SanDisk 2000 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2000 SanDisk annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13 . Sa n D is k C o r p o ra t io n . 2 0 0 0 A n n ua l Re p o r t

c ap acity ship p ed . In 20 0 0, the ave rag e m eg ab yte

c ap acity p e r u nit shipped inc re ased 17% w hile the

averag e selling p ric e p e r m e g ab yte o f flash m em o ry

ship ped d eclined 2 2% c o m p are d to the p rio r ye ar. The

m ix o f p ro d uc ts sold varie s fro m q uarter to q uarter and

m ay vary in the future , affe c ting o ur o verall ave rag e

se lling p ric es and g ro ss m arg ins.

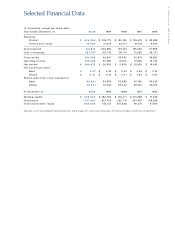

In 1999 , o ur p ro d uc t revenues w ere $ 205 .8 m illio n,

an inc re ase o f 99% fro m $103 .2 m illio n in 19 98. In 19 9 9

the larg est inc rease in unit vo lum e c am e fro m sales o f

Co m p actFlash w hic h repre se nted 61% o f p ro d uct re v-

enue s, an d M u ltiM e d iaCard p ro d ucts w hic h re p resen t-

ed 7% o f p ro d uc t reve nues. A shift in p ro d uc t m ix to

hig her cap ac ity c ard s in 19 99 p artially o ffset a d ecline

in the average se lling p ric e p er m e g ab yte o f c ap acity

ship ped . In 19 9 9, the averag e m egab yte c apac ity p er

unit ship p ed incre ased 65% w hile the ave rag e selling

p ric e p e r m e g ab yte o f flash m em o ry sh ip p ed d e c line d

52% c om pared to the p rior ye ar.

Our b ac klog as o f De c em b er 31, 200 0 w as $6 3.3

m illio n c o m p are d to $ 15 7.2 m illio n in 19 99 and $13.4

m illio n in 1998 . Se e “ Fac to rs That M ay Affec t Future

Results – Our Operating Results M ay Fluctuate

Sig nific antly” and “ – There is Se asonality in Our

Busine ss.” B o o kings visibility d e c line d sig nific antly late

in the fo urth q uarte r o f 2 0 00, and w e exp erie nc e d

m aterial o rd er c anc ellatio ns and re sc hed uling of exist-

ing p urc hase o rd e rs fro m so m e o f o ur c usto m e rs.

Visibility re m ains low in the first q uarte r o f 2 0 01 d ue to

the current ec ono m ic u nc e rtainty in o ur m arkets. Sinc e

o rd ers c o nstituting o ur c urrent b ac klog are sub je c t to

c hang es in d e livery sc hed ules o r canc e llations, b ack-

lo g is not nec e ssarily an ind ic atio n o f future reve nue.

Retail sale s are typ ically b o o ked and shipp ed in the

sam e q uarter.

In the first q uarter o f 200 1, dem and fro m our m ajo r

OEM c usto m ers has b een sub stantially b e lo w fo recast,

as these c usto m ers c o n tinue to try to re d uc e their

invento rie s. In ad ditio n, retail c hanne l o rd e rs have

b een lo w e r than the leve ls w e e xp e rienc ed in the

fo urth q uarter of 200 0. Due to this c o ntinuing w eak-

ne ss o f ec o no m ic c o nd itions and o ng o in g c usto m e r

invento ry c o rrec tio ns, w e exp ect first q uarter 200 1 rev-

enue s to be sig nific antly b e lo w o ur reve nue s in the

fo urth q uarter of 200 0.

Lic e nse a nd Royalty Re ve nue s. W e c urre ntly

earn pate nt lic ense fees and ro yalties und er nine

c ro ss- lic ense ag ree m e nts w ith Hitac hi, Inte l, Lexar,

Sharp , Sam sung , Sm artDisk, SST, TDK and Toshib a.

Lic ense and ro yalty re venue s fro m p ate nt c ro ss-

lic ense agree m e nts w as $ 75 .5 m illio n in 20 00, up fro m

$41.2 m illion in 19 9 9 and $ 32.6 m illio n in 19 98. The

inc re ase in lic ense and ro yalty revenues in 2 000 w as

p rim arily due to p atent ro yalties from increased sales

b y c e rtain o f o ur lic e nsee s, and the re venue o f $ 4.7

m illio n rec ognize d in c o njunc tion w ith the s ettlem ent of

the Lexar litigatio n. The inc re ase in license and ro yalty

reve nues in 19 99, as com p are d to 19 9 8, w as p rim arily

d ue to an increase in p atent ro yalty re venues.

