SkyWest Airlines 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

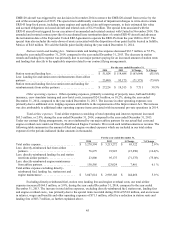

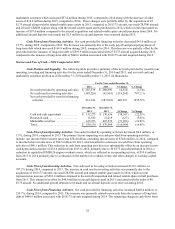

marketable securities which increased $57.4 million during 2015, compared to 2014 along with the decrease of other

assets of $16.0 million during 2015, compared to 2014. These changes were partially offset by the acquisition of 25

E175 aircraft along with the related rotable spare assets in 2015, compared to 20 E175 aircraft, one used CRJ700 aircraft

and 20 used CRJ200 engines along with the related rotable spare assets purchased in 2014, which in total represented an

increase of $57.4 million compared to the aircraft acquisition and related rotable spare aircraft purchases from 2014. No

additional aircraft deposits were made but $1.9 million in aircraft deposits were returned during 2015.

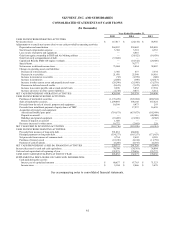

Cash Flows from Financing Activities. Net cash provided by financing activities decreased $41.0 million, or

15.7%, during 2015, compared to 2014. The decrease was primarily due to the early payoff and principal payments of

long-term debt which increased $168.9 million during 2015, compared to 2014. This decrease was partially offset by the

proceeds from the issuance of long-term debt of $591.9 million associated with 25 E175 aircraft acquired during 2015,

compared to the issuance of long-term debt of $460.6 million associated with 20 E175 aircraft acquired during 2014.

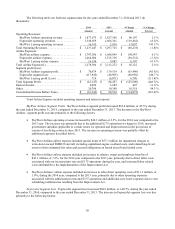

Sources and Uses of Cash—2014 Compared to 2013

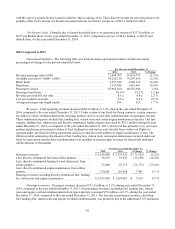

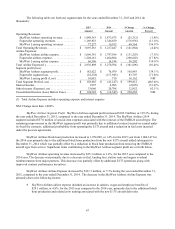

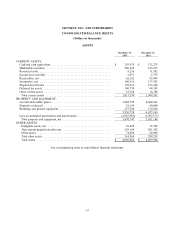

Cash Position and Liquidity. The following table provides a summary of the net cash provided by (used in) our

operating, investing and financing activities for the years ended December 31, 2014 and 2013, and our total cash and

marketable securities position as of December 31, 2014 and December 31, 2013 (in thousands).

For the Year ended December 31,

2014 2013 $ Change % Change

N

et cash provided by operating activities $ 285,539 $ 289,890 (4,351) (1.5)%

N

et cash used in investing activities . . . (585,226) (65,961) (519,265) 787.2 %

N

et cash provided by (used in) financing

activities ........................ 261,326 (187,065) 448,391 (239.7)%

December 31,

December 31,

2014

2013

$ Change

% Change

Cash and cash equivalents ........... $ 132,275 $ 170,636 (38,361) (22.5)%

Restricted cash ..................... 11,582 12,219 (637) (5.2)%

Marketable securities . .............. 415,273 487,239 (71,966) (14.8)%

Total ............................. $ 559,130 $ 670,094 (110,964) (16.6)%

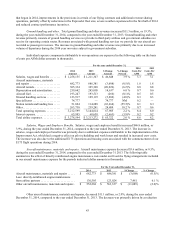

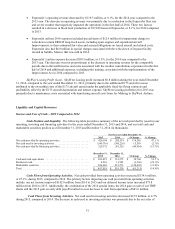

Cash Flows from Operating Activities. Net cash provided by operating activities decreased $4.4 million, or

1.5%, during 2014, compared to 2013. The primary factors impacting our cash provided from operating activities

include: our income before income taxes was $58.4 million, excluding special items of $74.8 million, in 2014, compared

to income before income taxes of $98.5 million for 2013, which resulted in a decrease in cash flows from operating

activities of $40.1 million. This reduction in cash from operating activities was substantially offset by an increase in non-

cash depreciation expense of $14.6 million from 2013 to 2014, primarily due to 20 E175 aircraft purchased in 2014; a

reduction in capitalized EMB120 engine overhaul events, which are reflected as an operating activity, of $10.8 million

from 2013 to 2014 primarily due to a reduction in the number of overhaul events; and other changes in working capital

accounts.

Cash Flows from Investing Activities. Net cash used in investing activities increased $519.3 million, or

787.2% during 2014, compared to 2013. The increase in cash used in investing activities was primarily due to the

acquisition of 20 E175 aircraft, one used CRJ700 aircraft and related rotable spare assets in 2014, which in total

represented an increase of $563.4 million compared to the aircraft acquisition and related rotable spare aircraft purchases

from 2013. This amount was offset by $40.0 million in aircraft deposits paid in 2013 associated with the order of 40

E175 aircraft. No additional aircraft deposits were made and no aircraft deposits were received during 2014.

Cash Flows from Financing Activities. Net cash provided by financing activities increased $448.4 million, or

239.7%, during 2014, compared to 2013. The increase was primarily related to proceeds from the issuance of long term

debt of $460.6 million associated with 20 E175 aircraft acquired during 2014. The remaining change in cash flows from