SkyWest Airlines 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

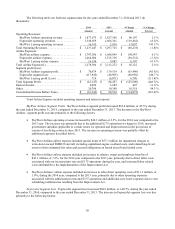

Depreciation and amortization. Depreciation and amortization expense increased $4.8 million, or 1.9%, during

the year ended December 31, 2015, compared to the year ended December 31, 2014. The increase in depreciation and

amortization expense was primarily due to the purchase of additional E175 aircraft and spare engines in 2015 that was

significantly offset by the reduction in fixed asset depreciation expense that resulted from our removal of all EMB 120

aircraft from service in early 2015.

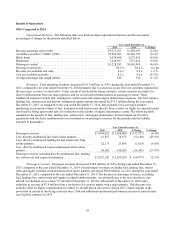

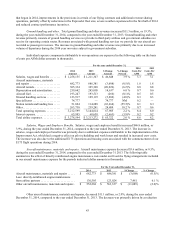

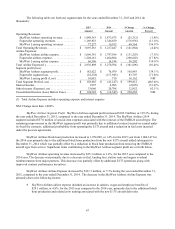

Fuel. Fuel costs decreased $75.1 million, or 38.9%, during the year ended December 31, 2015, compared to the

year ended December 31, 2014. The decrease in fuel cost was primarily due to the decrease in the average fuel cost per

gallon in 2015 compared to 2014, along with a decrease in the volume in gallons that we purchased under our fixed-fee

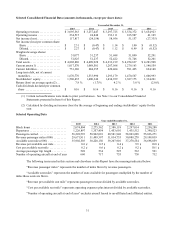

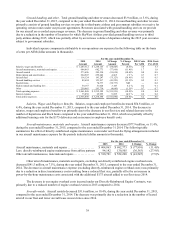

contracts. The following table summarizes our aircraft fuel expenses (less directly-reimbursed fuel expense under our

fixed-fee flying arrangements) for the periods indicated (dollar amounts in thousands).

For the year ended December 31,

2015 2014 $ Change % Change

Aircraft fuel expenses ..................................... $ 118,124 $ 193,247 $ (75,123) (38.9)%

Less: directly-reimbursed fuel from airline partners ............. 41,567 76,675 (35,108) (45.8)%

Aircraft fuel less fuel reimbursement from airline partners ....... $ 76,557 $ 116,572 $ (40,015) (34.3)%

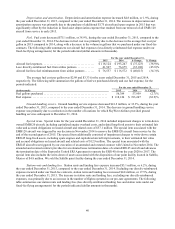

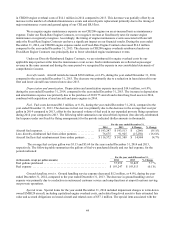

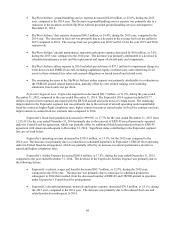

The average fuel cost per gallon was $2.09 and $3.33 for the years ended December 31, 2015 and 2014,

respectively. The following table summarizes the gallons of fuel we purchased directly and our fuel expense, for the

periods indicated:

For the year ended December 31,

(in thousands) 2015 2014 % Change

Fuel gallons purchased ............................................. 56,389 57,959 (2.7)%

Fuel expense ..................................................... $ 118,124 $ 193,247 (38.9)%

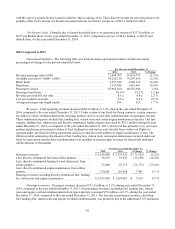

Ground handling service. Ground handling service expense decreased $41.2 million, or 33.3%, during the year

ended December 31, 2015, compared to the year ended December 31, 2014. The decrease in ground handling service

expense was primarily due to a reduction in the number of locations for which SkyWest Airlines provided ground

handling services subsequent to December 31, 2014.

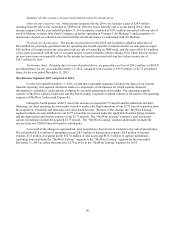

Special items. Special items for the year ended December 31, 2014 included impairment charges to write-down

owned EMB120 aircraft, including capitalized engine overhaul costs, and related long-lived assets to their estimated fair

value and accrued obligations on leased aircraft and related costs of $57.1 million. The special item associated with the

EMB120 aircraft was triggered by our decision in November 2014 to remove the EMB120 aircraft from service by the

end of the second quarter of 2015. The special item additionally consisted of impairment charges to write-down certain

ERJ145 long-lived assets, including spare engines and capitalized aircraft improvements, to their estimated fair value

and accrued obligations on leased aircraft and related costs of $12.9 million. The special item associated with the

ERJ145 aircraft was triggered by our execution of an amended and restated contract with United in November 2014. The

amended and restated contract provides for accelerated lease termination dates of certain ERJ145 aircraft and advances

the termination date of the ExpressJet United ERJ Agreement to operate the ERJ145s from the year 2020 to 2017. The

special item also includes the write-down of assets associated with the disposition of our paint facility located in Saltillo,

Mexico of $4.8 million. We sold the Saltillo paint facility during the year ended December 31, 2014.

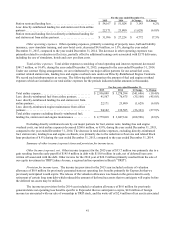

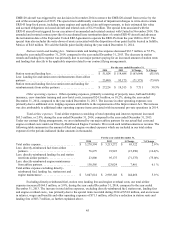

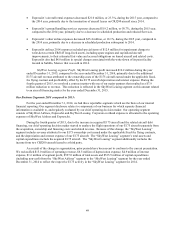

Station rents and landing fees. Station rents and landing fees expense increased $3.1 million, or 6.2%, during

the year ended December 31, 2015, compared to the year ended December 31, 2014. Excluding our directly-reimbursed

expenses incurred under our fixed-fee contracts, station rents and landing fees increased $4.8 million, or 17.5%, during

the year ended December 31, 2015. The increase in station rents and landing fees, excluding our directly-reimbursed

expenses, was primarily due to an increase in the number of flights operated in our pro-rate agreements. The following

table summarizes our station rents and landing fees (less directly-reimbursed landing fees and station rents under our

fixed-fee flying arrangements) for the periods indicated (dollar amounts in thousands).