Revenues fro m lic enses and ro yalties w e re 13% of to tal

reve nues in 200 0 , 17% in 199 9 and 2 4 % in 19 98.

Our inc o m e fro m p ate nt lic e nses and ro yalties c an

fluctuate sig nific antly fro m q uarter to quarter. A sub-

stantial p o rtio n o f this inc o m e com es from ro yalties

b ased o n the ac tual sales b y o ur licensees. Given the

c urrent m arket o utlook fo r 20 01, sales o f lic e nsed flash

p ro d uc ts b y o ur lic ensees m ay b e sub stantially lo w e r

than the c o rre sp o nding sale s in rec e nt q uarters, w hic h

m ay c ause a sub stantial d ro p in o ur ro yalty reve nues.

Gro ss Pro fits . In fisc al 200 0 , g ro ss p ro fits

inc re ase d to $2 44.8 m illio n, or 4 1% o f total reve nues

fro m $94 .8 m illio n, o r 38% o f total reve nues in 19 99

and $55 .5 m illio n, o r 41% o f to tal re venue s in 1998 .

Pro d uct gro ss m arg ins inc re ased to 32 % in 2 000 fro m

26% in 199 9 and 2 2 % in 19 98. The inc re ases in 200 0

w ere p rim arily due to the lo w er c o st p e r m eg abyte o f

o ur 25 6 m e g ab it flash m e m o ry pro du c ts, w hic h repre -

se nte d the m ajo rity of our pro du c t sale s in 20 0 0. The

inc re ase s in 19 99 w ere due to the lo w er c o st p e r

m egab yte o f our 2 56 m eg ab it and 12 8 m e g abit flash

m em o ry p ro d ucts, w hich beg an ship p ing in vo lum e in

the second half o f 1999 .

Due to w e ak ec o no m ic c o nd itions, e xc e ss sup p ly

in the m arke ts fo r o ur p rod uc ts, and lo w e r d e m and

fro m c usto m ers as the y c o ntinue to red uc e their

invento rie s, w e are exp e rienc ing inte nse p ric ing p res-

sure s. Due to the se fac tors, w e e xp e c t o ur averag e

se lling p ric es p e r m eg abyte to d ecline sig nific antly in

the first q uarter o f 2 001. Our averag e selling p ric es w ill

c o ntinue to b e neg atively im p acted in future q uarte rs

thro ugho ut 2 001 and p o ssib ly beyo nd, until m arket

sup ply and d e m and for o ur p ro d uc ts re turns to e q uilib-

rium . Altho ug h w e are taking sig nific ant steps to lo w er

o ur produc t c o sts, g iven the c urre nt m ark et c o ndi-

tio ns , w e e xp e c t o ur selling p ric e s to d ecline m o re

q uic kly than o ur produc t c o st, re sulting in a dec lin e in

o ur produc t g ro ss m arg ins in 2 0 01.

Re se arch and Develo pm ent. Researc h and

d eve lo p m e nt e xp e nse s c o nsist p rinc ip ally o f salaries

and p ayro ll- re lated exp ense s fo r d esig n and d evelo p -

m ent eng ine ers, p roto typ e sup p lie s and c o ntrac t serv-

ic es. Researc h and d evelo p m ent e xp e nses inc re ased

to $4 6 .1 m illio n in 200 0 fro m $ 2 6.9 m illio n in 19 99 and

$18.2 m illio n in 19 98. As a p e rc e ntage o f revenues,

research and d eve lo p m e nt exp e nse s w ere 8% in

200 0, 11% in 199 9 and 13% in 1998 . In 200 0 and 1999 ,

the inc rease in re se arc h and d e velo pm ent e xp e nses

w as p rim arily d ue to an increase in salaries and p ay-

ro ll- re late d expenses associate d w ith ad d itio nal per-

so nnel and hig her p ro ject re lated exp ense s. Increased

d eprec iatio n d ue to c apital eq uipm ent ad d itio ns also

c o ntrib uted to the g ro w th in researc h and d evelo p -

m ent exp ense s in both years. The ad d itio nal p ro je c t

exp ense s in 20 00 w ere to sup p ort the d evelo p m ent o f

ne w g ene rations o f flash d ata sto rag e p ro d ucts inc lud-

ing the 512 m e g ab it and 1 g ig ab it flash m e m o ry co-

d eve lo p m e nt w ith Toshib a. We exp ect our re se arc h

and d evelo p m e nt e xp e nses to c o ntinue to increase in

future q uarte rs to s up p o rt the d eve lo p m e nt and intro -

d uc tion o f new g e ne ratio ns o f flash d ata sto rage p ro d -

uc ts, inc luding the jo int ve nture w ith Toshib a and the

d eve lo p m e nt o f ad vanc ed c o ntro ller c hip s.