 .89 .86 58,465 60,910

2004 Income statement data: Partner Drive-In sales Other Total revenues Partner Drive-In operating expenses Selling, general and administrative Other Total expenses Income from operations

$ 99,745 18,963 118,708 79,852 9,121 7,823 96,796 21,912...

-

Page 37

... balance sheets of Sonic Corp. as of August 31, 2004 and 2003, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the three years in the period ended August 31, 2004. These financial statements are the responsibility of the Company's management...

-

Page 38

... Lead Independent Director

Officers J. Clifford Hudson Chairman, Chief Executive Officer and President W. Scott McLain President Sonic Industries Inc. (the company's franchising subsidiary) Michael A. Perry President Sonic Restaurants, Inc. (the company's restaurant-operating subsidiary) Ronald...

-

Page 39

... p.m. Central Standard Time on January 20,2005, at our Headquarters Building, 4th Floor, 300 Johnny Bench Drive, Oklahoma City, Oklahoma.

Annual Report on Form 10-K A copy of our annual report on Form 10-K for the year ended August 31, 2004, as filed with the Securities and Exchange Commission, may...

-

Page 40

300 Johnny Bench Drive • Oklahoma City, Oklahoma 73104 • 405/225-5000