SanDisk 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 SanDisk annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

financial institution which is the record holder of the shares but who does not receive voting instructions from the

beneficial owners of those shares, or if shares are not voted in other circumstances in which proxy authority is

defective or has been withheld with respect to any matter, these non-voted shares, or “broker non-votes,” are

deemed not to be entitled to vote on the matter and accordingly are not counted for purposes of determining whether

stockholder approval of that matter has been obtained with respect to Proposals 2 and 3.

REVOCABILITY OF PROXIES

Any person giving a proxy has the power to revoke it at any time before its exercise. A proxy may be revoked

by filing with an Assistant Secretary of the Company an instrument of revocation or a duly executed proxy bearing a

later date, or by attending the Annual Meeting and voting in person.

SOLICITATION OF PROXIES

The Company’s Board of Directors is soliciting proxies for the Annual Meeting. The Company will bear the

cost of soliciting proxies. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and

custodians holding shares in their names that are beneficially owned by others to forward to such beneficial owners.

The Company may reimburse such persons for the costs they incur to forward the solicitation material to such

beneficial owners. The original solicitation of proxies by mail may be supplemented by solicitation by telephone,

facsimile, or other means by Directors, officers, employees or agents of the Company. No additional compensation

will be paid to these individuals for any such services. The Company has retained a proxy solicitation firm, The

Altman Group, Inc., to aid it in the solicitation process. The Company will pay The Altman Group, Inc. a fee equal

to $6,000 plus reasonable customary expenses. Following the original mailing of the proxies and other soliciting

materials, the Company will request brokers, custodians, nominees and other record holders to forward copies of the

proxy and other soliciting materials to persons for whom they hold shares and to request authority for the exercise of

proxies. In such cases, the Company, upon the request of the record holders, will reimburse such holders for their

reasonable expenses.

STOCKHOLDER PROPOSALS TO BE PRESENTED AT THE NEXT ANNUAL MEETING

Proposals of stockholders of the Company that are intended to be presented by such stockholders at the

Company’s 2008 Annual Meeting must be received no later than December 11, 2007 in order that they may be

included in the proxy statement and form of proxy relating to that meeting. In addition, the proxy solicited by the

Board of Directors for the 2008 Annual Meeting will confer discretionary authority to vote on any stockholder

proposal presented at that meeting, unless the Company receives notice of such proposal before February 24, 2008.

The Annual Report on Form 10-K of the Company for the fiscal year ended December 31, 2006 (the

“2006 fiscal year” or “fiscal 2006”) has been mailed concurrently with the mailing of the Notice of Annual

Meeting and Proxy Statement to all stockholders entitled to notice of and to vote at the Annual Meeting. The

Annual Report on Form 10-K is not incorporated into this Proxy Statement and is not considered proxy

soliciting material.

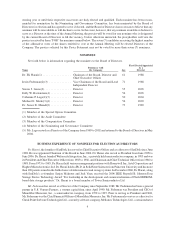

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The current Board of Directors consists of seven (7) members with one vacancy. The Board of Directors has not

nominated an individual to fill the vacancy. It is intended that the proxies will be voted for the seven (7) nominees

named below for election to the Company’s Board of Directors unless authority to vote for any such nominee is

withheld. Each of the seven (7) nominees is currently a Director of the Company and was elected to the Board of

Directors by the stockholders at the last annual meeting. Each of the non-employee nominees is independent as

defined under Securities and Exchange Commission (“SEC”) and applicable stock exchange rules. Alan F. Shugart

resigned as a director on May 25, 2006. During his service on the Board, Mr. Shugart was independent as defined

under SEC and applicable stock exchange rules. Directors elected to the Board of Directors will serve for the

Proxy Statement

3